The maze of banking options in Australia can be overwhelming, with an array of transaction accounts, high-interest savings, and debit card offerings, finding the best bank in Australia to suit your needs requires sifting through countless terms, conditions, and fees. Fortunately, the solution lies in comprehensive research and comparison of Australia’s top financial institutions. Our guide dives into the specifics of the top 5 best banks in Australia for 2024, evaluating their account options, savings rates, and customer service, ensuring you make an informed decision tailored to your financial goals.

Introduction to the Australian Banking Sector

The Australian banking sector, often celebrated as one of the strongest globally, plays a pivotal role in the country’s financial stability and economic growth. Over the years, Australia has nurtured a blend of traditional banking institutions and emerging fintech startups, each striving to be the best bank in Australia. This diverse banking ecosystem ensures that both residents and businesses have access to a variety of financial services tailored to their needs. As the demand for seamless, tech-driven banking solutions grows, so does the competition among banks to secure the coveted title of “best banks in Australia.”

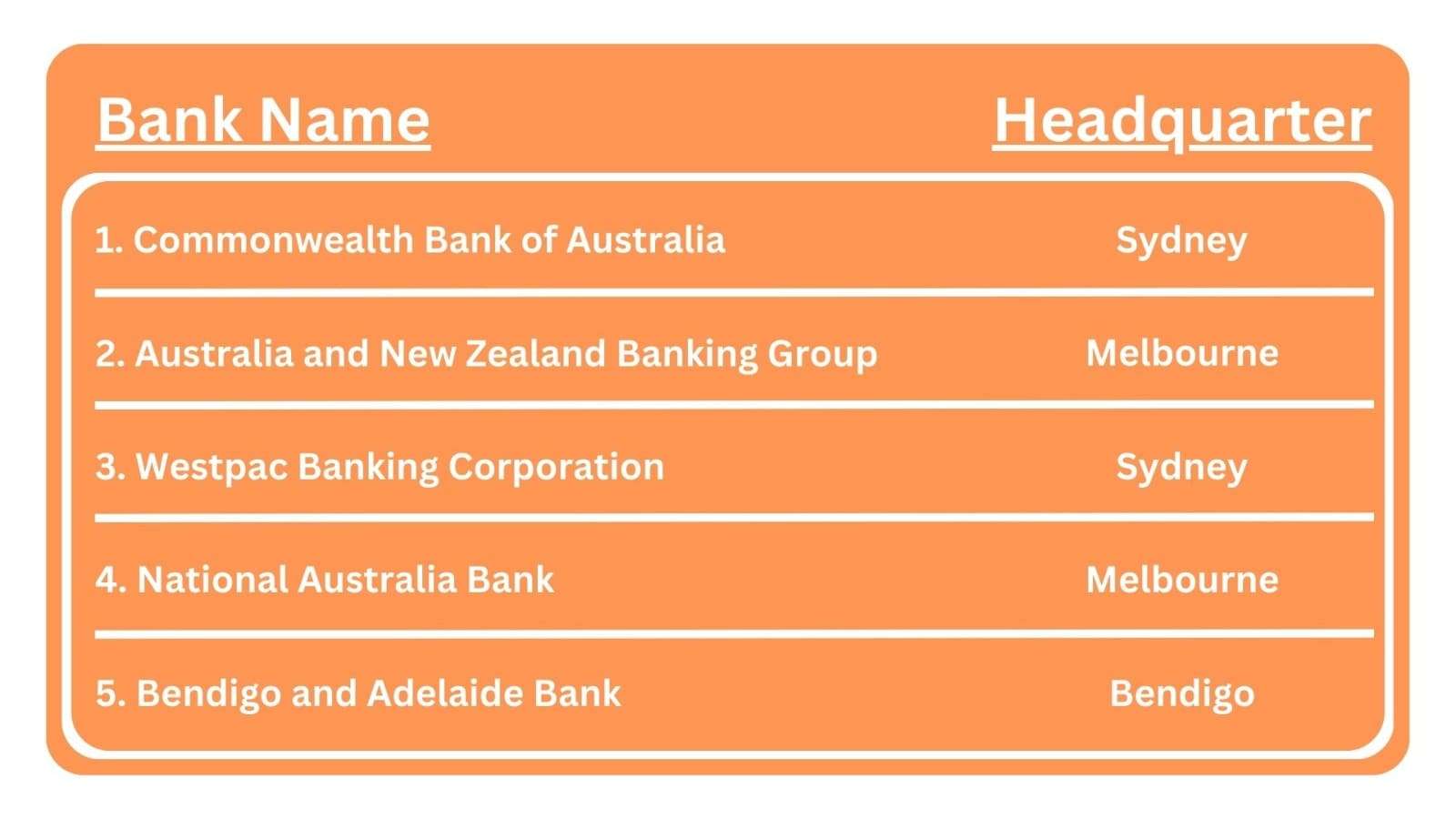

Top 5 Best Banks in Australia

1. Commonwealth Bank of Australia:

Commonwealth Bank of Australia, fondly known as CBA, stands tall as the largest bank in the country. With its vast array of financial products and services, it has secured its position as a top contender for the best bank in Australia. CBA has consistently prioritized digital innovation, ensuring its customers enjoy a blend of traditional banking reliability with modern tech conveniences. Read More

Key Features:

- Extensive Network: Offers the largest branch network across the country, making deposits and banking services easily accessible.

- Innovative Technology: Pioneers in adopting new technologies for a seamless banking experience, including a top-rated mobile banking app.

- Diverse Financial Products: Provides a wide range of financial products, from home loans to insurance, catering to various customer needs.

- Strong Customer Focus: Known for exceptional customer service, ensuring that clients’ banking needs are met efficiently.

- Robust Security Measures: Implements cutting-edge security features to protect customers’ deposits and personal information.

2. Australia and New Zealand Banking Group:

The Australia and New Zealand Banking Group, popularly termed ANZ, is another banking titan in the region. With a reputation built on stellar customer service and a comprehensive suite of financial solutions, ANZ makes a strong case for being the best bank in Australia. Their commitment to community initiatives and sustainable banking sets them apart in the competitive banking landscape. Read More

Key Features:

- Global Presence: Offers a significant international network, ideal for customers with overseas banking needs.

- Comprehensive Online Banking: Provides an easy-to-use online platform for managing accounts, making it simple to deposit funds anytime.

- ANZ Worldline Payment Solution: ANZ Worldline offers innovative merchant solutions tailored to Australian hospitality and retail businesses. They also partner with Australian POS systems like POSApt to create a seamless and integrated experience for businesses.

- Sustainability Initiatives: Committed to sustainable banking practices and investment in community projects.

- Competitive Loan Options: Known for competitive rates on home and personal loans, and term loans, helping customers achieve their financial goals.

- Customer Education: Offers financial literacy programs to help customers make informed decisions about their finances.

3. Westpac Banking Corporation:

Being one of Australia’s oldest banking establishments, Westpac merges time-tested banking practices with contemporary innovations. Their vast network and diversified services make them a favourite among Aussies. While they embrace modern banking trends, their long-standing history amplifies their claim to being the best bank in Australia. Read More

Key Features:

- Global Presence: Offers a significant international network, ideal for customers with overseas banking needs.

- Comprehensive Online Banking: Provides an easy-to-use online platform for managing accounts, making it simple to deposit funds anytime.

- Sustainability Initiatives: Committed to sustainable banking practices and investment in community projects.

- Competitive Loan Options: Known for competitive rates on home and personal loans, helping customers achieve their financial goals.

- Customer Education: Offers financial literacy programs to help customers make informed decisions about their finances.

4. National Australia Bank:

National Australia Bank, commonly referred to as NAB, specializes in business banking but doesn’t shy away from offering an extensive range of personal banking services. Their dedication to community upliftment and philanthropic endeavours further solidifies their stature in the race for the best bank in Australia. Read More

Key Features:

- Business Banking Leader: Recognized as one of the biggest banks for business banking, offering specialized services for businesses of all sizes.

- Sustainability Focus: Strong focus on environmental sustainability, with initiatives aimed at reducing carbon footprint and promoting green banking.

- Comprehensive Financial Services: Offers a broad spectrum of financial services, including wealth management and retirement planning.

- Customer Support Excellence: Provides exceptional customer support, with a focus on personalized banking solutions.

- Innovative Banking Apps: Features user-friendly mobile apps for both personal and business banking, making it easy to manage deposits on the go.

5. Bendigo and Adelaide Bank:

Emerging from the union of two historic banks, Bendigo and Adelaide Bank emphasizes community-driven banking. With a personalized touch to their services and a robust commitment to local initiatives, they not only cater to the financial needs of their customers but also strive for community betterment, making them a notable contender for the best bank in Australia. Read More

Key Features:

- Business Banking Leader: Recognized as one of the biggest banks for business banking, offering specialized services for businesses of all sizes.

- Sustainability Focus: Strong focus on environmental sustainability, with initiatives aimed at reducing carbon footprint and promoting green banking.

- Comprehensive Financial Services: Offers a broad spectrum of financial services, including wealth management and retirement planning.

- Customer Support Excellence: Provides exceptional customer support, with a focus on personalized banking solutions.

- Innovative Banking Apps: Features user-friendly mobile apps for both personal and business banking, making it easy to manage deposits on the go.

Each of these banks demonstrates a commitment to excellence, innovation, and customer satisfaction, making them leaders in Australia’s banking sector. Whether you’re looking for a bank to manage your deposits, seek financial advice, or access a wide range of banking services, these major banks offer reliable and comprehensive solutions to meet your needs.

Online Bank Accounts in Australia

Online banking in Australia offers a range of accounts tailored to meet diverse financial needs, from everyday transactions to savings and international dealings. Here are some of the best online bank accounts:

- Everyday Global Account: HSBC’s Everyday Global Account is a standout for those needing to minimize international transaction fees.

- High-Interest Savings Account: ING’s Savings Maximiser offers competitive interest rates for those looking to boost their savings.

- No-Fee Transaction Account: Up Bank provides a no-fee transaction account, making it an excellent choice for daily use without monthly charges.

- Digital-First Banks: Revolut and Xinja are at the forefront, offering innovative banking solutions and easy management of deposit accounts through their apps.

Essential Criteria to Evaluate When Selecting a Bank

Interest Rates:

Interest rates are the heartbeat of any financial institution. They determine how much you earn on your savings and how much you pay on your loans. When searching for the best banks in Australia, it’s imperative to compare the rates they offer. A bank with competitive interest rates can significantly affect your financial growth, allowing your savings to flourish. On the flip side, lower loan rates can ease the burden of repayments. By selecting a bank that offers favourable rates, you’re essentially choosing a partner that understands the value of your money.

Account Fees:

The little charges here and there, often overlooked, can accumulate over time. Account fees, whether for maintenance, ATM withdrawals, or overseas transactions, can eat into your funds. The best bank in Australia would offer transparent fee structures, allowing customers to be aware of potential charges. Some banks even provide accounts with no monthly fees, bringing relief to many. Before committing to any bank, it’s wise to analyze the fee structure. Remember, every dollar saved on fees is a dollar you can invest or spend elsewhere.

Security:

In an era where digital transactions dominate, the security of your finances should be of paramount importance. The best bank in Australia would prioritize advanced security measures, ensuring the safety of your funds and personal data. Features like two-factor authentication, fraud detection systems, and encrypted communications are no longer optional; they’re a necessity. It’s crucial to trust your bank to defend against potential threats, both online and offline. After all, the foundation of any banking relationship is trust, and security is a cornerstone of that trust.

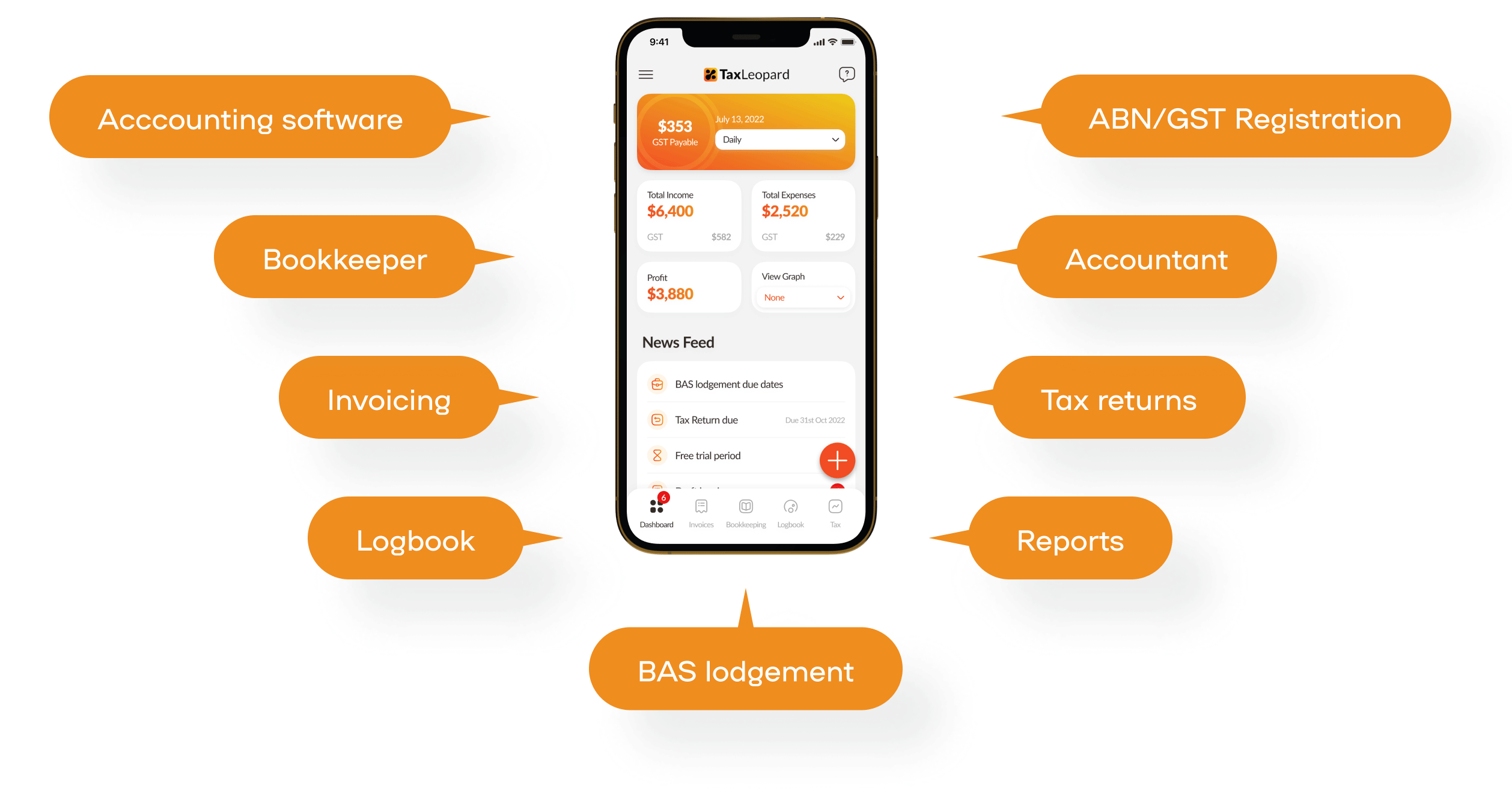

Navigating Australia’s Top Banks with TaxLeopard

Whether you’re an entrepreneur, a freelancer, or simply someone looking to manage your finances better, the right bank can make a world of difference. Imagine coupling your bank with a powerhouse application like TaxLeopard. As you explore the banking labyrinth of Australia, TaxLeopard serves as your financial compass, simplifying many of the complexities that come with banking and finance.  While Australian banks offer various services, from loans to high-interest savings accounts, TaxLeopard ensures you’re always a step ahead. Whether you’re juggling multiple bank accounts or diving into the nuances of Australian financial regulations, TaxLeopard is there to streamline the process, ensuring you get the most out of your chosen bank.

While Australian banks offer various services, from loans to high-interest savings accounts, TaxLeopard ensures you’re always a step ahead. Whether you’re juggling multiple bank accounts or diving into the nuances of Australian financial regulations, TaxLeopard is there to streamline the process, ensuring you get the most out of your chosen bank.

Wrapping Up

Selecting the right bank in Australia for 2024 hinges on balancing fees, services, and convenience. Our analysis of the top 5 best banks in Australia reveals options for fee-free accounts, competitive savings rates, and extensive ATM networks, addressing the diverse needs of Australians. Whether you’re opening your first account or looking to switch, understanding what each bank offers is crucial, enhancing your banking experience with TaxLeopard’s prowess elevates your financial journey to new heights. So, are you ready to revolutionize your banking experience Down Under?

FAQs

1. Which bank in Australia offers the best interest rates?

Interest rates can vary based on market conditions and bank policies. Always check the current rates before making a decision.

2. Are digital-only banks safe?

While digital-only banks might not have physical branches, they are regulated and need to adhere to the same safety standards as traditional banks.

3. How do I switch banks in Australia?

Many banks offer a switching service to make the process smooth. It involves transferring your account details, direct debits, and other essentials.

4. Which bank is best for small businesses in Australia?

Many consider NAB a top choice for business banking due to its range of tailored services.

5. Do banks in Australia charge for account maintenance?

Some banks might charge fees, while others offer fee-free accounts. Always read the terms and conditions before opening an account.