The complexities of income tax returns can be a tough task for Australian businesses and individuals alike. Many people find the process of understanding and complying with tax obligations overwhelming, leading to unnecessary stress and confusion. Enter the PAYG (Pay As You Go) payment system, a solution introduced by the Australian Taxation Office to streamline tax payments. This system allows taxpayers to pay their income tax incrementally. It eases the burden of a lump sum payment at the end of the financial year. Our guide delves into the intricacies of PAYG, offering clear explanations and practical advice to demystify this essential aspect of Australian taxation.

How to Register for PAYG?

To register for PAYG withholding, businesses or tax agents must follow these steps:

- Determine if you are required to pay PAYG instalments or subject to PAYG withholding obligations based on your business and investment income.

- Visit the Australian Tax Office (ATO) website or contact a tax agent to initiate the registration process.

- Provide details about your business, including ABN, and the type of payments you make that are subject to withholding.

- Once registered, you will need to lodge and pay the withheld amounts quarterly, aligning with the PAYG instalments due dates.

- Utilize the PAYG instalment form provided by the ATO to report and pay your instalments, ensuring you meet your income tax liability efficiently.

What is PAYG Withholding?

PAYG withholding is a process where businesses withhold tax from payments made to employees and other entities. This method ensures that income tax is collected in real time, aligning tax obligations with earning periods. Businesses must register for Pay As You Go withholding with the ATO to comply, thereby contributing to a smooth and consistent tax collection process.

Benefits of PAYG Withholding

The PAYG withholding in Australia offers several benefits for both businesses and individuals. It simplifies tax obligations by allowing taxpayers to meet their end-of-year tax liabilities gradually, through instalments based on the income they earn. This approach reduces the likelihood of facing a large tax bill at the end of the financial year. Additionally, PAYG withholding obligations ensure that businesses withhold tax from payments where required, promoting compliance and streamlining the process of lodging and paying taxes. Employers benefit from a structured framework to collect and remit taxes on behalf of their employees, making tax time less daunting.

What are PAYG Instalments?

PAYG instalments allow taxpayers to meet their income tax obligations by making regular payments towards their expected tax liability. This system is particularly beneficial for sole traders and investors, as it provides a structured way to manage tax payments on business or investment income. The ATO provides an instalment rate, guiding taxpayers on the amount to be paid, and ensuring that their tax liabilities are met gradually and reliably.

How to Calculate PAYG Instalment?

Calculating PAYG instalments requires estimating your yearly tax based on your latest tax return. The ATO issues a Pay As You Go instalment form to set your quarterly tax payments, facilitating a gradual income tax payment throughout the year.

When are PAYG Instalments Due?

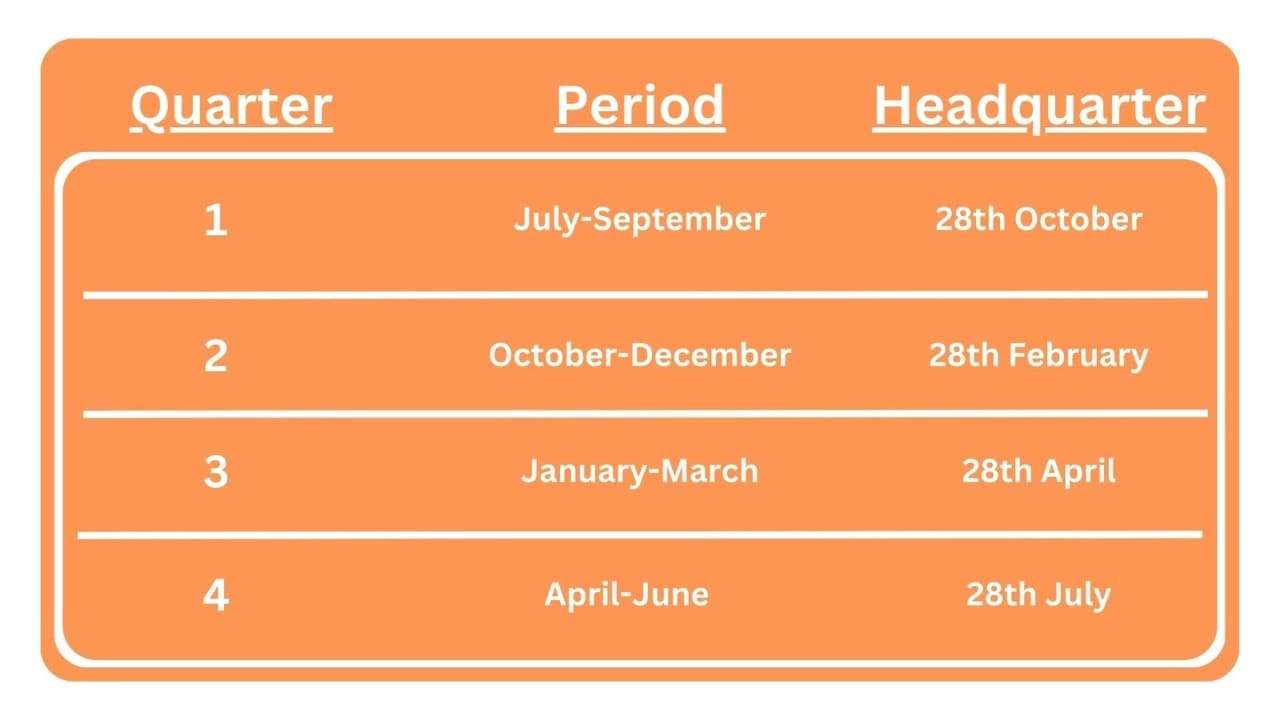

PAYG instalments are generally paid quarterly, helping taxpayers spread their tax payments throughout the year. The due dates for these instalments are typically the 28th day after the end of each quarter, allowing businesses and individuals to manage their tax payments efficiently and avoid a huge tax bill at the end of the financial year.

Using PAYG to Manage Cash Flow and Tax Liabilities

- Understand Your Tax Obligations: Stay informed about the expected tax and ensure you meet your PAYG withholding obligations.

- Plan for Tax Time: Anticipate your annual tax bill and set aside funds to meet end-of-year tax liabilities.

- Monitor Instalment Income: Keep track of instalment income to avoid a huge tax surprise at the year’s end.

- Adjust Payments as Needed: If your business income changes, adjust your PAYG instalments to reflect your current income tax liability.

- Consult a Professional: Engage with a tax agent to navigate complex PAYG issues and ensure you’re not over or underpaying.

Pay As You Go for Employees:

In Australia, employees are subject to PAYG withholding, where employers withhold tax from payments to meet income tax obligations. This system ensures that individuals’ income tax liability is partially or fully covered by the time they lodge their annual tax return. The difference between PAYG withholding amounts and the actual tax assessment can result in a tax bill or refund at the end of the financial year. Employees can adjust their PAYG withholding to better match their expected tax liability, preventing a large tax bill. This proactive approach helps manage financial expectations and obligations efficiently.

Pay As You Go for Employers:

Employers in Australia play a crucial role in the PAYG withholding system, obligated to withhold tax from their employees’ payments. This responsibility includes calculating the correct amount of tax to withhold based on the income brackets and submitting these withholdings to the Australian Tax Office (ATO). Employers must also provide payment summaries to their employees, detailing the income earned and the tax withheld throughout the financial year. This system simplifies tax time for both parties and ensures that employees meet their end-of-year tax liabilities. Employers need to lodge and pay the withheld amounts periodically, usually quarterly, aligning with their business’s reporting and payment cycles.

Pay As You Go for Sole Traders:

- Personal and Business Tax Combined: Understand that business and investment income is subject to your tax return.

- Stay on Top of Instalments: These instalments are generally paid quarterly, so plan your cash flow accordingly.

- Know Your Rates: The ATO assesses your instalment rate based on your most recent tax return.

- Manage Withholding Requirements: If you employ others, you need to withhold PAYG amounts from their payments.

- Use Instalments to Prevent Tax Debt: Regular PAYG instalments help prevent a large tax bill at the end of the financial year.

Managing PAYG in Partnerships and Companies

Partnerships and companies must diligently handle PAYG obligations to ensure smooth operations. Each partner’s share of business income is subject to PAYG instalments. Companies need to pay PAYG instalments quarterly, based on the income they report. It’s essential to withhold the correct amount of tax from employees’ wages. Regular consultation with a tax agent can help partnerships and companies navigate their PAYG obligations. Finally, accurate record-keeping is crucial for meeting tax assessment requirements and avoiding penalties.

Conclusion

The PAYG system simplifies tax obligations for Australians, aiding both businesses and individuals in effective financial management throughout the year. By dividing income tax into manageable payments, the Australian Taxation Office offers a solution that reduces tax time stress. This guide has detailed the PAYG essentials, aiming to provide the knowledge for confident navigation of this system. Have you found the PAYG payment system beneficial for your tax management?