How TaxLeopard works

for Sole Traders

2

Get a snapshot of your net profit, create quotes and invoices, and complete vehicle logbooks seamlessly.

All tax services in one app

What our users say about us

Working on an ABN, previous accountant was slow and expensive. Switching to TaxLeopard was a game-changer. They streamlined the process, saved me time, and offered competitive pricing. Now, I can focus on my business with peace of mind. Highly recommend their efficient and affordable services!

Working on an ABN, previous accountant was slow and expensive. Switching to TaxLeopard was a game-changer. They streamlined the process, saved me time, and offered competitive pricing. Now, I can focus on my business with peace of mind. Highly recommend their efficient and affordable services!

Working on an ABN, previous accountant was slow and expensive. Switching to TaxLeopard was a game-changer. They streamlined the process, saved me time, and offered competitive pricing. Now, I can focus on my business with peace of mind. Highly recommend their efficient and affordable services!

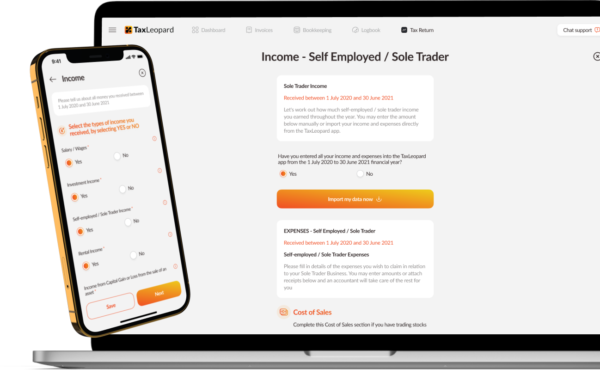

Leopard-Easy ABN Sole Trader Tax Returns

Effortlessly navigate tax season with ease as you submit your ABN sole trader tax returns through our platform, leaving behind the stress of paperwork and complexity.

SIMPLIFY

your tax journey with TaxLeopard’s

powerful and efficient platform

ENJOY

the success of your business while our expert tax accountants take care of your returns

EXPERIENCE

a seamless and stress-free tax season with TaxLeopard as your trusted companion.

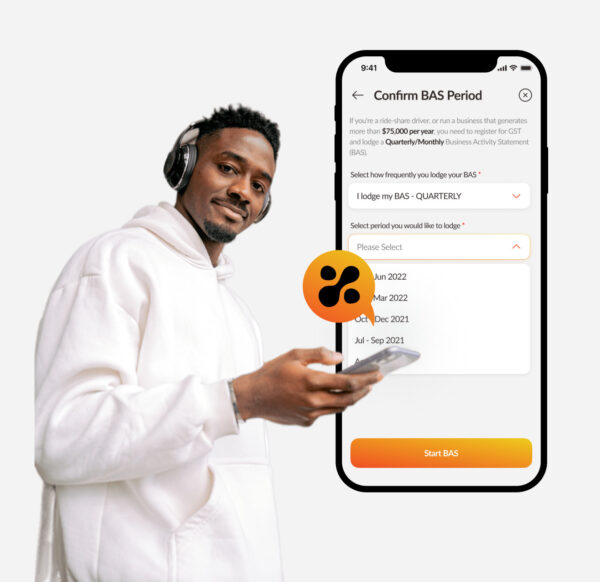

Streamline BAS Lodgement

Sole Trader Business Activity Statement

When it comes to reporting your sole trader goods and services tax (GST), TaxLeopard has got you covered with our BAS (Business Activity Statement) feature.

As a sole trader, you can effortlessly submit your BAS to our tax accountants through our platform. We will review and lodge your BAS to the Australian Taxation Office (ATO) on your behalf, ensuring compliance and accuracy.

Let TaxLeopard handle the complexities of calculations and paperwork for you. Enjoy peace of mind with expert review and efficient BAS lodgement.

BAS Quarters

BAS Quarters

for Sole Traders

BAS Quarters

BAS Quartersfor Sole Traders

Q1 – July to September

Q2 – October to December

Q3 – January to March

Q4 – April to June

GST Registrations

When Do Sole Traders Need to Register?

If your annual turnover hits $75k, it’s time to step onto the GST dance floor. However, taxi and rideshare drivers should register from the first dollar earned, even if you earn below the threshold. Signing up for GST brings benefits such as fancy tax credits

Streamline your GST journey with TaxLeopard. Let’s rock the GST world together!

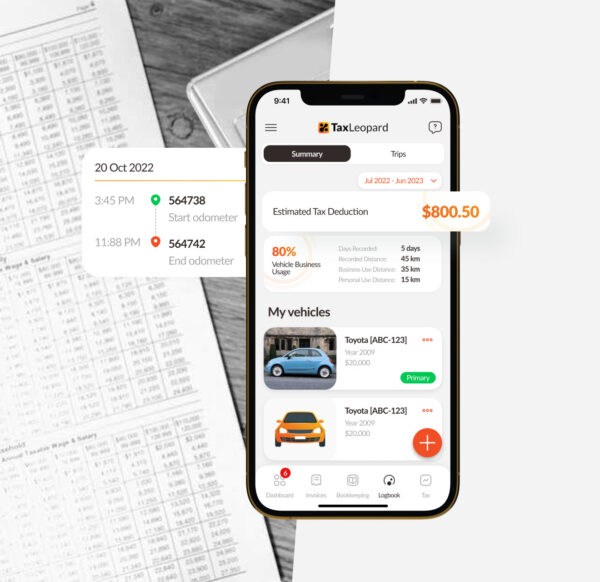

Digital Logbooks for Sole Traders

Your ATO-Compliant

Logbook App

Roar ahead and leave those traditional logbooks behind!

With TaxLeopard’s digital vehicle logbook, you’ll track your business mileage with ease. Just enter your trips, and our intuitive logbook will take care of the rest. TaxLeopard is your compliant ATO logbook app and keeps a watchful eye on your journey.

No more lost papers or messy forms! Unleash your inner leopard and conquer the road confidently, knowing that TaxLeopard has your back!

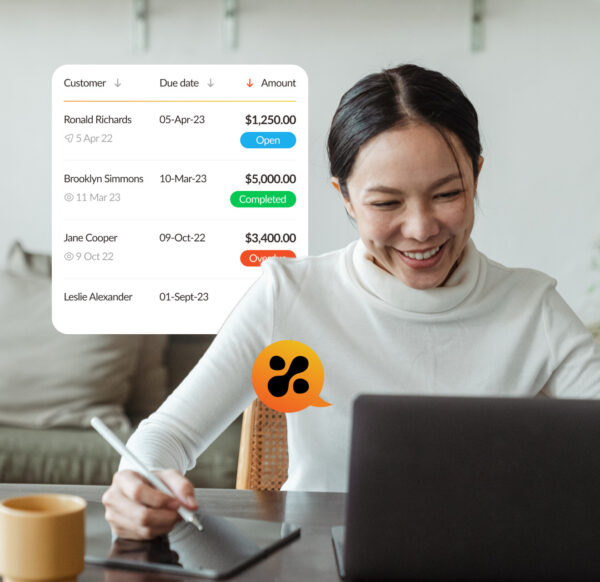

Quotes and Invoicing

for Sole Traders

With TaxLeopard, you’ll have the power to roar with confidence as you effortlessly create professional and purrfect quotes that leave a lasting impression.

Our quirky leopard-inspired platform will have you leaping ahead in the invoicing game, making your business shine like never before.

So, don’t be a shy kitten—embrace your wild side and let TaxLeopard be your trusty companion. Get ready to make a statement with quotes that make your clients go “meow!”

Start Your Sole Trader

Journey with TaxLeopard

Get your ABN today!

Embarking on your journey as a Sole Trader requires obtaining an Australian Business Number (ABN) to establish your business identity.

With TaxLeopard, ABN registration becomes a seamless and hassle-free process. Join TaxLeopard today and get your ABN with ease, empowering you to excel in your self-employed venture.