Managing finances can be a daunting task for small business owners, especially when it comes to tracking income and expenses. Recent research indicates that efficient accounting software can significantly reduce the time spent on financial management, allowing businesses to focus more on growth. The solution lies in choosing the right accounting software for your small business. The best small business accounting software in Australia offers comprehensive accounting features, integrating seamlessly with other business applications.

When selecting accounting software, it’s important to consider the specific needs of your Australian small business to ensure that the software supports and enhances your business operations. In this article, we will delve into the 5 best ones for small businesses in Australia, highlighting their key features and how they can help you manage your business finances more effectively.

Importance of Accounting Software

Accounting software is important for small businesses to manage their finances efficiently. It simplifies accounting tasks, enabling business owners to focus on growth. By automating processes, it reduces errors and saves time. Cloud-based accounting software allows access from anywhere, enhancing flexibility. It provides real-time financial insights, aiding informed decision-making. For Australian small businesses, it ensures compliance with local tax regulations. Overall, the right accounting software solution supports the financial health and operational efficiency of a business.

Key Features to Look for in Small Business Accounting Software

When choosing accounting software for small businesses, consider these key features:

- Easy to Use: The software should have an intuitive interface, making it accessible for non-accountants.

- Comprehensive Accounting Features: It should cover essential tasks such as invoicing, payroll, inventory management, and support seamless virtual bookkeeping workflows.

- Cloud-Based: Cloud-based accounting software offers flexibility to manage your business from anywhere.

- Integration Capabilities: The ability to integrate with other business tools streamlines operations.

- Scalability: The software should be able to grow with your business, accommodating more complex needs as you expand.

- Australian Compliance: For Australian small businesses, it’s important that the software complies with local tax and financial reporting standards.

Benefits of Accounting Software

- Time and Cost Efficiency: “It automates many routine tasks, reducing the need for manual data entry and minimizing errors. This efficiency can lead to significant time and cost savings for small businesses.” Says Alex Taylor, Head of Marketing at CrownTV

- Improved Accuracy: “With features like automatic calculations and real-time data updates, accounting software ensures more accurate financial records, reducing the likelihood of errors that can occur with manual bookkeeping.” Says Oliver Capon, Operations Manager at Smart Detectors

- Enhanced Financial Analysis: “Comprehensive accounting software provides detailed reports and analytics, allowing small business owners to track income and expenses, analyze financial performance, and make informed decisions.” Says Craig Hawthorne, writer at Modest Money

- Simplified Tax Compliance: “Many accounting software options are designed with tax regulations in mind, offering features like GST calculation and easy tax filing, which can help businesses in Australia and New Zealand stay compliant.” Says Mike Johnson, CMO of Great Homeschool Conventions

- Scalability: “As your business grows, cloud-based software can easily adapt to your changing needs, offering additional features like project accounting, advanced inventory management, and integration with other business apps.” Says Martin Seeley, CEO and Sleep Expert, Mattress Next Day

- Security and Data Protection: “It typically includes advanced security measures such as encryption and regular backups, ensuring that sensitive financial data is protected from unauthorized access and potential data loss. This enhanced security helps businesses safeguard their financial information and maintain data integrity.” Says Michael Hurwitz, Chief Executive Officer (CEO) of Careers in Government

Overall, the right accounting software can help small businesses in Australia manage their finances more effectively, freeing up time and resources to focus on other aspects of running their business.

5 Best Accounting Software in Australia

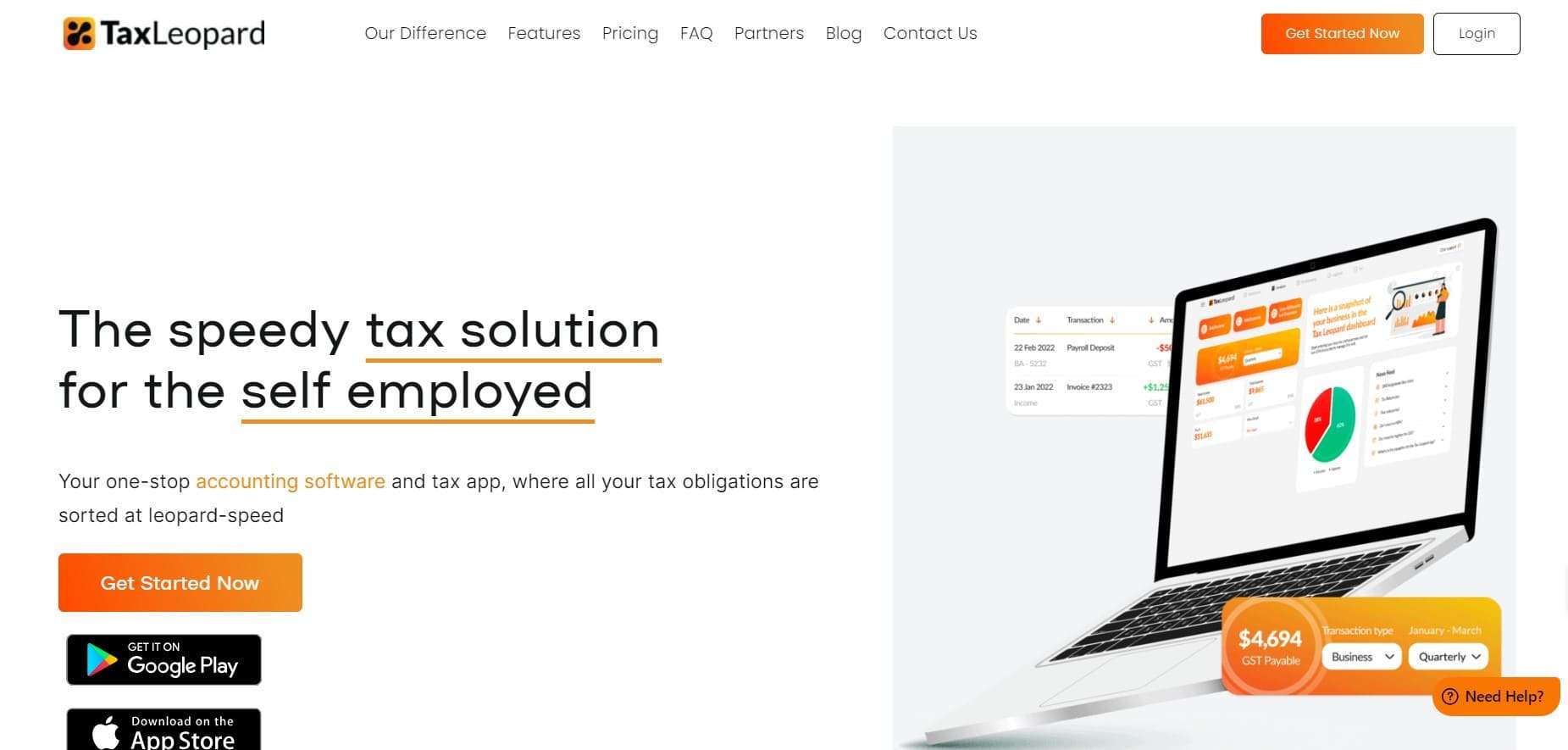

1. TaxLeopard:

-

- Cloud-Based Solution: TaxLeopard is a cloud-based accounting software designed for small businesses in Australia. Can be accessed from anywhere.

-

- GST Compliance: Ensures compliance with Australian GST regulations, simplifying tax reporting.

-

- User-Friendly Interface: Features an intuitive interface, making it easy to manage your business finances.

-

- Real-Time Financial Insights: Provides real-time financial reports to help you make informed business decisions.

-

- Affordable Pricing: Offers competitive pricing with a free trial to test its features.

-

- Integration Capabilities: Integrates with other business applications to streamline your business processes.

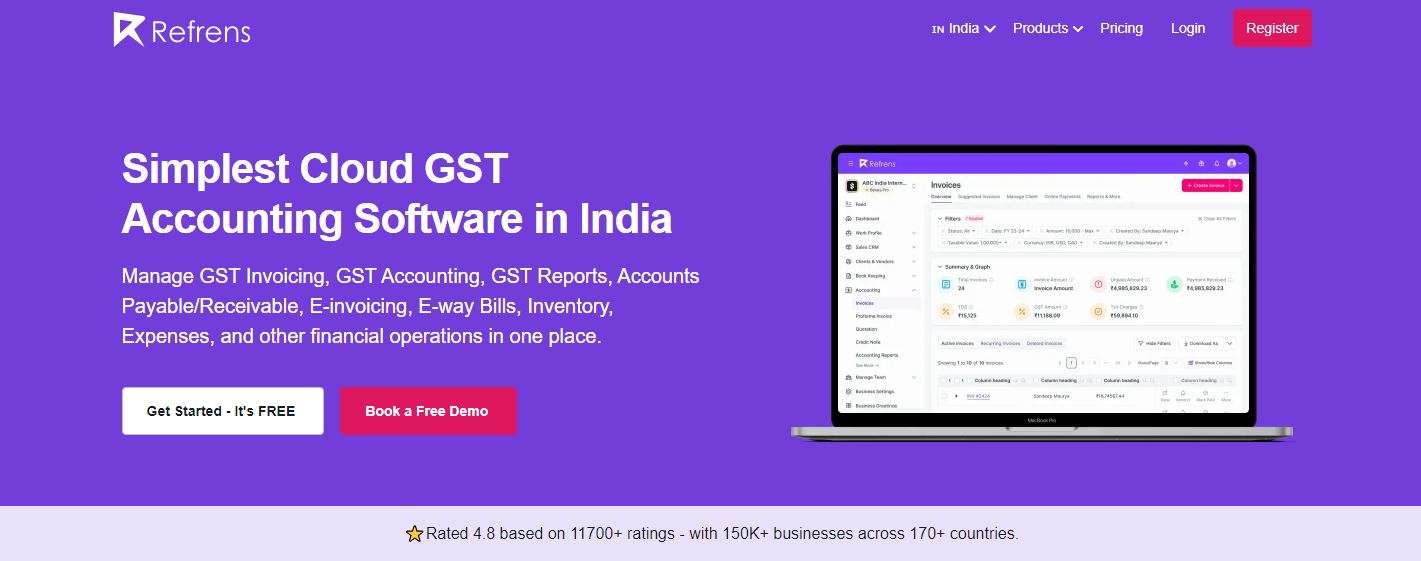

2. Refrens:

- Comprehensive Invoicing: Manage multi-currency, recurring invoices, and e-invoices with auto-generated vouchers and journal entries.

- Expense Management: Record and track purchases, petty expenses, salaries, and utility bills, with detailed summaries and reports.

- Automated Payment Receipts: Automatically generate payment receipts for recorded payments, including advance and lump-sum payments.

- Sales and Purchase Orders: Convert quotations to invoices, proformas, or sales/purchase orders in one click.

- Client & Vendor Management: Automate client creation, bulk upload client data, request testimonials, and manage vendor transactions.

- Advanced Reporting: Generate financial reports such as Balance Sheet, Profit & Loss, GSTR, and profitability reports.

- Banking & Payments: Track transactions across bank accounts, employee accounts, and wallets with automatic ledger and voucher entries.

- Customizable Templates: Customize invoice templates with fonts, colors, letterheads, bank details, UPI IDs, and payment links.

- Audit Trails & Security: Track changes made to documents with audit trails and ensure secure data storage with cloud-based solutions.

- Multi-Currency Support: Manage international transactions and multi-currency invoicing seamlessly.

- Team Management: Add users with customizable roles and permissions for secure collaboration.

- Integration & API: Integrate with payment gateways, third-party services, and use Refrens’ invoicing API for automation.

3. Xero:

-

- Popular Choice: Xero is a widely popular accounting software in Australia and New Zealand.

-

- Cloud Accounting: Offers cloud-based accounting solutions to run your small business from anywhere.

-

- Comprehensive Features: Includes features like invoicing, payroll, and bank reconciliation.

-

- Third-Party Integrations: Integrates with over 800 business apps to enhance functionality.

-

- Scalable Plans: Offers plans that cater to the growing needs of your business.

-

- User-Friendly: Known for its easy-to-use interface and efficient customer support.

4. MYOB:

-

- Tailored for Australian Businesses: MYOB Business Lite is specifically designed for small businesses in Australia.

-

- Comprehensive Accounting: Provides comprehensive accounting features, including GST tracking and payroll software.

-

- Cloud-Based: Offers cloud-based software for easy access and data security.

-

- Business Growth Support: Supports your business as it grows with scalable plans.

-

- Integration Options: Can integrate with other business applications for a seamless workflow.

-

- Reliable Support: Offers reliable customer support to assist with any software-related queries.

5. QuickBooks Online:

-

- User-Friendly: QuickBooks Accounting Software is known for its ease of use and straightforward setup.

-

- Cloud-Based Accounting: Allows you to manage your business finances on the go.

-

- Versatile Plans: Offers various plans to suit the needs of different small businesses.

-

- Advanced Features: Includes advanced accounting features like project accounting and inventory management.

-

- Integration Capabilities: Integrates with other software to streamline business processes.

-

- Strong Customer Support: Provides robust customer support to help with any issues.

While Xero, MYOB, QuickBooks Online, and Reckon One are all reputable accounting software options, TaxLeopard stands out as one of the best choices for Australian small businesses. Its user-friendly interface, real-time financial insights, GST compliance, affordable pricing, and integration capabilities tailored to the Australian market make it a compelling option for business owners looking to streamline their accounting processes.

What Makes TaxLeopard the Best Accounting Software for Your Business?

- Like Xero, MYOB, QuickBooks Online, and Reckon One, TaxLeopard is a cloud-based accounting software, that ensures accessibility and data security. However, TaxLeopard’s interface is designed with the specific needs of Australian small businesses in mind, making it an ideal choice for those seeking a solution tailored to the local market.

- All five software options provide GST compliance, but TaxLeopard goes a step further by offering intuitive GST management and reporting features that simplify the process for business owners, ensuring accurate and timely tax submissions.

- It offers competitive pricing with a free trial, similar to Reckon One’s flexible plans. However, TaxLeopard’s pricing structure is designed to provide maximum value for Australian small businesses, ensuring that users get a comprehensive set of features without unnecessary costs.

- Like MYOB and QuickBooks Online, TaxLeopard integrates with other business applications, but it focuses on seamless integration with Australian-specific apps and services, enhancing the overall efficiency of business operations.

- Similar to Xero and QuickBooks Online, TaxLeopard provides real-time financial insights, but it sets itself apart by offering customized reports and analytics that cater specifically to the Australian market, helping business owners make informed decisions based on local economic trends.