Chasing invoices can be a major hurdle for sole traders, consuming valuable time that could be better spent growing the business. Freelancers and small business owners often struggle with inefficient invoicing systems, leading to delayed payments and cash flow issues. The ideal solution is to adopt the best invoicing software for sole traders, tailored to streamline the invoicing process.

This software can automate accounting tasks, manage invoices efficiently, and integrate seamlessly with online payment systems. For a deeper dive into how these solutions can transform your business operations, the complete guide is detailed in the article below.

Why Invoicing Software is Good for Sole Traders?

For sole traders, invoicing software is invaluable for streamlining their financial processes. It automates data entry, allowing more time for core business tasks. These tools ensure that invoices are sent promptly and are easy to track, improving cash flow management. They also simplify expense tracking and can integrate seamlessly with bank accounts, enhancing overall financial oversight. By using a dedicated accounting app, sole traders can maintain good accounting practices more effortlessly.

Key Considerations in Choosing Software

- Assess your specific business needs to find suitable features

- Look for software that offers integration with your existing tools

- Ensure the software supports automatic updates for compliance and efficiency

- Opt for platforms that provide robust security measures to protect your data

- Consider the availability of customer support and a free trial to test the software

Evaluating Your Business Needs

Identify the scale of your operations and the complexity of your financial transactions. This assessment helps determine the features you require in accounting software, ensuring it aligns with your specific business demands.

Advantages of Using Dedicated Software

Choosing dedicated invoicing software for sole traders simplifies many aspects of business management. It automates essential tasks such as data entry and expense tracking, freeing up time for other business activities. The inclusion of mobile apps allows owners to handle financial matters on the go. Features like automated invoice generation ensure timely billing, which improves cash flow. Here are some key benefits:

- Reduction of Manual Errors: Automation minimizes the risk of errors in bookkeeping and financial calculations.

- Enhanced Oversight of Finances: Real-time tracking of cash flow and expenses aids in making informed decisions.

- Time Efficiency: Automated routine tasks, like sending invoices and monitoring expenses, save considerable time.

- Streamlined Invoice Management: Quick and efficient invoice processing enhances revenue cycles.

Features to Look for in Invoicing Software

1. Comprehensive Invoicing Capabilities:

When selecting invoicing software, prioritize systems that offer comprehensive features to manage and send invoices efficiently. Ideal software should allow customization to reflect brand identity, handle multiple currencies for global business, and provide detailed invoice tracking to monitor payments.

2. Robust Expense Tracking and Management:

For sole traders and small businesses, the ability to track expenses directly through accounting software is essential. Look for features that automate data entry, categorize expenses, and offer insights into spending patterns, helping to manage cash flow effectively.

3. Integration with Bank Accounts and Financial Tools:

The best accounting software integrates seamlessly with bank accounts and other financial tools. This integration simplifies the reconciliation process, reduces manual entry errors, and provides a real-time overview of your financial health, enhancing decision-making capabilities.

4. Mobile Accessibility and Cloud-based Solutions:

In an era where business moves quickly, having access to your accounting software via a mobile app is crucial. Cloud-based software ensures your data is accessible anytime, anywhere, which is particularly useful for freelancers and those who travel often.

5. Free Trial and Scalable Options:

Before committing, consider software that offers a free trial. This allows you to test the software’s functionality and ensure it meets your specific business needs. Scalable options are advisable, as they accommodate growing business needs without requiring a switch to a new system.

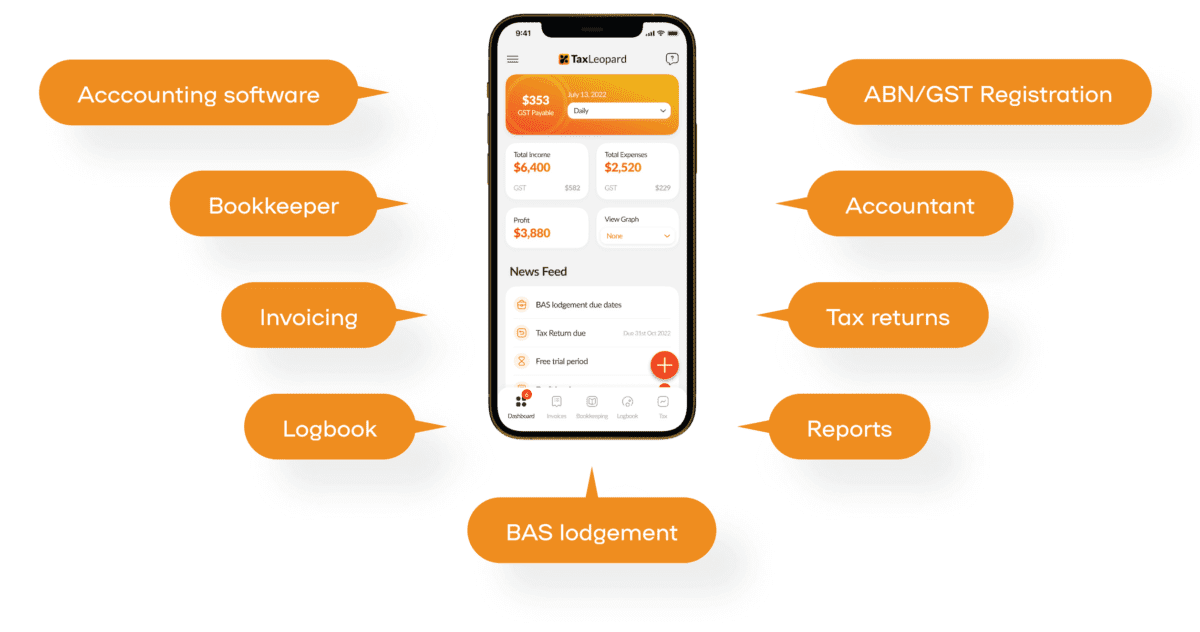

TaxLeopard: The Best Invoicing Software for Sole Traders

TaxLeopard, tailored for self-employed individuals and contractors in Australia, offers comprehensive accounting solutions. Designed with direct input from certified accountants, this platform ensures top-tier financial management. Key features include streamlined expense tracking, automated data entry, and easy connection to bank accounts.

With TaxLeopard, sole traders can send invoices efficiently, manage cash flow effectively, and track expenses with precision. The mobile app lets users manage finances on the go, making it an indispensable tool for small businesses.

Why Choose TaxLeopard for Your Invoicing Needs?

Choosing TaxLeopard brings several advantages for managing your business finances:

- Automates and simplifies invoice creation and bookkeeping tasks.

- Offers a free trial, allowing you to test its extensive features without any commitment.

- Integrates seamlessly with bank accounts, providing real-time financial insights.

- Supports effortless tracking of receipts and expenses, which enhances budgeting and tax preparation.

- Designed specifically for the unique needs of freelancers and sole traders, helping to maintain accurate and up-to-date financial records.

TaxLeopard streamlines your accounting tasks, freeing up more time to focus on growing your business.

How to Optimize Your Invoicing Process with Software?

To optimize your invoicing process with software, consider these approaches:

- Automate data entry to save time and reduce errors.

- Utilize mobile apps to send invoices and track expenses on the go.

- Integrate your software with bank accounts for real-time cash flow visibility.

- Choose a platform offering a free trial to test features without commitment.

- Ensure your software supports both freelancers and small businesses for scalability.

Conclusion

Choosing the right invoicing software for sole traders is crucial for optimizing business workflows and financial management. With the right tool, creating professional-looking invoices, managing recurring charges, and receiving payments online become effortless. As you look to enhance your business efficiency, consider how features like cloud-based capabilities and basic accounting functions fit your unique needs. Have you assessed how the different software options align with your business objectives?