TaxLeopard Blog

ATO Cents Per Kilometre Rate for Car Expenses 2024 | Australian Taxation Office

Hamza Usmani2024-10-21T09:23:23+11:00October 21, 2024|

When is Tax Return 2024 Australia?

Hamza Usmani2024-10-21T05:15:08+11:00October 15, 2024|

The Best Accounting Software for Sole Traders in 2024 | TaxLeopard

Hamza Usmani2024-10-12T07:05:39+11:00October 12, 2024|

Top 6 Most Profitable Small Business Industries

Hamza Usmani2024-10-07T23:30:32+11:00October 7, 2024|

How to Find My ABN Fast: Essential Tips and Tricks

Hamza Usmani2024-10-17T04:11:08+11:00September 23, 2024|

Work related car expenses calculator

Hamza Usmani2024-10-17T18:49:45+11:00September 21, 2024|

The Ultimate Guide to Maximizing Tax Benefits with Managed Investment Trusts

Hamza Usmani2024-10-01T04:04:36+10:00September 17, 2024|

Sole Trader Insurance Guide: How to Protect Your Business with Public Liability Insurance

Hamza Usmani2024-10-17T18:57:20+11:00September 3, 2024|

How to Organize Financial Documents on Mac

Hamza Usmani2024-08-21T06:47:11+10:00August 19, 2024|

TPAR: Your Comprehensive Guide to Lodging the Taxable Payments Annual Report

Hamza Usmani2024-08-17T12:32:13+10:00August 16, 2024|

Online services for tax agents | ATO

Hamza Usmani2024-10-16T23:48:59+11:00August 15, 2024|

ApprovalMax: Maximizing Efficiency and Streamlining Your Workflow on the App Store

Hamza Usmani2024-08-15T09:44:32+10:00August 15, 2024|

Bookkeeping Solutions: Simplifying Accounting for Young Entrepreneurs

Abdul Moeed2024-10-10T19:49:56+11:00August 4, 2024|

Guide to Individual Non-Business PAYG Payment Summaries in Australia

Hamza Usmani2024-07-29T11:11:11+10:00July 29, 2024|

Estate Planning and Tax Law: Strategies for Minimizing Inheritance Tax

Hamza Usmani2024-09-23T20:19:30+10:00July 25, 2024|

5 Benefits of Digital Logbooks

Abdul Moeed2024-06-29T23:01:33+10:00June 29, 2024|

10 Advantages of Bookkeeping Software

Abdul Moeed2024-06-28T23:41:17+10:00June 28, 2024|

What is a Virtual CFO and How to Become One?

Abdul Moeed2024-09-01T02:25:38+10:00June 28, 2024|

Top 3 Thriday Alternatives in 2024

Hamza Usmani2024-10-01T18:03:23+10:00June 14, 2024|

How to Get an ATO Linking Code?

Hamza Usmani2024-10-08T00:02:01+11:00June 13, 2024|

Taxation and Social Equity

Abdul Moeed2024-09-23T20:17:57+10:00May 22, 2024|

What is a Super Fund ABN? How to Look It Up

Hamza Usmani2024-05-20T03:52:15+10:00May 20, 2024|

ACN vs ABN: 5 Major Differences Between Them

Hamza Usmani2024-05-26T20:45:26+10:00May 15, 2024|

Best Invoicing Software for Sole Traders

Hamza Usmani2024-05-05T23:38:44+10:00May 5, 2024|

A Complete Guide to Sole Trader Accounting

Hamza Usmani2024-04-21T20:49:05+10:00April 21, 2024|

Small Business Bookkeeping Guide 2024

Hamza Usmani2024-04-20T22:07:38+10:00April 20, 2024|

What is a Logbook? Car Logbook Method

Hamza Usmani2024-04-15T18:52:16+10:00April 15, 2024|

GST Refund for Sole Traders: How to Claim it?

Hamza Usmani2024-09-10T19:28:19+10:00April 4, 2024|

Sole Trader Tax Deductions in Australia

Hamza Usmani2024-03-25T00:08:31+11:00March 24, 2024|

ATO Tax Return 2024: A Guide for Australians

Hamza Usmani2024-10-21T03:17:34+11:00March 20, 2024|

Stage 3 Tax Cuts: Revised Tax Rates for 2024

Hamza Usmani2024-06-12T23:52:28+10:00March 13, 2024|

Australian Rental Income Tax: A Complete Guide

Hamza Usmani2024-09-03T21:07:14+10:00March 3, 2024|

How to Apply for a Tax File Number (TFN)?

Hamza Usmani2024-03-02T23:11:05+11:00March 2, 2024|

A Guide to Tax Agent Services Act 2009

Hamza Usmani2024-02-27T19:07:58+11:00February 26, 2024|

Australian Working Holiday Maker Tax Rates 2024

Hamza Usmani2024-02-22T07:01:02+11:00February 21, 2024|

Small Business Income Tax Offset: A Complete Guide

Hamza Usmani2024-02-21T19:16:26+11:00February 21, 2024|

Zone Tax Offset and Overseas Forces Tax Offset 2024

Hamza Usmani2024-02-20T19:11:15+11:00February 20, 2024|

Small Business Tax in Australia

Hamza Usmani2024-02-20T06:56:12+11:00February 20, 2024|

What is a Trust Account? A Complete Guide

Hamza Usmani2024-06-05T16:12:51+10:00February 18, 2024|

What is an Expense Account? Definition and Types

Hamza Usmani2024-10-03T17:03:12+10:00February 13, 2024|

10 Best Self Employed Tax Return Strategies

Hamza Usmani2024-06-13T20:21:13+10:00February 12, 2024|

R&D Tax Incentive: How to Claim it?

Hamza Usmani2024-02-10T04:40:47+11:00February 8, 2024|

Tax Brackets 2023-24: Current Australian Tax Rate

Hamza Usmani2024-06-02T23:07:09+10:00February 7, 2024|

What is PAYG? (Pay As You Go)

Hamza Usmani2024-03-14T05:01:00+11:00January 31, 2024|

Low and Middle Income Tax Offset: A Complete Guide

Hamza Usmani2024-01-28T22:36:27+11:00January 28, 2024|

Best Digital Logbook App For 2024

Hamza Usmani2024-04-18T16:41:57+10:00January 19, 2024|

How to Avoid Contribution Tax? 5 Tips You Must Know

Hamza Usmani2024-01-19T04:50:58+11:00January 19, 2024|

Australian Before and After-Tax Super Contributions

Hamza Usmani2024-03-14T01:56:15+11:00January 18, 2024|

Super Contributions Tax: Understanding (ATO) Rules

Hamza Usmani2024-01-17T22:31:22+11:00January 17, 2024|

Investment Property Tax Deductions You Can Claim

Hamza Usmani2024-10-03T17:35:40+10:00January 16, 2024|

Invoice vs Receipt: Key Differences Between Them

Hamza Usmani2024-04-18T00:15:58+10:00January 13, 2024|

Invoice vs Bill: Major Differences Between Them

Hamza Usmani2024-10-03T17:02:14+10:00January 8, 2024|

What is Freight Invoicing? A Complete Guide

Hamza Usmani2024-10-18T01:20:08+11:00January 6, 2024|

Cash vs Accrual Accounting: Major Differences

Hamza Usmani2024-01-04T01:14:53+11:00January 4, 2024|

What is an Invoice? Importance and Benefits

Hamza Usmani2024-08-16T03:05:31+10:00January 3, 2024|

What is Hedge Accounting? A Detailed Overview

Hamza Usmani2024-01-02T20:53:37+11:00January 2, 2024|

Why is Lease Accounting Important?

Hamza Usmani2024-01-13T06:00:49+11:00January 1, 2024|

A Complete Guide on NSW Land Tax

Hamza Usmani2024-02-19T00:14:24+11:00December 31, 2023|

Australian Accounting Standards: A Complete Overview

Hamza Usmani2023-12-21T20:48:42+11:00December 21, 2023|

What is Real Estate Accounting?

Hamza Usmani2024-10-08T01:05:22+11:00December 21, 2023|

What is Bookkeeping? A Complete Guide

Hamza Usmani2024-01-01T18:50:49+11:00December 20, 2023|

The Best Accounting Service For Businesses

Hamza Usmani2024-09-29T21:31:26+10:00December 19, 2023|

What is Income Tax 551?

Hamza Usmani2024-02-19T20:05:48+11:00December 18, 2023|

The Best Bookkeeping Service For Businesses

Hamza Usmani2023-12-19T04:51:26+11:00December 18, 2023|

Capital Gains Tax in Australia: A Complete Guide

Hamza Usmani2024-09-24T09:10:57+10:00December 15, 2023|

What is Fringe Benefits Tax and How Does it Work?

Hamza Usmani2024-10-17T18:47:39+11:00December 12, 2023|

Australian Financial Year: A Complete Guide

Hamza Usmani2024-10-17T09:29:48+11:00December 6, 2023|

Tax File Declaration Form in Australia

Hamza Usmani2024-07-31T09:04:48+10:00December 5, 2023|

What is BAS and How to Lodge it?

Hamza Usmani2024-04-02T03:56:18+11:00December 2, 2023|

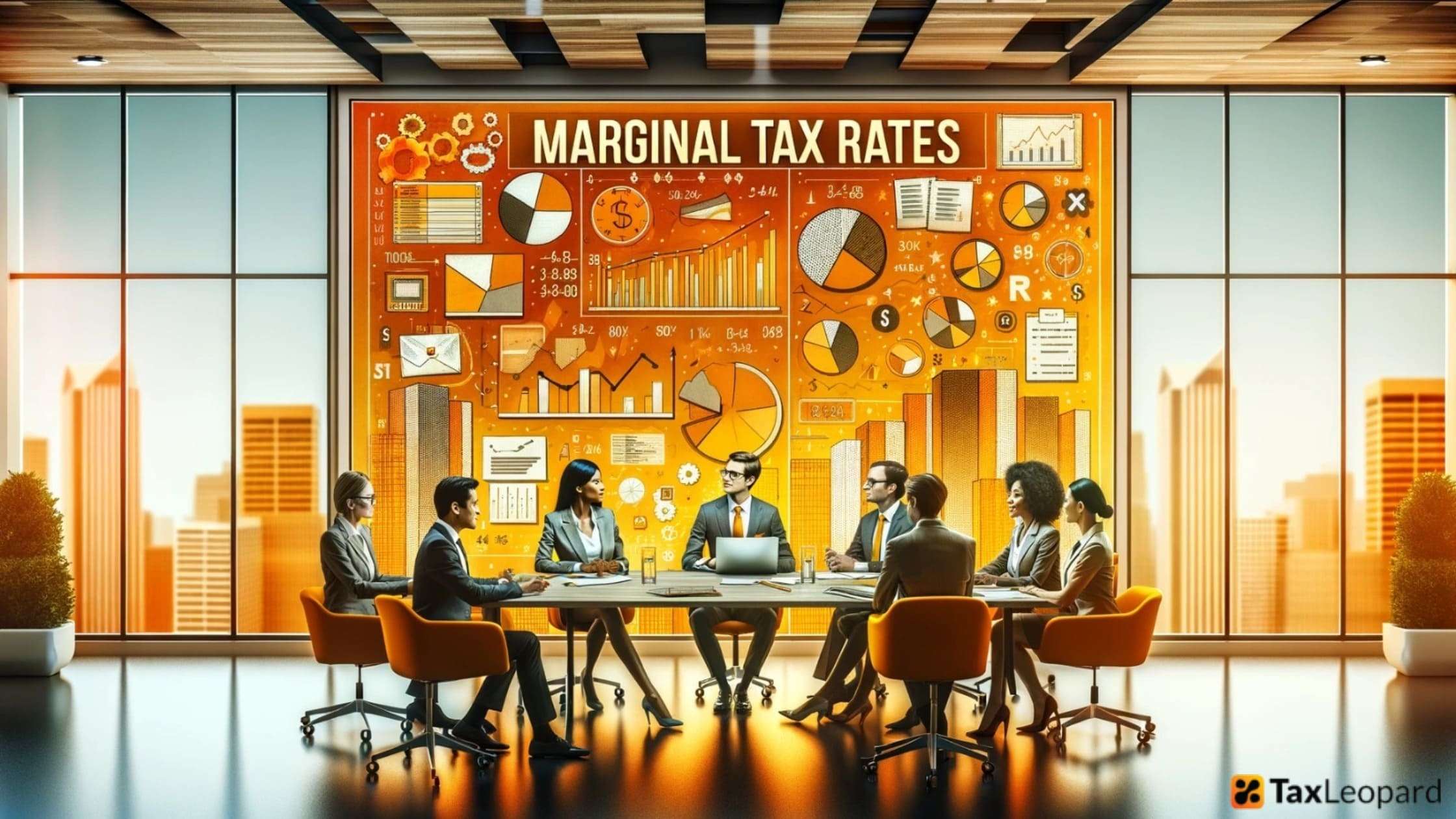

Marginal Tax Rates: A Complete Guide

Hamza Usmani2024-03-10T19:26:43+11:00November 30, 2023|

Invoice Payment Terms in Australia 2023

Hamza Usmani2023-11-29T23:50:00+11:00November 29, 2023|

ATO Monthly Tax Table: A Complete Guide

Hamza Usmani2024-03-26T02:06:25+11:00November 29, 2023|

10 Tips to Reduce Tax on Property

Abdul Moeed2023-11-26T21:56:54+11:00November 24, 2023|

How Much is Annual NSW Property Tax?

Hamza Usmani2024-10-03T16:38:22+10:00November 15, 2023|

Queensland Payroll Tax: Rates and Threshold

Hamza Usmani2024-04-05T02:30:56+11:00November 15, 2023|

5 Best Accounting Projects to Upgrade Your Skills

Hamza Usmani2024-10-16T22:18:52+11:00November 15, 2023|

What is Pay Advance and How Does it Work?

Hamza Usmani2023-11-10T22:21:28+11:00November 10, 2023|

Hospitality Award Rates 2023

Hamza Usmani2024-02-10T22:34:35+11:00November 9, 2023|

What is Division 293 Tax and How Does it Work?

Hamza Usmani2024-05-30T22:26:32+10:00November 9, 2023|

What is an Input Tax Credit and How Does it Work?

Hamza Usmani2024-09-29T21:33:46+10:00November 9, 2023|

5 Best Business Bank Accounts in Australia 2024

Hamza Usmani2024-08-14T22:09:03+10:00November 7, 2023|

The Complete Guide to Tax Invoice Requirements

Hamza Usmani2023-11-04T01:34:50+11:00November 4, 2023|

Fuel Tax Credit Australia

Hamza Usmani2024-06-01T05:06:10+10:00November 3, 2023|

Tax Fraud in Australia

Hamza Usmani2023-11-02T06:24:52+11:00November 2, 2023|

Luxury Car Tax for 2023-24

Hamza Usmani2024-09-09T20:08:29+10:00November 2, 2023|

Understanding the Family Tax Benefit

Hamza Usmani2023-11-01T18:55:56+11:00November 1, 2023|

Australian Wealth Management: Top Insights

Hamza Usmani2023-10-26T03:23:58+11:00October 26, 2023|

What is a Business Line of Credit?

Hamza Usmani2024-10-03T16:34:22+10:00October 24, 2023|

Second Job Tax Rate in Australia

Hamza Usmani2024-04-05T02:41:04+11:00October 19, 2023|

Best Tax Advice for Australians

Hamza Usmani2024-01-02T23:24:55+11:00October 18, 2023|

Company Tax Return Instructions 2023

Hamza Usmani2024-02-08T02:43:22+11:00October 15, 2023|

Top 5 Best Banks in Australia for 2024

Hamza Usmani2024-10-03T16:36:47+10:00October 12, 2023|

How To Find My Tax File Number

Hamza Usmani2024-03-02T05:19:50+11:00October 11, 2023|

How to Register as a Sole Trader ABN?

Hamza Usmani2024-04-07T22:11:26+10:00October 6, 2023|

Is there GST on Bank Fees?

Hamza Usmani2024-03-05T18:18:42+11:00October 5, 2023|

What Does a Balancing Account ATO Mean?

Hamza Usmani2024-02-02T22:17:36+11:00October 1, 2023|

Guide on ATO Weekly Tax Table 2023

Hamza Usmani2024-03-26T02:12:33+11:00September 30, 2023|

How Long Does It Take to Get an ABN?

Hamza Usmani2024-10-21T09:31:05+11:00September 27, 2023|

Tax Tips for Photographers

Michael Kambouridis2023-07-28T15:10:51+10:00May 24, 2023|

Tax Tips for Grooming Professionals

Michael Kambouridis2024-10-17T18:55:43+11:00May 17, 2023|

Managing Your Finances as an Electrician

Michael Kambouridis2023-05-17T21:29:31+10:00May 17, 2023|

Tax Guide for Online Sole Traders

Michael Kambouridis2024-10-16T22:15:51+11:00May 4, 2023|

Guide to Tax Planning for Freelancers

Michael Kambouridis2023-05-03T19:56:50+10:00May 3, 2023|

Expert Tax Tips for Food Delivery Riders

Michael Kambouridis2023-07-28T15:47:54+10:00April 28, 2023|

Chatbots can Simplify Tax Preparation

Michael Kambouridis2023-05-15T20:31:39+10:00April 25, 2023|

Taxes for Uber Drivers in Australia

Michael Kambouridis2024-05-05T23:57:05+10:00April 19, 2023|

Accounting App For Small Businesses-What Are The Most Important Features?

Michael Kambouridis2023-07-28T14:07:49+10:00March 28, 2023|

Key Invoice Management Tips for Small Businesses

Michael Kambouridis2024-10-04T20:37:10+10:00October 28, 2022|

6 Common Small Business Mistakes to Avoid

Michael Kambouridis2023-07-28T14:08:43+10:00September 26, 2022|

5 Ways Self-Employed Individuals Can Pay Less Taxes

Michael Kambouridis2022-09-28T18:53:13+10:00September 21, 2022|