Featured in

Official Partners Of

Join 5000+

savvy sole-traders

already paying less tax

TaxLeopard is perfect

for independent earners

How it works

3 Steps To

LessTax

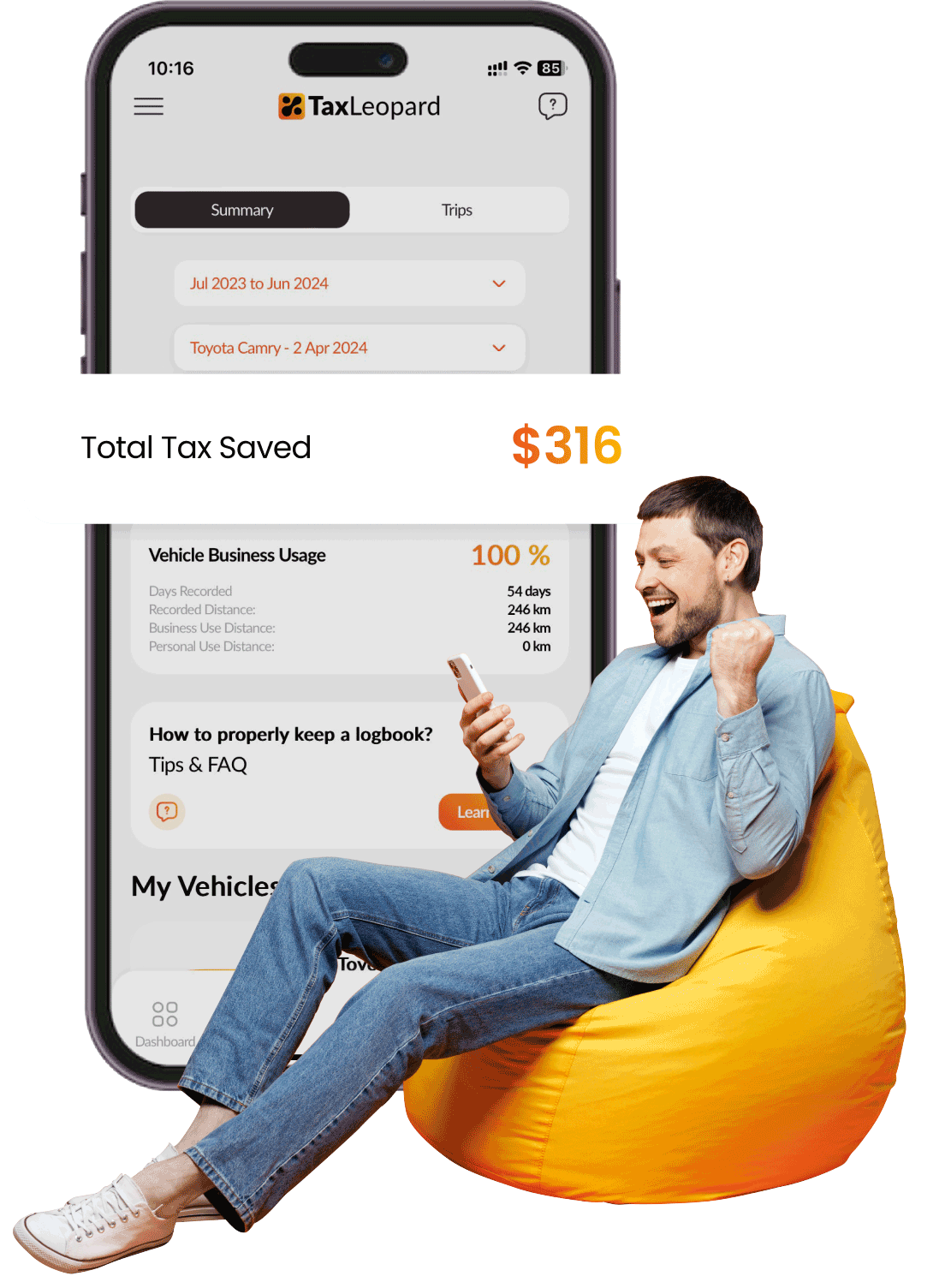

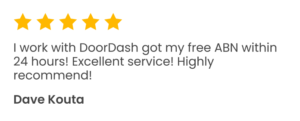

Set yourself up for savings

Download the app

or set up an account online

It automatically records what you’ve earned, what you’ve spent, what you owe – and what the ATO might owe you.

Connect your current bank account.

Sort your business expenses with the tap of a button.

Submit your tax through the app

Your taxes lodged

in minutes, not hours

Lodge your BAS statements & tax returns straight through the app and get it processed fast.

We’ve made tax time take no time.

Answer a few questions in the app.

Hit Submit.

It gets processed at leopard-speed.

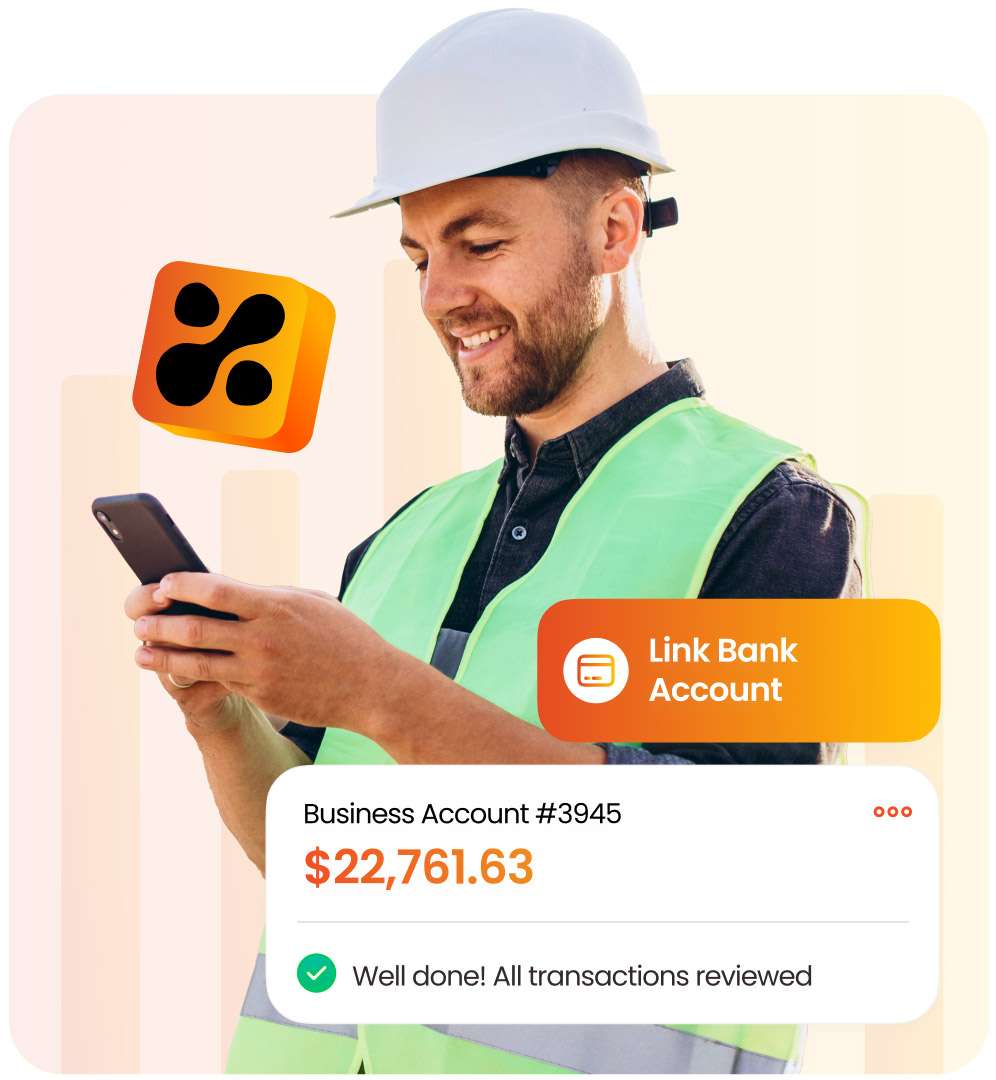

We become your expert accountant

We find ways to

take down your tax

And if we can’t, we still lodge it – and give you a full refund for the lodging service.

Our expert accountants apply the deductions you’re eligible for – but missed.

We submit it to the ATO for you.

We let you know exactly how much tax we saved you.

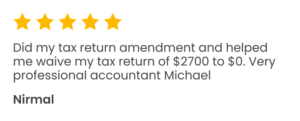

TaxLeopard has saved

sole-traders $1.4m so far.

Frequently Asked Questions

We’ve made tax less taxing.