Managing taxes can be overwhelming for self-employed individuals and contractors. Choosing the right tool is crucial for efficient tax management. According to recent studies, nearly 60% of freelancers face issues with tax calculations and filings. This can lead to penalties and financial stress. TaxLeopard vs Hnry offers solutions, but which is better?

TaxLeopard vs Hnry provides automated tax calculations, detailed reporting, and real-time support from certified public accountants. Hnry simplifies tax payments and filings, catering to freelancers.

This article will guide you through the key differences between TaxLeopard vs Hnry. You’ll learn which is more suitable for your tax management needs. Read on for a comprehensive comparison and make an informed decision.

What Is TaxLeopard?

TaxLeopard is an advanced accounting software designed specifically for self-employed individuals and contractors in Australia. TaxLeopard offers real-time support from CPA accountants, ensuring professional assistance is available for complex tax situations. It simplifies managing taxes, allowing users to calculate tax payments accurately and file tax returns efficiently.

With TaxLeopard, sole traders can track income and expenses seamlessly, ensuring accurate financial records. The platform integrates with various banking tools, making expense management straightforward. This accounting software is ideal for freelancers and small business owners, helping them stay compliant with GST regulations and other tax obligations.

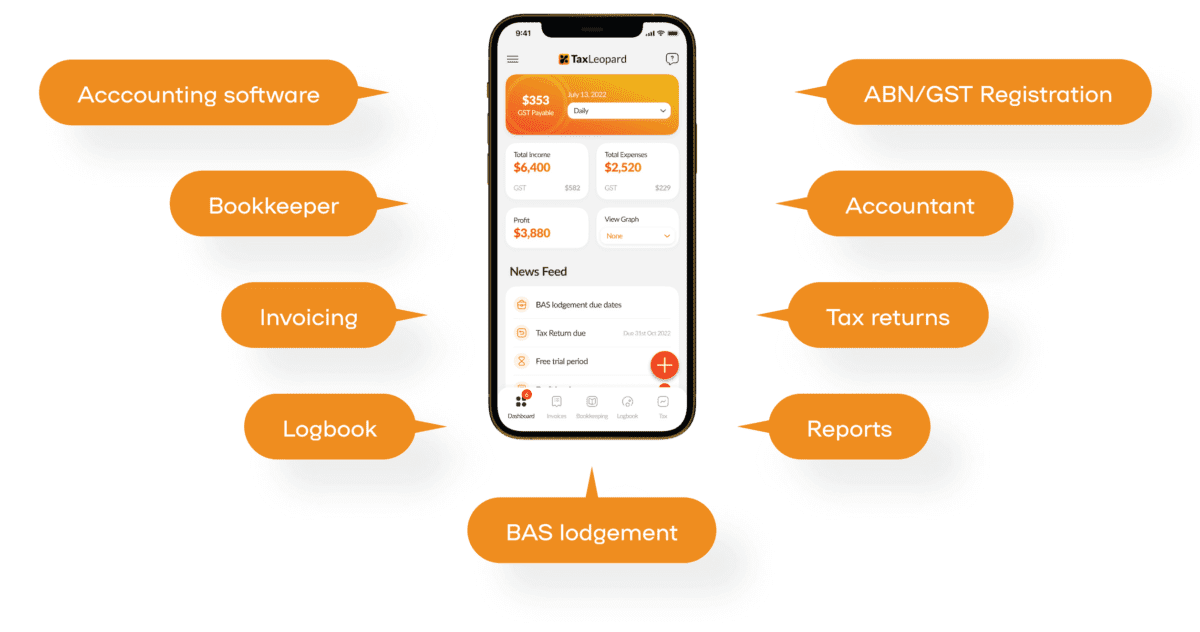

Key Features of TaxLeopard:

- Accounting: Offers comprehensive solutions for tracking earnings and investments accurately.

- Bookkeeper: Helps manage expenses, receipts, and bank transactions effectively.

- Invoicing: Enables swift creation and sending of invoices to get paid promptly.

- Logbook: Tracks vehicle expenses for tax deductions.

- BAS Lodgement: Automates BAS lodgement, ensuring compliance with ATO.

- Reports: Generates detailed financial reports for informed decision-making.

- Tax Return: Streamlines the tax return process, reducing stress.

- Accountant: Provides real-time support from certified public accountants.

- ABN/GST Registration: Assists with ABN and GST registration for new businesses.

What Is Hnry?

Hnry is a tax service designed to automate tax payments and filings for freelancers and contractors. It handles income tax, GST, and making tax management effortless. Hnry allocates a portion of your earnings for tax payments straight away, ensuring you stay compliant. This service simplifies the financial process by integrating invoicing and expense-tracking features.

Hnry is tailored for the self-employed, providing a streamlined platform to manage finances without the need for extensive accounting knowledge. Freelancers and contractors benefit from the automatic tax filing and real-time updates on tax rates. Hnry also offers a user-friendly interface, making it easy to manage self-employed income and ensure financial stability.

Key Features of Hnry:

- Tax Payments: Automates timely remittance of income tax and GST.

- Tax Lodgement: Ensures accurate and timely submission of tax returns.

- Invoicing: Allows easy generation and sending of invoices.

- Expenses: Tracks and records business expenses efficiently.

- Allocations: Automatically sets aside funds for tax payments.

- Payments: Processes and allocates incoming payments directly to the bank account.

TaxLeopard vs Hnry: Key Differences

| Feature | TaxLeopard | Hnry |

|---|---|---|

| Automated Tax Calculations | Yes | Yes |

| CPA Support | Yes | No |

| Integration with Financial Tools | Extensive | Limited |

| User Interface | Designed for self-employed | Designed for freelancers |

| Tax Filing and Reporting | Detailed and comprehensive | Basic |

| Expense Tracking | Integrated | Integrated |

| Invoice Management | Available | Available |

| GST Handling | Yes | Yes |

| Real-Time Tax Updates | Yes | Yes |

| Banking Integration | Seamless | Standard |

| Accountant Support | Real-time support from certified public accountants | Not available |

| Self-Employed Focus | Tailored for self-employed and contractors | Tailored for freelancers and contractors |

| Tax Agent Support | Yes | No |

| Receipt Management | Available | Available |

| Allocation of Payments | Automated | Automated |

| Investment Tracking | Available | Not available |

Which Is Better for Managing Taxes?

When comparing TaxLeopard vs Hnry for managing taxes, TaxLeopard offers more comprehensive features. It provides automated tax calculations, detailed reporting, and real-time CPA support, making it ideal for self-employed individuals and contractors. Hnry, on the other hand, focuses on automated tax payments and filings but lacks advanced integrations and CPA support. For those needing extensive tax management tools, TaxLeopard is the superior choice.

Why Choose TaxLeopard?

TaxLeopard excels with its comprehensive CPA support, detailed tax reporting, and seamless integration with financial tools. It is tailored for self-employed individuals, making tax management straightforward and efficient.