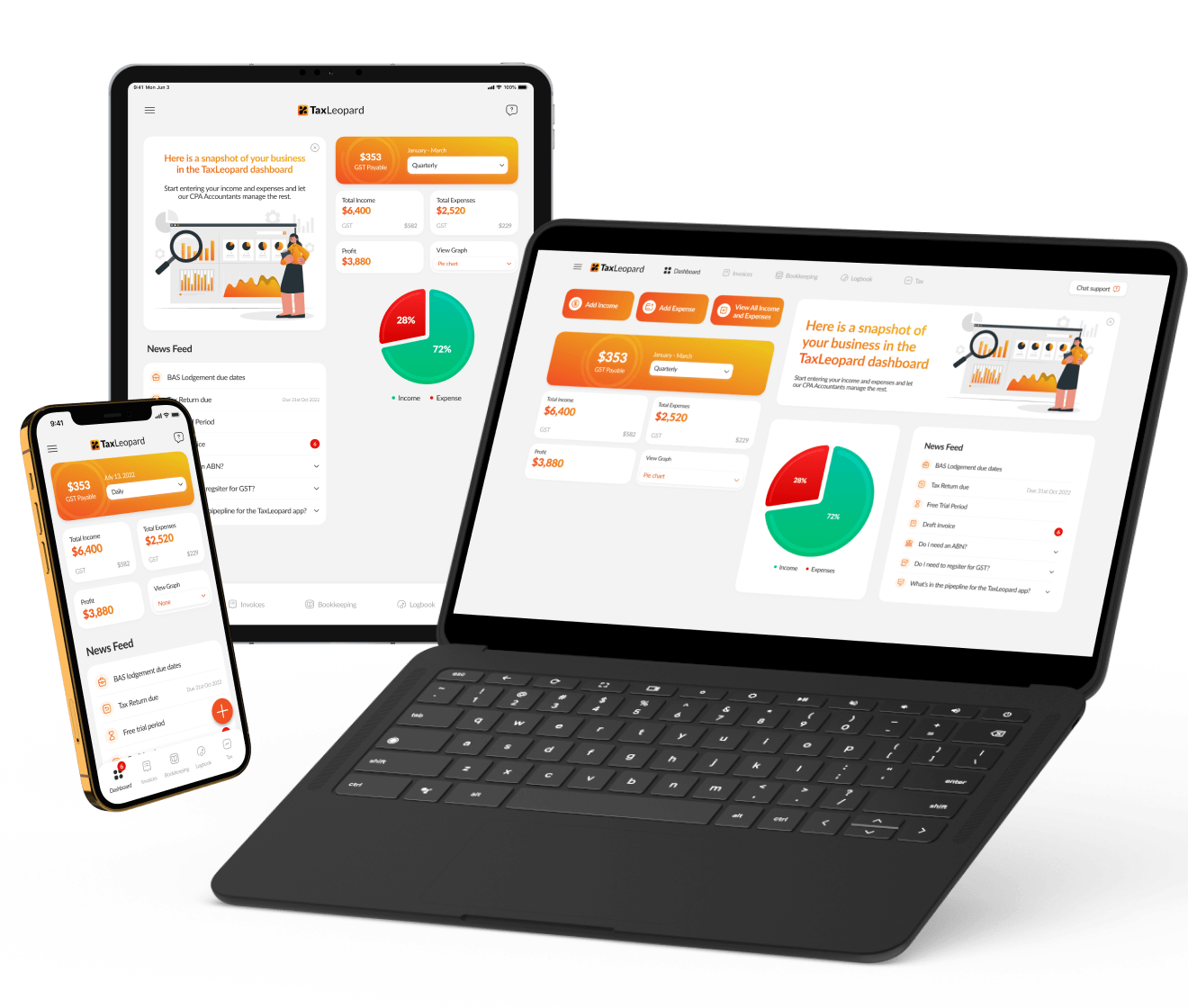

Cross Platform

Sign up to the TaxLeopard app on your phone, your laptop, or your tablet. It’s easy, and it’s FREE.

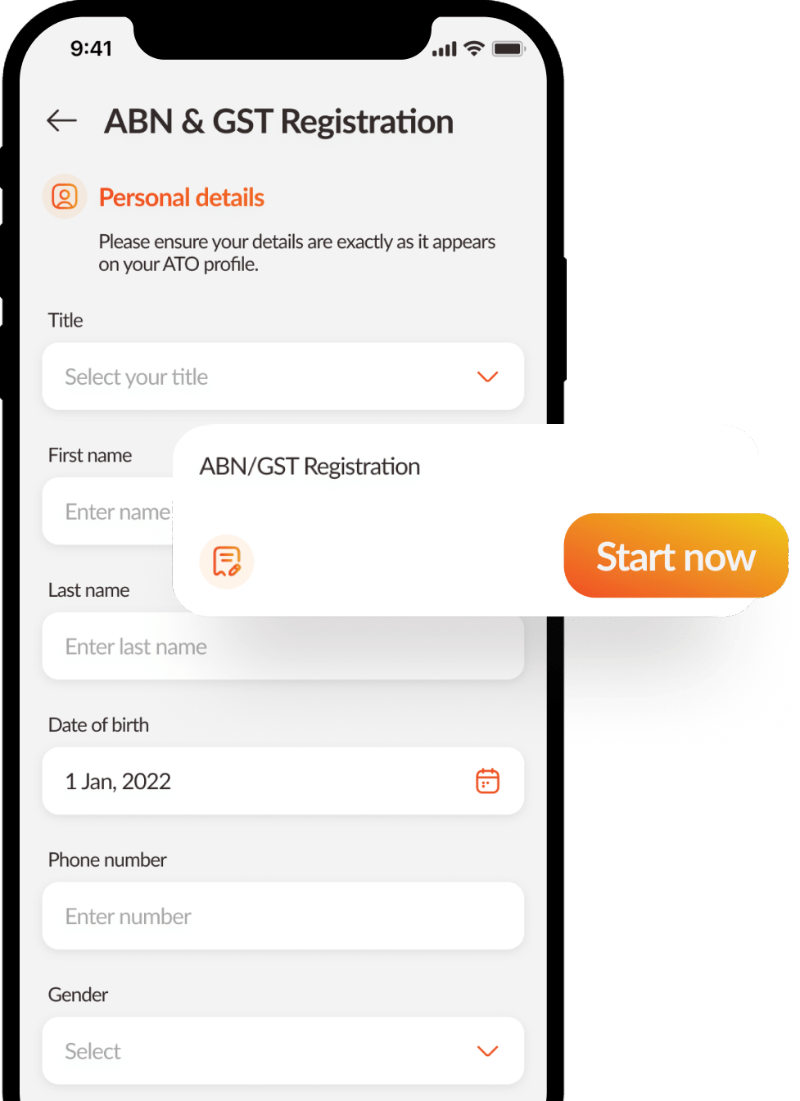

ABN & GST

You can ask for an ABN if you need one. And you can ask to be registered for GST if you need that for your business.

It’s quick, painless—and simple.

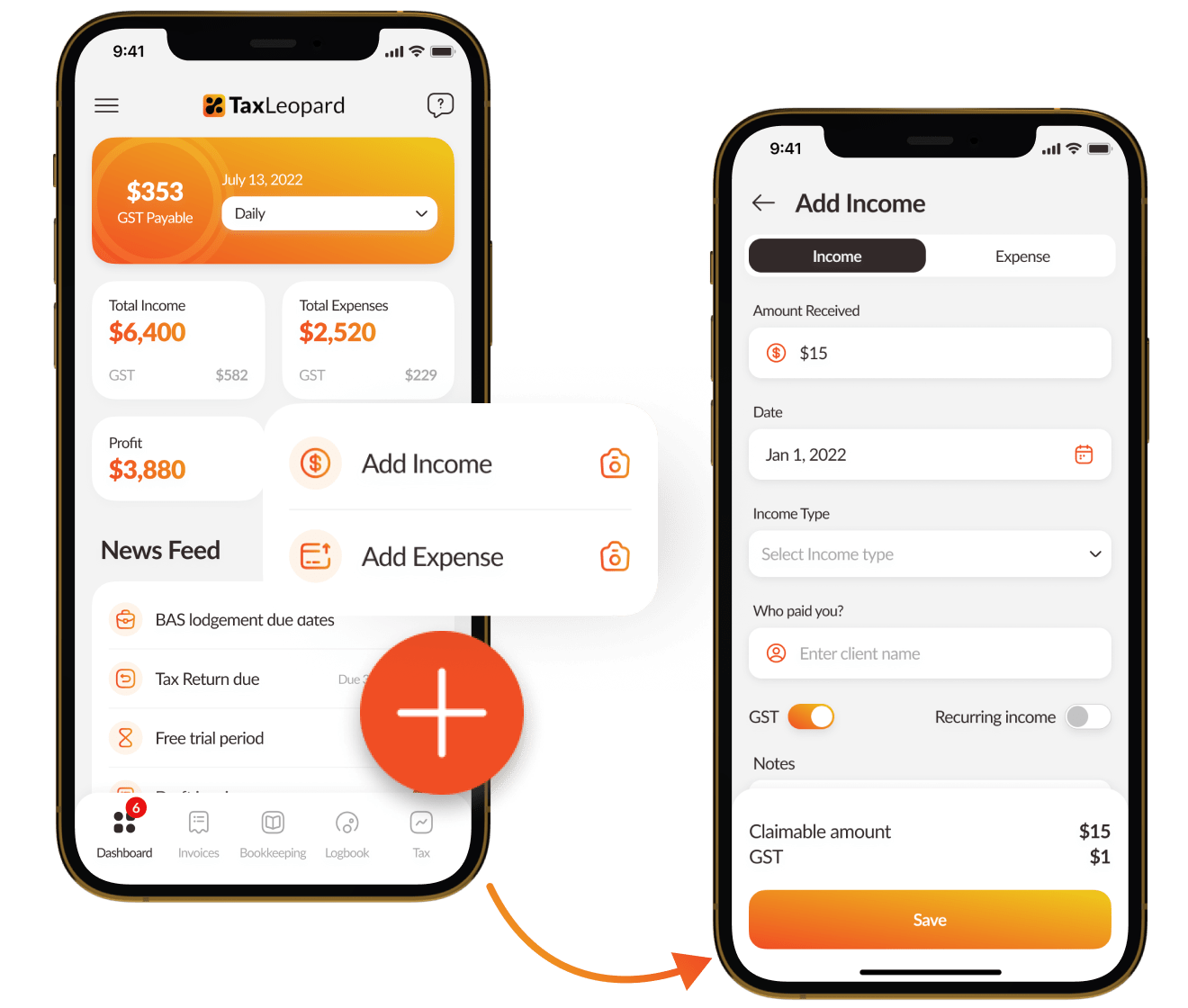

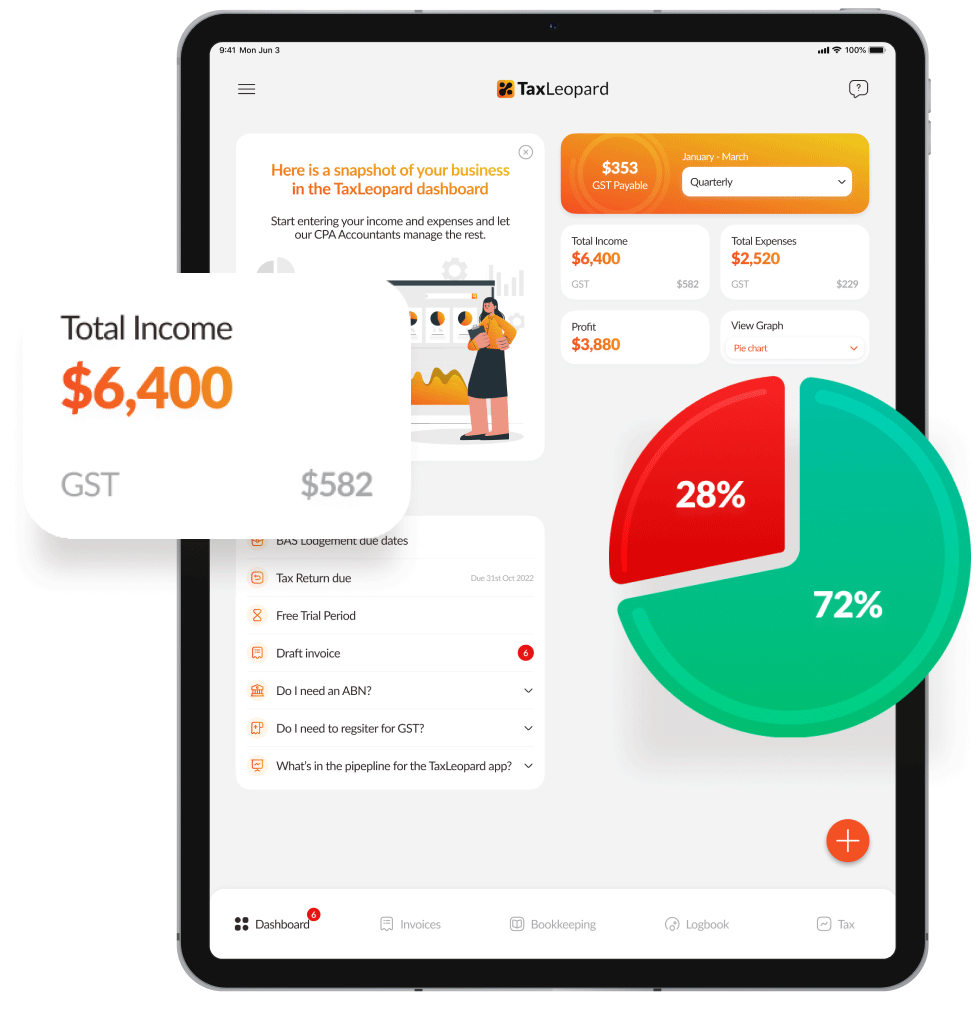

Your income

& expenses

Take care of your bookkeeping with our simple to use dashboard.

As you earn income, simply click a button on your Dashboard and add the amount you earned and its details. It’s the same with your expenses. The app automatically calculates your GST and net profit.

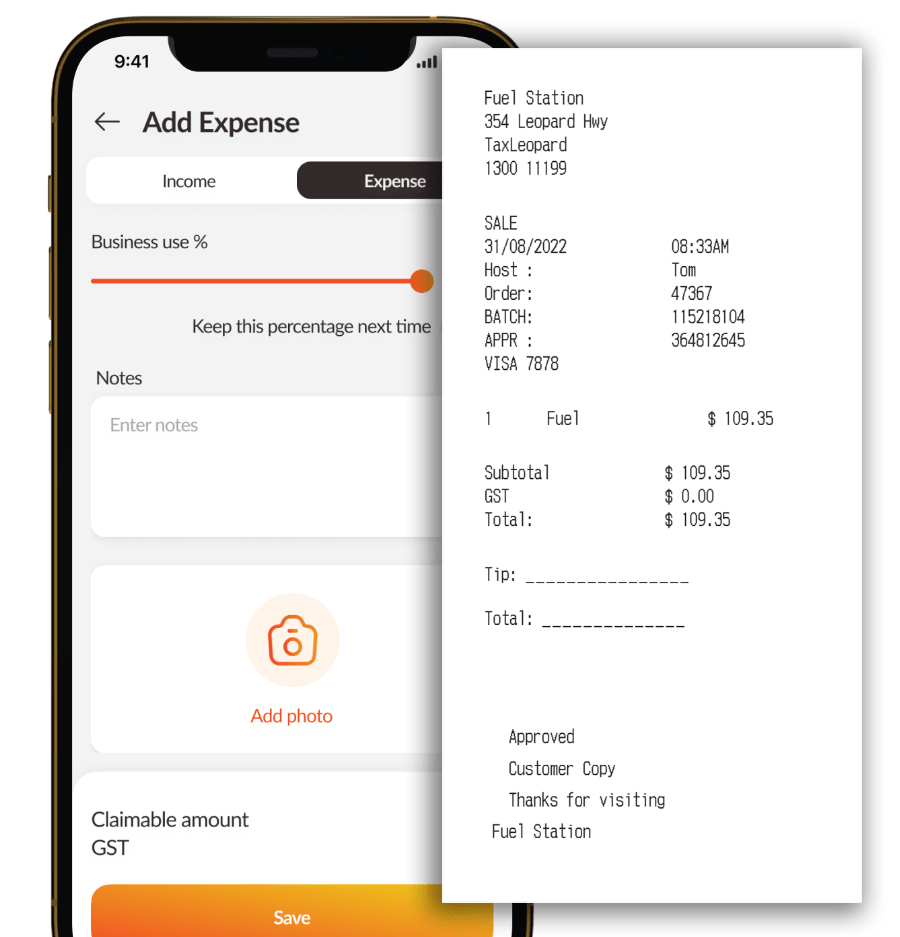

Upload your

receipts

You can even take a photo of your receipts and upload them into the app to store them safely. No need to keep receipts in a shoebox!

Instantly see your

Profit and GST

position

The dashboard instantly shows your profit and GST position. Whenever you add income or an expense, bingo! It’s updated in real time.

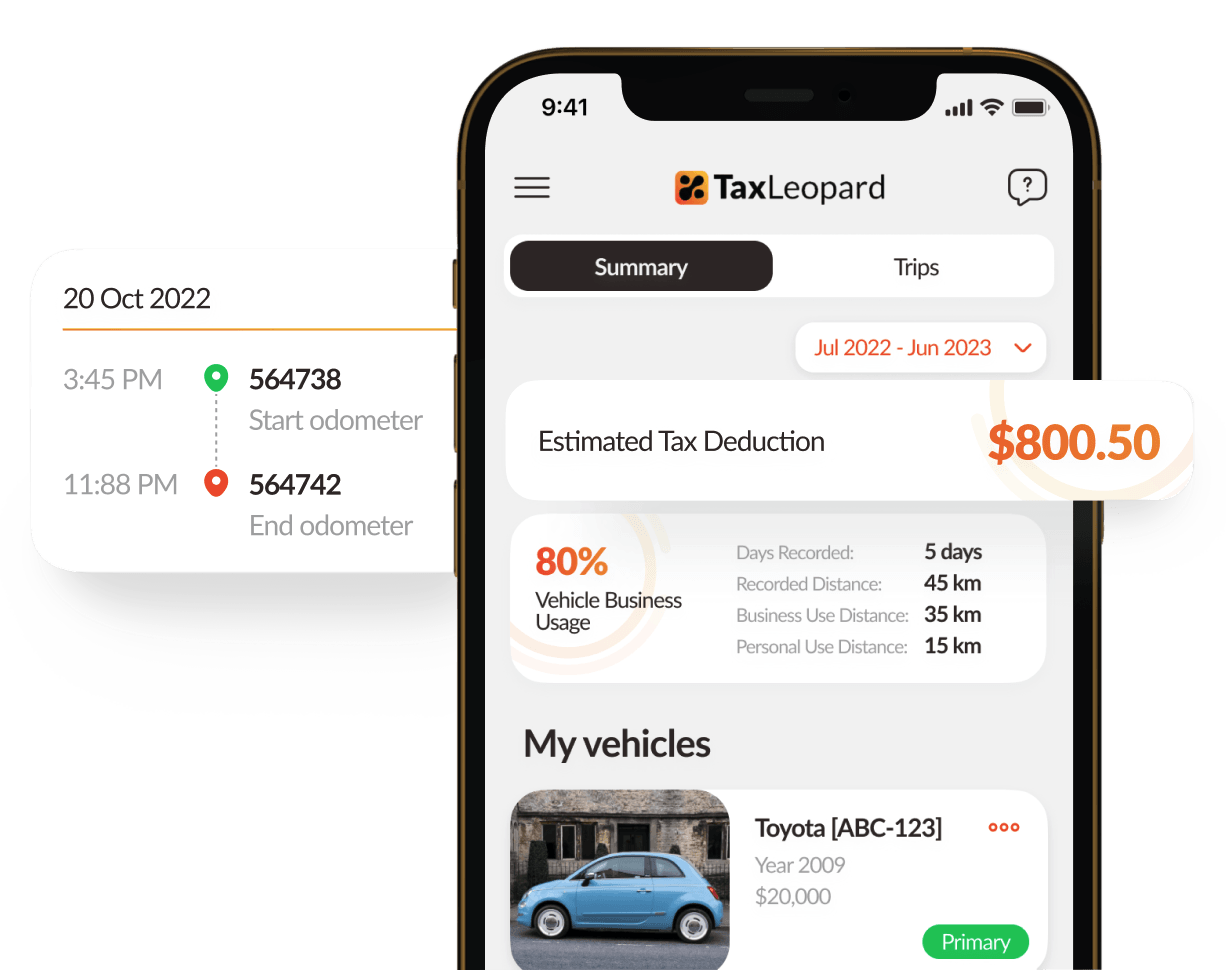

Digital Logbook

Simply log your trips, categorize them by business or private use, and maintain a detailed record of your kilometres for tax purposes. It’s easy, secure, and eliminates the need for manual record-keeping.

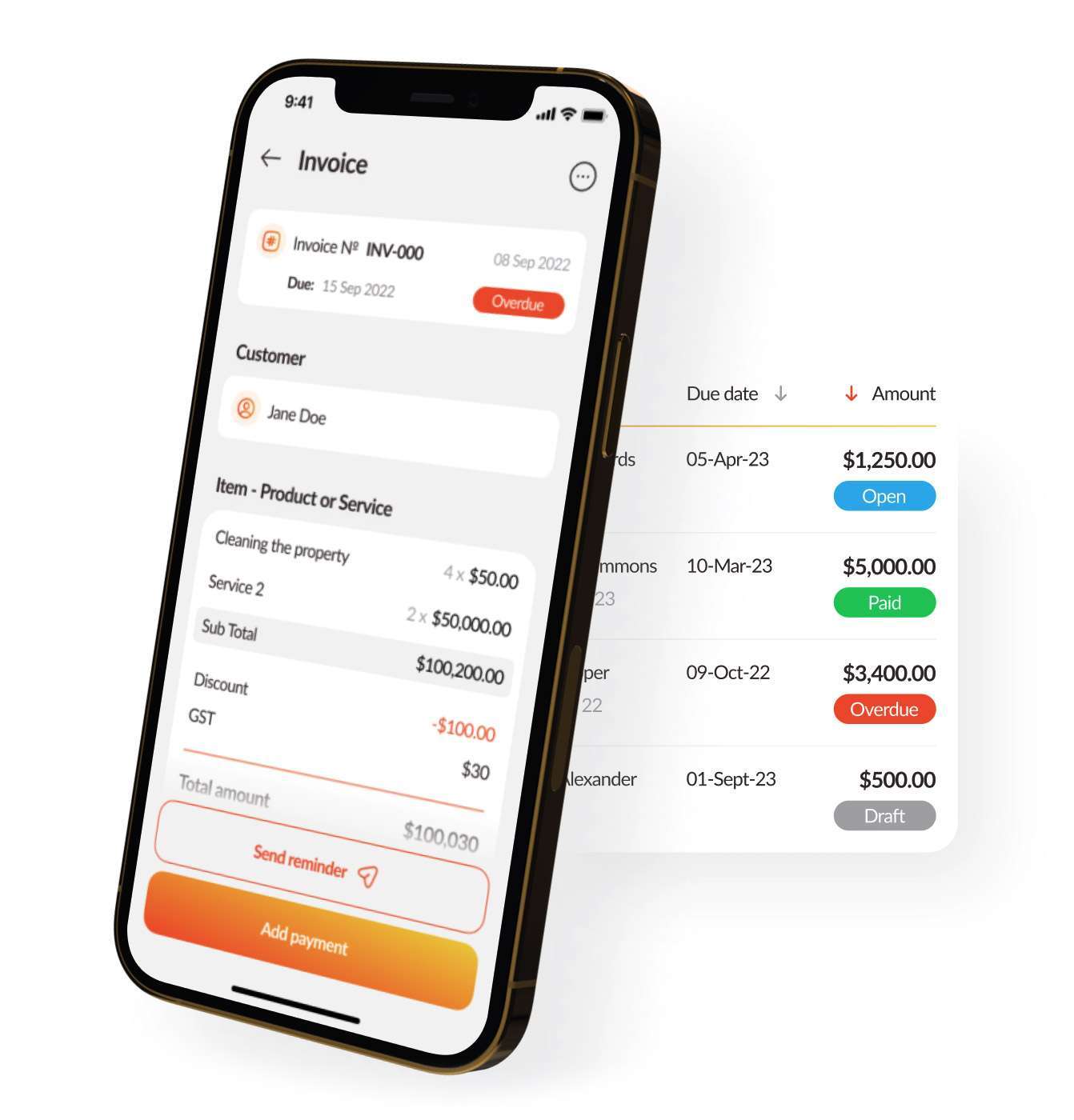

Send Quotes

and Invoices

on the go!

Our user-friendly platform allows you to create, send, and track customized invoices and quotes, all from one place. Streamline your billing process and stay organized with TaxLeopard’s Quotes and Invoicing features, which let you convert quotes to invoices with just a few clicks.

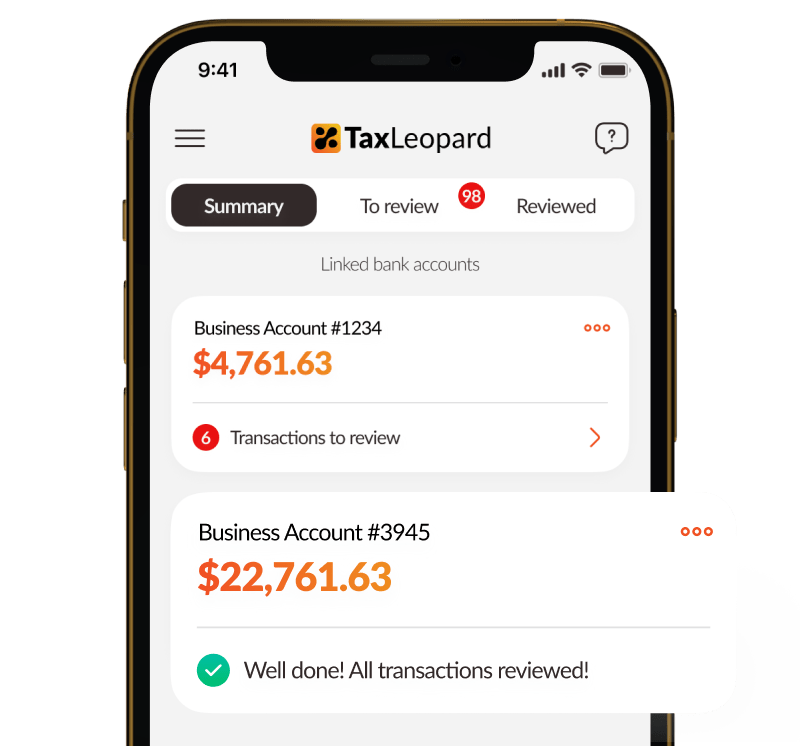

Link your Bank account

Link all your bank accounts and let TaxLeopard take it from there! We swiftly calculate your GST and net profit, turning tax time into a breeze. Welcome to hassle-free bookkeeping!

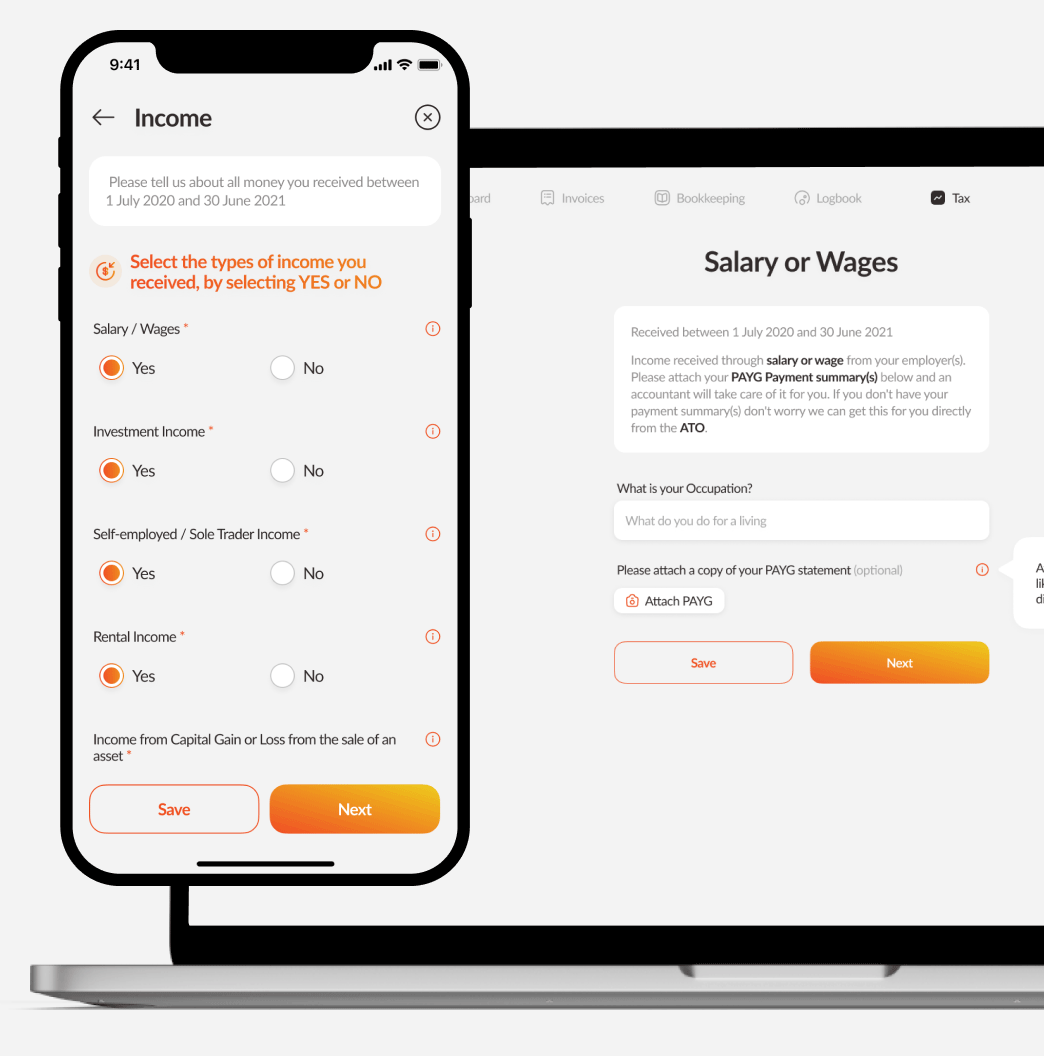

How your

tax return works

Click the Lodge Now button on the Tax section, for your annual Tax Return. Enter the information required. Select and pay for the service you want.

One of our CPA Accountants will prepare your tax return, and lodge it with the ATO after you accept it. And of course, we’ll email you a copy. If you owe money, you pay the ATO. If you have a refund, they’ll pay into your bank account.

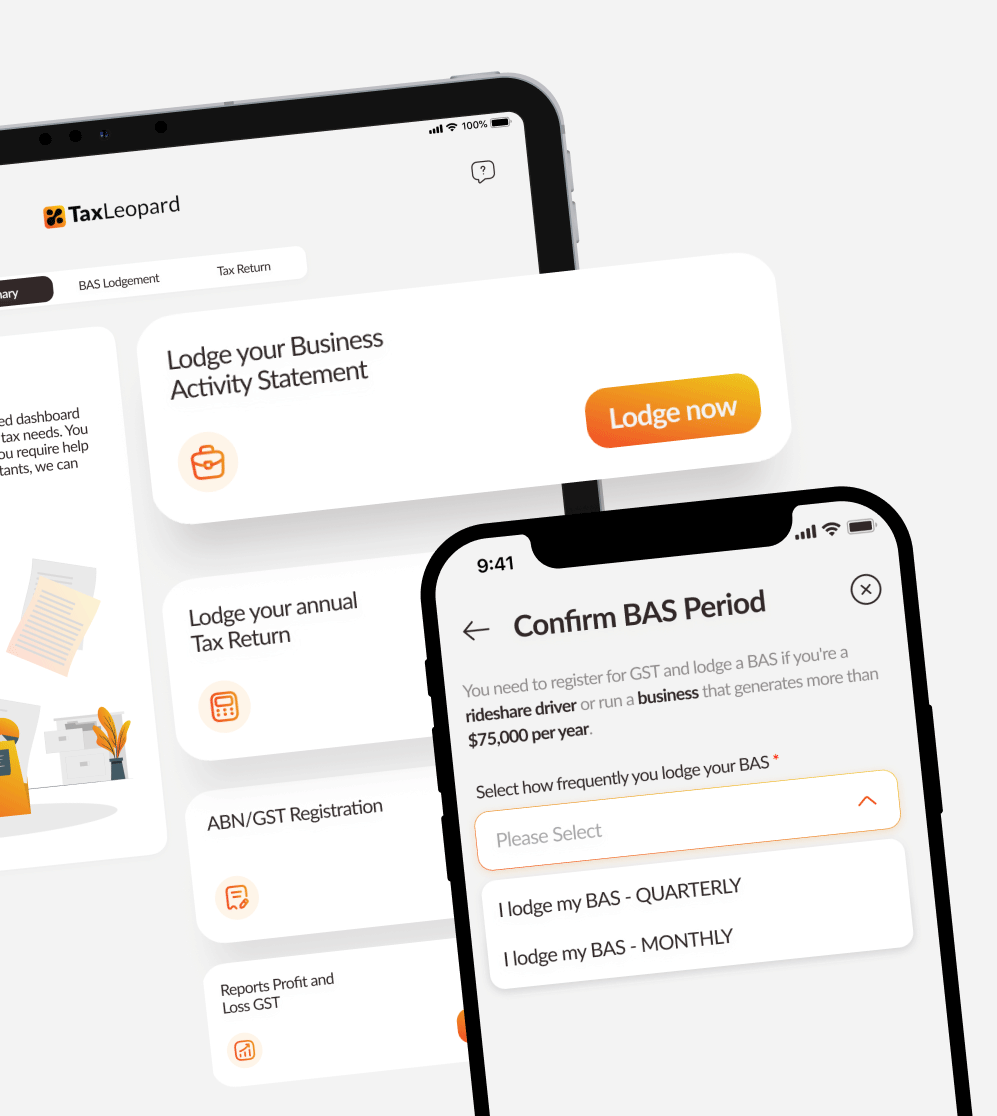

How your BAS

works?

If you’re registered for GST, your BAS needs to be lodged with the ATO. Ready to go with your BAS? Simply click the Lodge Now button on the Tax section, then it’s over to us.

We check it, then submit it to the ATO. And we email you a copy. If you owe money, you pay the ATO. If they owe you, they’ll pay into your bank account.

Coming soon

Get excited! With these functions in the pipeline, your accounting will be spot on with TaxLeopard.

Receipt scanning

Take a photo of your receipts and let the TaxLeopard app automatically categorise them for you.

Virtual CFO

Our Virtual CFO helps you with advice for your tax, to boost your deductions, and forecast income, plus heaps of handy tips to help you run your business more smoothly and efficiently.