Opening a joint bank account in Australia can seem daunting due to the various options and requirements. Many people struggle with understanding the differences between account types and the necessary steps involved. Over 30% of Australians find banking processes complicated and confusing. This guide provides clear steps to open a joint bank account, including choosing the right account and understanding account holder responsibilities.

By following this guide, you will simplify the process and make informed decisions. The complete guide is provided in the article, ensuring you have all the information needed to open a joint bank account in Australia.

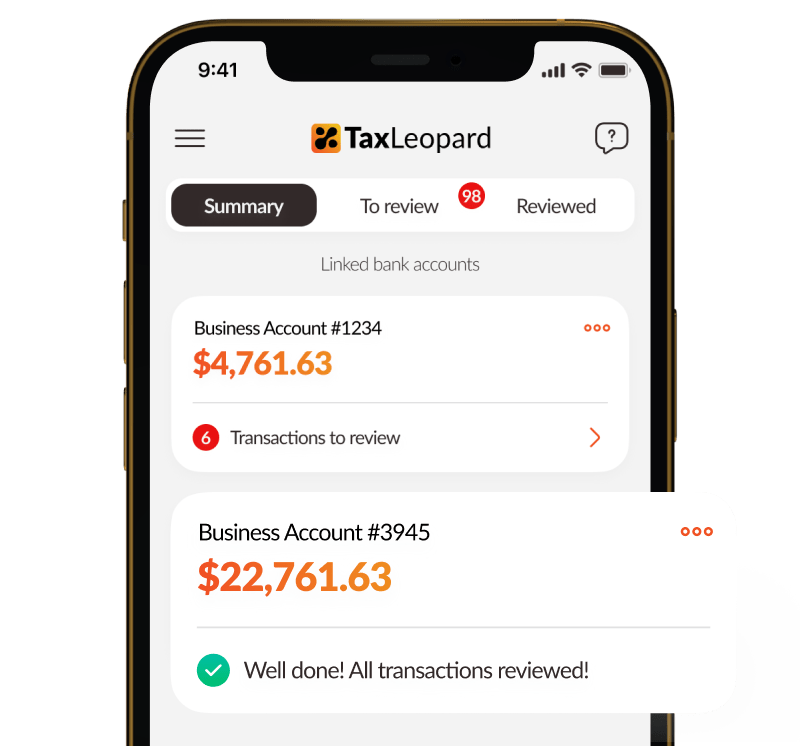

For even more convenience, consider using TaxLeopard, a one-stop accounting software with CPA accountants designed for self-employed individuals and contractors in Australia. Link all your bank accounts to TaxLeopard, and let it handle your GST and net profit calculations, making tax time a breeze. Welcome to hassle-free bookkeeping with TaxLeopard

What is a Joint Bank Account?

A joint bank account allows multiple individuals to manage funds together. Both account holders have access to the account for deposits, withdrawals, and managing finances. This can be particularly useful for couples or business partners. An everyday account or a savings account can be set up as a joint account. Trust and transparency are essential when opening a joint account with someone.

Types of Joint Accounts

Everyday Joint Account:

An everyday joint account is ideal for managing daily expenses. Both parties receive a debit card, enabling convenient access to funds for transactions. This type of account helps simplify budgeting and bill payments.

Joint Savings Account:

A joint savings account focuses on achieving shared financial goals. Regular deposits contribute to the savings goal, making it easier to accumulate funds. Interest earned benefits all account holders, enhancing collective financial growth.

Transaction Joint Account:

A transaction account suits those needing frequent access to funds. It offers features like a debit card and online banking, ensuring seamless transactions. This account type is perfect for managing shared expenses efficiently.

Steps to Open a Joint Bank Account

Everyday Accounts vs. Saver Accounts

| Feature | Everyday Accounts | Saver Accounts |

|---|---|---|

| Primary Use | Daily transactions | Saving money |

| Access | Easy access for both account holders | Limited access to encourage saving |

| Interest Rates | Usually low or none | Higher interest rates |

| Fees | May include monthly account keeping fees | Often have lower fees |

| Joint Household Expenses | Suitable for managing joint household expenses | Good for joint savings goals |

Features to Consider

- Access for both account holders

- Account keeping fees

- Interest rates

- Online banking options

- Joint account management tools

Requirements for a Joint Bank Account

- Identification for both account holders

- Proof of address

- Application form completion

- Agreement on account terms

- Initial deposit

Best Joint Bank Accounts in Australia

Commonwealth Bank Everyday Account:

The Commonwealth Bank Everyday Account offers a joint transaction account that is ideal for couples managing joint household expenses. This account provides access for both account holders and allows all account holders to use the account without restrictions. Funds in the account can be deposited by one person and accessed by the other. It includes features like account keeping fees that are waived under certain conditions, and the option to manage the account online. This account is a great choice for those looking to open an account with someone to simplify shared financial responsibilities.

ANZ Access Advantage Account:

ANZ Access Advantage Account is a popular choice for those wanting a joint bank account with their partner. This account offers access for both account holders and allows money in the account to be used for everyday transactions. Joint account holders need to provide necessary identification and meet the bank’s eligibility criteria. The account also offers online banking facilities, making it convenient to manage the account from anywhere. This joint account is suitable for couples or friends looking to share financial responsibilities without the hassle of maintaining separate accounts.

NAB Classic Banking Account:

The NAB Classic Banking Account is an excellent option for people who want a joint account that is easy to manage. This account makes no distinction between individual and joint accounts, allowing both account holders to access funds equally. It is often used by couples or friends to manage joint household expenses efficiently. This account provides features such as no monthly account keeping fees and easy online access. Setting up a joint account with NAB is straightforward, making it an attractive option for those looking to manage shared finances seamlessly.

Westpac Choice Account:

Westpac Choice Account offers a flexible joint account ideal for managing joint finances. The account can be opened with a friend, partner, or family member, providing shared access to funds. It includes features like no monthly fees for students, pensioners, and other eligible customers. The account can be managed online, and either account holder can make deposits and withdrawals. This account is perfect for those who need a reliable and accessible option for managing shared expenses and everyday transactions.

ING Orange Everyday Account:

The ING Orange Everyday Account is a versatile option for those deciding to open a joint account. This account offers benefits such as no monthly fees and cashback offers on eligible purchases. Joint account owners can manage the account online and access funds without any restrictions. This account would suit individuals who want to share financial responsibilities and enjoy perks like fee-free ATM withdrawals and a high-interest savings account linked for added savings. This joint account works well for managing joint expenses while enjoying the benefits offered by ING.

Benefits of a Joint Bank Account

- Shared Financial Responsibility: Joint accounts allow all account holders to manage joint household expenses effectively.

- Simplified Budgeting: Combining funds in the account makes it easier for couples to manage their finances.

- Convenient Access: Each account holder can access the account online, allowing for easy monitoring and transactions.

- Streamlined Bill Payments: Either account holder can use the account to pay bills, ensuring timely payments.

- Enhanced Savings: Saver accounts held in more than one name can accumulate savings more efficiently.

- Transparency: Funds in the joint account are visible to both account holders, promoting trust and openness.

- Flexibility: Joint account owners can deposit money in the account, ensuring contributions from both parties.

- Emergency Funds: Access to the account automatically when they’re due ensures funds are available for emergencies.

- No Distinction: The bank makes no distinction between personal accounts and shared accounts, offering the same benefits.

- Ease of Access: A joint account with your partner or friend allows for seamless financial transactions.

- Account Management: Managing the account becomes easier for couples, allowing for shared decision-making.

- Financial Unity: Opening an account together strengthens financial unity, fostering better cooperation.

- Account Rights: Each account holder will receive full access to account options, enhancing flexibility.

- Cost-Effective: Monthly account keeping fees are shared, reducing the financial burden on individual account holders.

Link Your Bank Account With TaxLeopard

Effortless bookkeeping can be achieved by linking your bank account with TaxLeopard. This action streamlines financial management and simplifies tax calculations. TaxLeopard swiftly calculates your GST and net profit, turning tax time into a breeze.

Benefits of Linking Your Bank Account:

- Seamless Integration: Link all your bank accounts and let TaxLeopard handle the rest.

- Automatic Calculations: Enjoy swift and accurate GST and net profit calculations.

- Hassle-Free Bookkeeping: Transform tax time into a stress-free experience.

How to Link Your Bank Account:

- Log into TaxLeopard: Access your TaxLeopard account through the app or website.

- Connect Your Bank Accounts: Follow the prompts to securely link your bank accounts.

- Verify and Sync: Ensure all details are correct and let TaxLeopard take over.

Conclusion

Opening a joint bank account in Australia requires understanding different account types and requirements. Following the steps outlined will help you choose the best option and manage your account effectively. Do you feel more confident about opening a joint bank account now?