Struggling to link your myGov account to the ATO can be frustrating. Many customers face difficulties obtaining an ATO linking code to connect their accounts. Without this code, access to ATO online services and managing tax and super details becomes challenging. Most common issues include inaccurate bank account details and problems with identity verification.

To get a linking code, you’ll need to answer questions to establish your identity. You may also need your tax file number, super account details, and taxable income for the last 2 years. Follow the complete guide provided in this article to resolve these issues and get your ATO linking code.

Documents Required for Linking

To link your myGov account to the ATO, specific documents and details are needed. The Australian Taxation Office requires your notice of assessment, PAYG payment summary, and super fund details. Bank account information, such as the account where your tax refund is deposited, is also necessary.

You must have your income and investment details, including dividend statements and earned interest. Ensure you have your Centrelink payment summary and ABN if you’re a sole trader.

For identity verification, provide personal details like your date of birth and tax file number. Your tax record should include details from previous tax returns and any taxable income. You might also need to pass age verification, ensuring your provided information aligns with official records.

If you face issues, updating your information and confirming your identity might be required. It’s advisable to have access to all relevant documents to avoid problems during the linking process.

- Notice of assessment

- PAYG payment summary

- Super fund details

- Bank account information

- Income and investment details

- Centrelink payment summary

- ABN for sole traders

- Personal details and tax file number

Steps to Link myGov Account to ATO

- First, log into your myGov account and select ‘Link your myGov account to the ATO’. If you’re new, create a myGov account and then proceed to further steps.

- Ensure you have your details and bank account information ready. Follow the prompts to enter the necessary details, such as your tax file number and date of birth.

- Confirm your identity using either your notice of assessment or your PAYG payment summary.

- Once all information is entered correctly, access the ATO online services through your myGov account.

Getting Your ATO Linking Code

- To obtain your ATO linking code, log into your myGov account and select ‘Link your myGov account to the ATO.’

- Ensure you have your personal details, tax record, and income information ready. You may need to answer questions about your tax return, investment reference number, or super fund.

- If you’re unable to obtain the code online, contact the Australian Taxation Office for assistance. They may ask for your ABN, dividend statement, or Centrelink payment summary to confirm your identity.

- Once verified, a unique linking code will be issued to access the ATO online services.

Congratulations on completing all the steps to link your MyGov account to the ATO! If you have successfully linked your account, well done! You can now access ATO online services. If you face any issues, don’t worry. Simply contact the ATO helpline (13 28 61) for assistance. We’re happy to see you taking control of your tax affairs.

Unable to Link: What to Do?

Verify all personal details and tax records are correct and up-to-date. If you’re still having issues, contact the ATO helpline (13 28 61) for further assistance.

Using the ATO Online Services

ATO online services provide a comprehensive platform for managing your tax affairs. Access your tax return, notice of assessment, and PAYG payment summary through your MyGov account. Ensure your information, including bank account and super fund details, is accurate for seamless processing. Confirm your taxable income, investment reference numbers, and earned interest are correctly logged. For privacy and security, regularly update your personal details and settings. Contact your tax agent or the ATO for assistance with complex issues or if you encounter problems accessing services.

Link Your Bank Account With ATO

To link the ATO with your bank account, start by signing into your MyGov account. Access the ATO online services through your MyGov account. You will need your tax file number (TFN) and accurate bank account details. Ensure you have all the required information before proceeding. If you’re unable to link your account, contact the ATO helpline for assistance. This step ensures smooth processing of your tax refunds, directly depositing them into your bank account. It simplifies the management of your tax and super affairs.

Benefits of Linking myGov to ATO

- Simplified Access: Access ATO online services by connecting your myGov to the ATO.

- Centralized Management: Manage your tax and super from one platform.

- Up-to-date Information: Keep your bank account details and super account information current.

- Efficient Tax Management: Easily track your taxable income and PAYG payments.

- Security: Protect your sensitive information with a secure myGov sign-in.

- Convenience: Access ATO services online anytime.

- Support: Get assistance with linking and other issues by calling 13 28 61.

- Identity Verification: Answer questions to establish your identity and ensure account security.

- Notification: Receive important updates and notices from the ATO promptly.

- Integration: Seamlessly integrate your tax file number with ATO services for streamlined management.

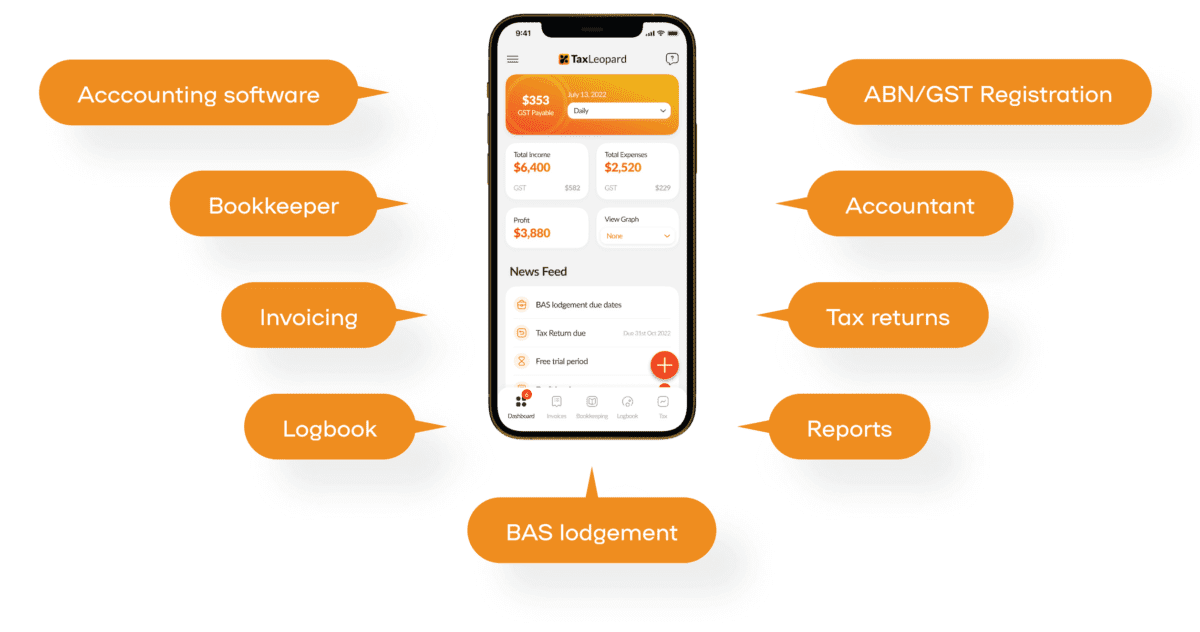

Take Control of Your Finances with TaxLeopard!

TaxLeopard is revolutionizing the way sole traders manage their finances by offering a complete automation solution for accounting, invoicing, and tax. With TaxLeopard, sole traders can automate their financial processes, from managing bookkeeping and tracking expenses to preparing tax returns. Enjoy seamless integration of your banking details, and let our CPA accountants provide you with precise reports and expert tax advice. TaxLeopard ensures your business remains compliant with free GST and ABN registration, making financial management effortless and efficient.

Conclusion

Obtaining an ATO linking code involves answering identity questions, ensuring accurate information, and possibly contacting customer support. If you’re unable to link your account, consider calling the ATO helpline for assistance. This guide aims to help you seamlessly connect your myGov account to the ATO. Have you experienced any specific issues while linking your account?

FAQs

1. What if I can’t find my linking code?

Contact ATO support for assistance in obtaining your linking code.

2. How do I update my bank account details with ATO?

Log in to your myGov account, select ATO services, and update your bank account details.

3. Is my linking code permanent?

No, your linking code is temporary and may need to be regenerated if it expires or is misplaced.