Inadequate financial management is a leading cause of business failure. The right accounting service not only minimizes risks but also maximizes growth potential. TaxLeopard provides tailored financial services, ensuring every aspect of your business’s finances, from tax planning to profit analysis, is handled precisely. Our complete guide is in the article below for an in-depth look at how TaxLeopard can transform your business financials.

Accounting Services in Australia

Accounting services in Australia encompass a range of financial tasks that are crucial for any business. Accountants are responsible for bookkeeping, managing payroll, preparing financial statements, and filing tax returns. These services ensure that businesses operate efficiently and comply with legal requirements.

- Bookkeeping keeps track of daily financial transactions.

- Payroll Management ensures accurate and timely payment to employees.

- Financial Statements provide a clear picture of financial health.

- Tax Return Preparation helps businesses meet their tax obligations on time.

The importance of these services cannot be overstated. Proper management of finances underpins the stability and growth of a company. It allows businesses to forecast cash flow, plan for the future, and make informed decisions. Additionally, accounting ensures compliance with the Australian Securities and Investments Commission (ASIC) regulations and lodgment of income tax returns.

Specialized services in taxation help businesses minimize their tax liability while adhering to taxation laws. This specialization is critical as it affects the bottom line and can influence business strategies and operations.

- Specialization in taxation reduces tax liabilities legally and effectively.

- Cash flow forecasting enables better resource allocation and financial planning.

The Importance of Efficient Accounting in Business

Efficient accounting plays a crucial role in business success. It ensures that financial records are accurate and up-to-date, enabling business owners to make informed decisions. An expert team of accountants and tax agents helps maximize financial outcomes and minimize tax liabilities. Businesses benefit from streamlined processes and enhanced financial reporting by using the latest accounting software.

Utilizing professional services like TaxLeopard ensures that every financial activity, from tax planning to the preparation of tax returns, is handled meticulously. Business owners can focus on growth while outsourcing complex accounting needs. The peace of mind provided by comprehensive fintech app development services allows businesses across Australia to thrive and achieve their goals.

How Software Can Serve as Your Digital Tax Accountant?

Modern accounting software functions as a digital tax accountant, streamlining tax planning and preparation tasks. It accurately manages tax returns, minimizes tax liabilities, and ensures compliance, providing business owners peace of mind.

How Accounting Software Enhances Financial Management?

Accounting software offers comprehensive tools for detailed financial reporting and performance analysis. This technology helps in maintaining accurate records and supports strategic business decisions, ultimately fostering business growth.

How Adaptive Software Meets Changing Business Demands?

Cloud-based accounting platforms adjust swiftly to evolving business needs. They offer tailored services that grow with your business, from managing BAS to intricate financial planning, thus safeguarding your financial agility across Australia.

Unleash Your Business’s Potential with TaxLeopard

TaxLeopard, the premier accounting software in Australia, is your gateway to simplified business management. With CPA-certified accountants at the helm, this cloud-based platform is ideal for self-employed individuals and contractors. TaxLeopard ensures your financial reporting and tax planning are seamless, empowering you to focus on business growth. From tax returns to financial advice, every service is tailored to meet the specific needs of your business, enhancing financial performance and ensuring compliance with statutory obligations.

Benefits for Business Owners

- TaxLeopard streamlines accounting and bookkeeping processes, saving valuable time that can be focused on strategic decisions

- Provides a full range of services including tax, BAS, and superannuation, helping to maximise returns and minimise liabilities

- Offers cloud-based solutions that keep business records accurate and up-to-date, enabling better financial planning and reporting

- Enhances peace of mind with expert team support for all compliance obligations, ensuring your business meets all Australian standards

- Personalised advisory services to align with your business goals, supporting sustainable growth and improving overall financial health

Why Choose Us?

Choosing TaxLeopard means opting for a service that understands the nuances of Australian business regulations and offers a full range of services to cover every financial aspect of your enterprise. This includes everything from cloud-based accounting to complex corporate secretarial tasks.

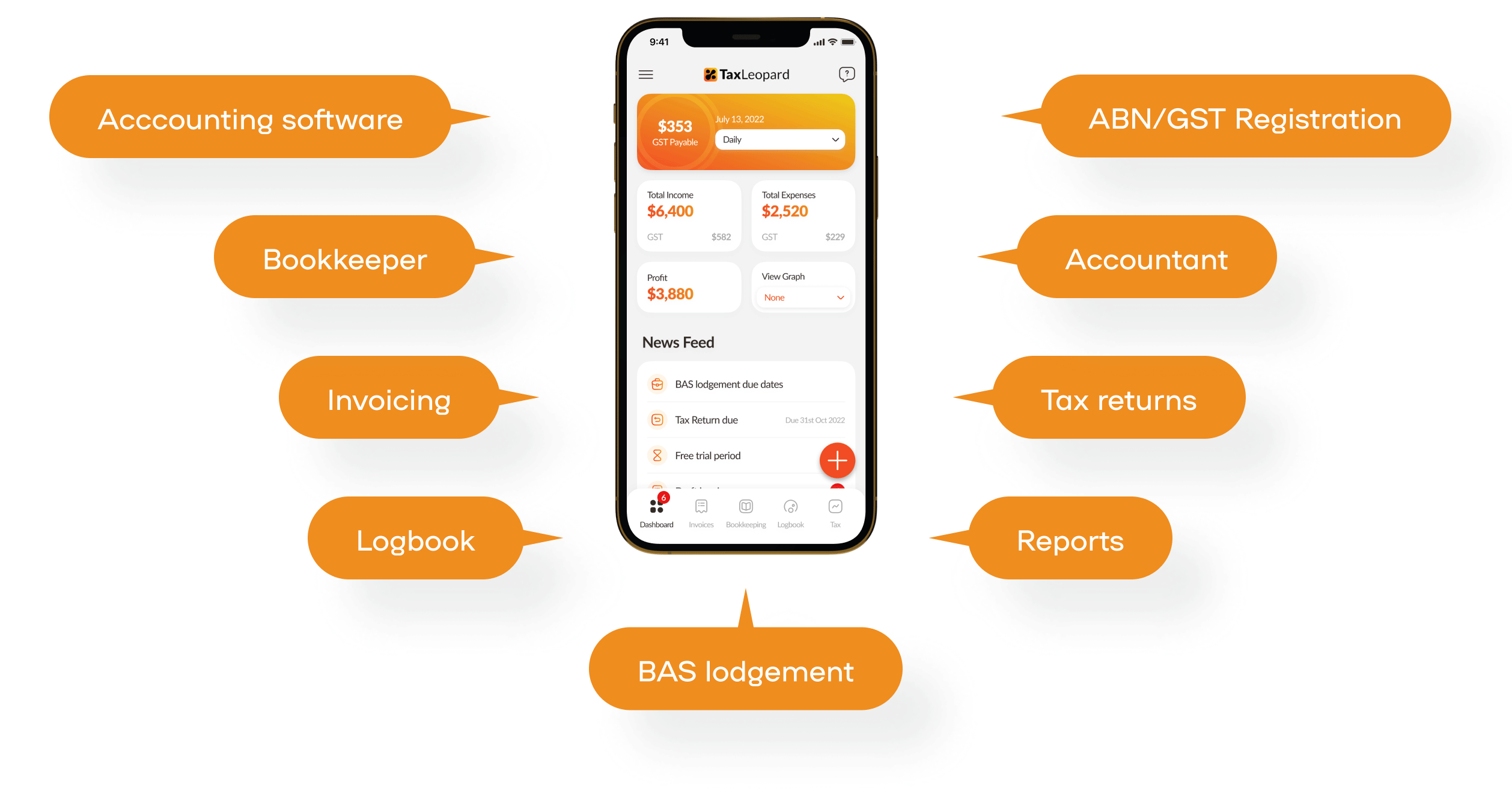

TaxLeopard offers an array of features designed to streamline the financial processes of any business, enabling owners to focus more on growth and less on paperwork. Our platform integrates several crucial services:

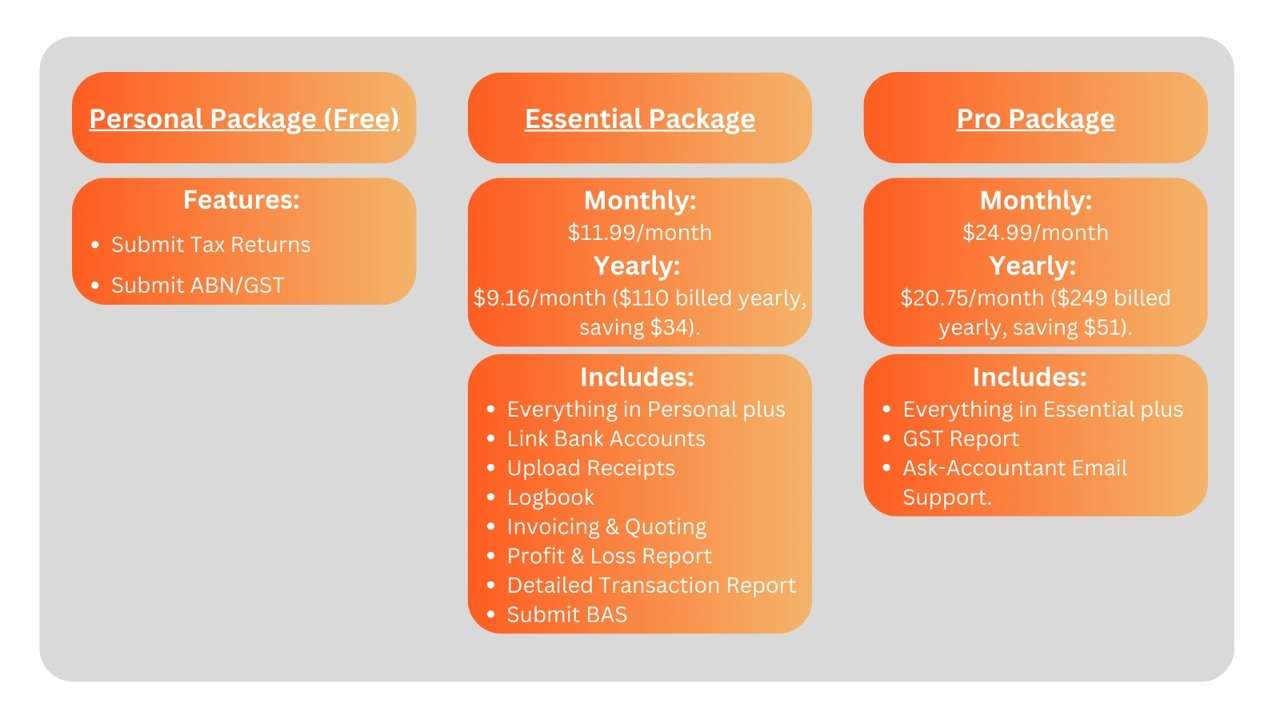

Pricing and Subscription Plans

Ready to take your business to the next level? Get in touch with us and explore how our detailed range of services can help transform your business operations. Our commitment to responsiveness and quality service ensures we manage your accounting and tax needs efficiently, allowing you to focus on running your business.