In the realm of accounting, skill enhancement is not just about understanding numbers; it’s about applying knowledge in practical, impactful ways. This guide introduces the “Best Accounting Projects to Upgrade Your Skills”, designed to provide hands-on experience in diverse aspects of accounting. From personal budgeting to sophisticated software implementation, these projects cater to a range of interests and skill levels.

They offer a unique blend of theoretical knowledge and practical application, essential for anyone looking to advance in the accounting field. Whether you’re a student, a professional seeking to refine your skills, or simply someone with an interest in financial management, these projects are tailored to elevate your accounting prowess. Dive into these projects to navigate the complex world of finance with confidence and competence.

Importance in Skill Development

Developing skills in accounting is crucial for anyone in the financial field. These skills extend beyond mere number crunching; they form the foundation for making informed business decisions. Mastery of accounting equips professionals with the ability to analyze financial data, ensuring accuracy and compliance with regulatory standards. It also enhances strategic thinking, enabling them to forecast financial trends and advise on budgeting and investment. Moreover, strong accounting skills are essential for personal financial management, helping individuals make sound decisions about investments, savings, and expenditures. In an ever-evolving economic landscape, having robust accounting skills ensures adaptability and long-term success.

Basic Accounting Concepts

Fundamental Principles

Basic accounting principles form the backbone of all financial analysis and reporting. The most fundamental concept is the double-entry system, where each transaction affects at least two accounts, maintaining the equation:

Assets = Liabilities + Equity

Another key principle is the accrual basis of accounting, which records revenues and expenses when they are incurred, regardless of when cash transactions occur. These principles ensure accuracy and consistency in financial reporting, providing a true and fair view of an organization’s financial position.

Key Terminologies

Understanding key accounting terminologies is essential for interpreting financial statements and conducting financial analysis. Terms like ‘assets’, which represent resources owned by a business, and ‘liabilities’, which are obligations the business owes, are foundational. ‘Equity’ refers to the owner’s interest in the company. Revenue, expenses, and profit terms reflecting the company’s operational performance are critical for assessing financial health. Grasping these terms provides the basis for deeper financial exploration and decision-making in both personal and professional contexts.

Accounting Projects to Boost Your Skills

1. Personal Budgeting and Financial Planning:

Personal budgeting and financial planning involve creating a detailed plan for managing personal finances. This project focuses on tracking income, expenses, and setting financial goals. It requires an analysis of spending habits and financial commitments, aiming to develop a realistic and sustainable personal budget. The process includes categorizing expenses, forecasting future financial scenarios, and planning for both short-term needs and long-term aspirations, like saving for retirement or purchasing a home.

Skills Developed

This project enhances skills in financial literacy and management. Participants gain proficiency in understanding cash flow and the importance of savings. They learn to make informed financial decisions and develop strategies for achieving financial stability. The project also hones skills in goal-setting, prioritization, and adapting to changing financial circumstances, vital for both personal and professional financial health.

2. Financial Analysis of Australian SMEs:

This project involves analyzing the financial health of Small and Medium Enterprises (SMEs) in Australia. It encompasses examining financial statements, such as balance sheets, income statements, and cash flow statements. The analysis focuses on key performance indicators like profitability, liquidity, and solvency. Participants engage in assessing business models, understanding industry trends, and evaluating financial risks. This project provides insight into the unique challenges and opportunities faced by Australian SMEs in various sectors.

Skills Developed

Skills developed include advanced financial statement analysis, critical thinking, and business acumen. Participants draw conclusions about business performance, learn to interpret financial data and provide actionable recommendations. The project enhances understanding of market dynamics and the economic environment affecting Australian SMEs, preparing individuals for strategic decision-making in a business context.

3. Australian Taxation Project:

The Australian Taxation Project involves understanding and applying the principles of the Australian tax system. It includes preparing tax returns for individuals and businesses and navigating complex tax laws and regulations. The project covers various aspects of taxation, such as Goods and Services Tax (GST), income tax, capital gains tax, and corporate tax. Participants engage in real-life scenarios, ensuring compliance with Australian Taxation Office (ATO) guidelines, and exploring tax planning and optimization strategies.

Skills Developed

This project develops skills in tax preparation, planning, and compliance. Participants become proficient in interpreting and applying tax laws, an essential skill for accountants and financial professionals. They also learn to identify tax-saving opportunities and understand the implications of tax decisions for individuals and businesses. The project fosters attention to detail and analytical skills, crucial for navigating the complexities of taxation.

4. Investment Portfolio Management:

Investment Portfolio Management involves creating and managing a mock investment portfolio. The project includes selecting a mix of assets like stocks, bonds, and mutual funds in Australia, with a focus on Australian financial markets. Participants analyze market trends, assess risk tolerance, and set investment goals. The project simulates real-world investment scenarios, providing experience in diversifying portfolios, making buy/sell decisions, and evaluating investment performance over time.

Skills Developed

Participants develop skills in investment analysis, risk management, and strategic planning. They gain insights into asset allocation, market analysis, and the impact of economic factors on investments. The project enhances decision-making abilities under uncertainty and teaches the importance of portfolio diversification. Skills in data analysis and interpretation are also developed, which are valuable in various financial roles.

5. Accounting Software Implementation:

This project entails implementing and mastering popular accounting software like Xero or MYOB. Participants learn to set up accounts, process transactions, and generate financial reports. The focus is on understanding how these tools can streamline accounting processes for businesses. The project includes tasks like managing invoices, payroll, and reconciling bank statements. The emphasis is also placed on understanding how these systems can provide real-time financial insights and aid in strategic decision-making.

Skills Developed

Skills developed include technical proficiency in using accounting software, data entry accuracy, and financial reporting. Participants become adept at automating routine accounting tasks, enhancing efficiency and accuracy. The project also builds skills in financial data analysis and interpretation, crucial for providing insights into business performance. Participants learn the importance of integrating technology into accounting, a key competency in the digital age.

Integrating Technology in Accounting Projects

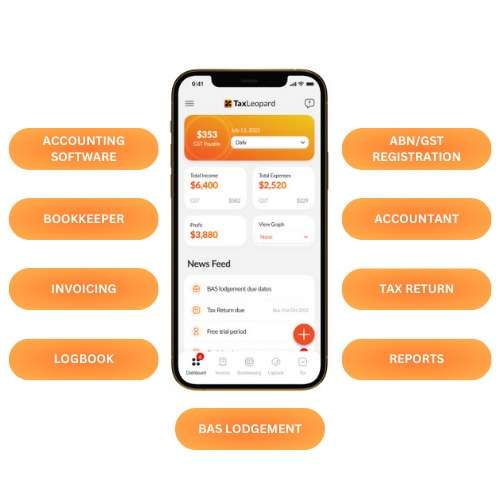

Using Accounting Software: TaxLeopard

TaxLeopard is revolutionizing the way businesses manage their finances. This comprehensive application offers a suite of features, including Bookkeeping, Invoicing, a Logbook, BAS Lodgement, Reports, Tax Return Preparation, Accountant collaboration, and ABN/GST Registration. Each of these features is designed to streamline and automate various aspects of financial management. With TaxLeopard, businesses can efficiently manage their day-to-day financial tasks, ensuring accuracy and compliance with Australian tax laws. By adopting TaxLeopard, users can save time, reduce errors, and focus more on strategic aspects of their business. This application is not just a tool but a financial management partner, making it an essential asset for modern businesses.

Embracing Digital Transformation

In today’s fast-paced world, digital transformation in accounting is not just an option but a necessity. Embracing technology means moving beyond traditional accounting practices to a more dynamic, automated, and efficient system. This transition involves integrating digital tools and software, like TaxLeopard, to handle various accounting tasks. Digital transformation in accounting leads to improved accuracy, real-time data analysis, and enhanced decision-making capabilities. It empowers businesses to keep up with regulatory changes and manage financial data more effectively. By embracing digital transformation, businesses can achieve greater efficiency, improve client satisfaction, and stay competitive in an increasingly digital world. This shift not only optimizes financial operations but also paves the way for future growth and innovation.

Project Management Skills in Accounting

Time Management

Effective time management is crucial for accounting projects. Accounting tasks often involve tight deadlines and require meticulous attention to detail. Efficiently managing your time by prioritizing tasks, setting realistic deadlines, and avoiding procrastination ensures the timely completion of accounting projects without compromising accuracy. Adopting time management tools and techniques can significantly enhance productivity and reduce stress.

Communication and Teamwork

Accounting isn’t just about numbers; it involves clear communication and effective teamwork. Whether it’s explaining financial concepts to non-accountants or collaborating with team members on complex projects, strong communication skills are essential. Accountants need to articulate financial information clearly and concisely. Teamwork involves coordinating with colleagues, sharing information transparently, and working harmoniously towards common goals. These skills are pivotal for successful project completion and fostering a productive work environment. Integrating a SharePoint calendar app can contribute to effective task allocation and time management, leading to improved project outcomes.

Challenges and Solutions in Accounting Projects

Common Hurdles

Accounting projects often face challenges like data complexity, regulatory compliance, and technological advancements. Navigating through intricate financial data while ensuring accuracy can be daunting. Additionally, keeping up with constantly evolving accounting standards and regulations demands continual learning and adaptability.

Overcoming Obstacles

To overcome these hurdles, it’s important to stay updated with the latest accounting trends and regulatory changes. Embracing technology, such as accounting software and analytical tools, can simplify complex data management. Continuous learning and professional development are key to understanding and implementing new standards. Effective problem-solving strategies and a proactive approach to challenges can lead to successful project outcomes.

Evaluating Your Progress

Self-assessment

Regular self-assessment is vital for the continuous improvement of your accounting skills. Reflect on your completed projects to identify strengths and areas for improvement. Assess how well you met deadlines, adhered to regulations, and achieved project objectives. Consider maintaining a journal to track your progress and set specific goals for skill enhancement.

Seeking Feedback

Feedback from colleagues, supervisors, or mentors is invaluable in understanding your performance from different perspectives. Constructive feedback provides insights into your work quality, efficiency, and team collaboration. Actively seeking and graciously accepting feedback demonstrates your commitment to professional growth and excellence in accounting.

Conclusion

Embarking on these accounting projects marks the beginning of a journey toward financial expertise and professional growth. Each project is a stepping stone to understanding the intricate world of accounting and finance, tailored to enhance skills, boost confidence, and prepare individuals for the dynamic demands of the financial industry. From grasping basic principles to mastering advanced software, these projects lay the groundwork for a successful accounting career.

As you reflect on these projects, consider which aligns most with your career aspirations and personal interests. Which project sparks your curiosity, and why do you think it’s the right choice for your skill enhancement?

FAQs

1. How does personal budgeting help with professional accounting skills development?

Personal budgeting builds foundational skills in cash flow management and financial planning, crucial for any accounting role.

2. Can the financial analysis of SMEs provide insights relevant to larger corporations?

Yes, analyzing SMEs teaches universal financial principles applicable to businesses of all sizes, including larger corporations.

3. Is knowledge of Australian taxation beneficial for accountants working internationally?

Absolutely, understanding Australian taxation laws enhances global tax compliance knowledge, which is valuable in multinational contexts.

4. How does investment portfolio management aid in developing accounting skills?

It sharpens analytical skills, risk assessment, and strategic financial planning, all essential in the accounting profession.

5. What are the advantages of learning accounting software for modern accountants?

Proficiency in accounting software ensures efficiency, accuracy, and up-to-date knowledge in digital financial management.