The complexities of financial management can be daunting, especially when it involves holding funds on behalf of others. Trust account serves as a vital solution, offering a legal arrangement for securely managing assets for beneficiaries. This comprehensive guide delves into trust accounts, exploring their types, the process of setting up and operating one, and the crucial role of audits in ensuring compliance with legislation. Whether for personal or business purposes, understanding trust accounts can provide peace of mind and financial security.

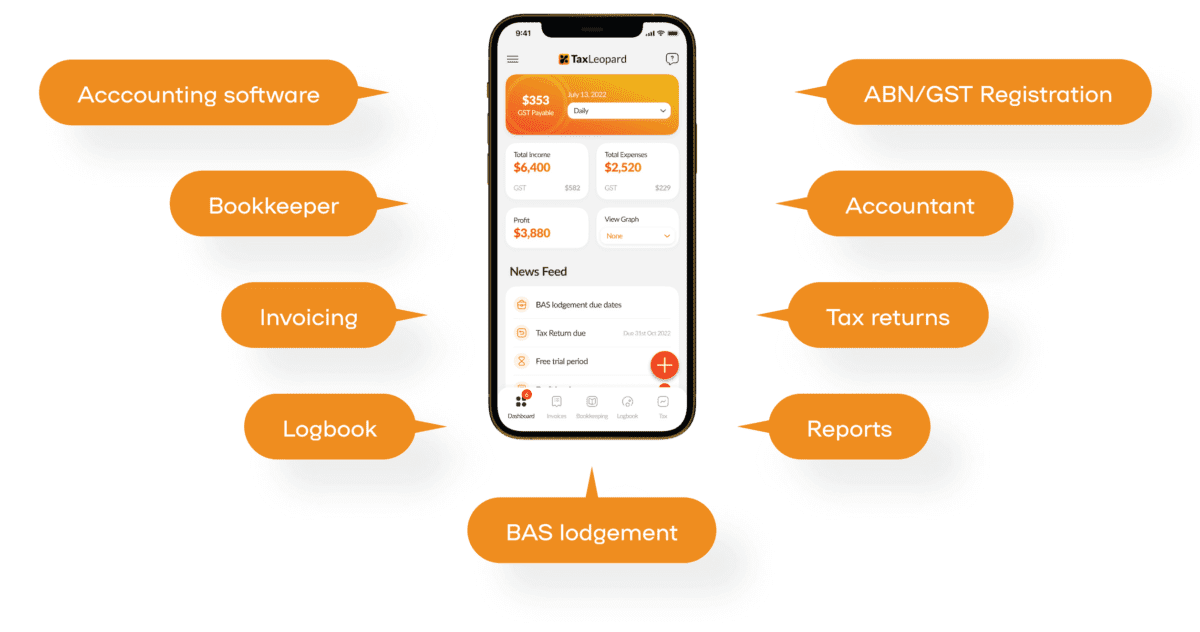

Maximize Your Trust Account Management with TaxLeopard Software: Simplify your trust account operations and ensure compliance with our cutting-edge TaxLeopard software. Designed to streamline accounting and auditing processes, TaxLeopard offers user-friendly features and robust security, making it the perfect tool for managing your trust accounts efficiently. Explore the benefits and elevate your financial management today with TaxLeopard.

Understanding Trust Accounts

A trust account is a specialized account used primarily in real estate transactions to hold trust money on behalf of others. Estate agents and trustees in NSW are required to have an account to receive and deposit funds, such as bond money or property deposits, for their clients.

Purpose and Use of Trust Money:

Trust money is used to safeguard the financial interests of parties involved in a transaction. In real estate, it ensures that funds are securely held until all conditions are met. For example, an estate agent may hold a buyer’s deposit in a trust account until the property sale is finalized. This protects both the buyer and seller, providing assurance that the money will be handled fairly and according to the terms of the agreement.

Key Components of a Trust Account:

- License: A valid license is necessary to operate this account, with strict regulations set by Fair Trading NSW.

- Accounting: Accurate accounting is crucial for tracking all transactions, including deposits, withdrawals, and stock transfers.

- Audit: Regular audits are required to ensure compliance with legal and financial standards.

- Institution: The trust accounts must be held at an authorized financial institution.

- Authorization: Only authorized licensees can access and manage the account on behalf of their clients.

Setting Up a Trust Account

Opening a Trust Account: Steps and Requirements:

To open a trust account in NSW, one must approach a financial institution authorized by the NSW Fair Trading. The account must be designated as a ‘trust account’ and should have a unique identifying number (UID). The account name should include a prefix indicating its nature, such as “Trust.” It’s essential to have all necessary documentation, including the ABN of the trust, ready before opening the account.

Choosing the Right Financial Institution:

Selecting the right authorised deposit-taking institution is crucial for setting up a trust account. The institution should offer security, easy access to funds, and compatibility with your accounting software. It’s also important to consider transaction fees and the availability of online banking services for managing the account online.

Statutory Requirements for Trust Accounts:

It must comply with legislation set by bodies like the NSW Fair Trading and the Queensland Government. The account must be registered, and the licensee must lodge monthly returns and notify the commissioner of any changes. The account should be set up to handle clients’ funds according to statutory guidelines.

Also Read: A Complete Guide on NSW Land Tax

Managing a Trust Account

Role of the Licensee in Trust Account Management:

The licensee is responsible for managing the account on behalf of clients. This includes ensuring that client’s funds are held securely and are used only for their intended purposes. The licensee must also ensure compliance with legal and regulatory requirements, including maintaining accurate records and providing necessary notifications.

Conducting Transactions through a Trust Account:

Transactions through this account must be conducted carefully to ensure the security of clients’ funds. The licensee must authorize withdrawals and transfers, and accurately record all transactions. It’s important to use cheques or electronic transfers for disbursements to maintain a clear audit trail.

Trust Account Audits

Compliance with Fair Trading Regulations:

Audits are crucial for ensuring compliance with NSW Fair Trading regulations. They involve inspecting accounts to confirm that clients’ funds are managed correctly. The process checks for a unique identifying number (UID) and accurate transaction records. Auditors also verify that withdrawals are authorized and documented. Adhering to these regulations maintains the security and integrity of accounts, safeguarding both the beneficiary and the managing entity.

Legal and Regulatory Framework

The legal and regulatory framework for these accounts in Australia is designed to safeguard clients’ funds. Legislation requires that any entity holding clients’ funds must establish a ‘trust account’ with an authorised deposit-taking institution. The type of account and the specific requirements, such as the prefix of the account name and the account number, depend on the nature of the business and the state’s regulations, such as those set by the Queensland government or NSW Fair Trading.

Conveyancers, public accountants, and other professionals must comply with these regulations, which include the appointment of an auditor, registration of the account, and the submission of monthly returns and notifications to the commissioner. Compliance ensures transparency, security, and trust in financial transactions conducted on behalf of another party.

Conclusion

Trust accounts are indispensable tools for managing and protecting assets on behalf of beneficiaries. They offer flexibility, security, and compliance with legal requirements, making them a preferred choice for various financial needs. By adhering to the guidelines and regulations outlined in this guide, you can confidently establish and maintain the trust accounts, ensuring the safeguarding of assets for future generations. Have you considered the benefits a trust account could bring to your financial planning?

FAQs

1. Are Trust Accounts insured?

Yes, these accounts in Australia are required to be insured to protect the funds against loss or misappropriation.

2. What happens to the funds in a Trust Account when a transaction is complete?

The funds are disbursed to the appropriate parties according to the terms of the transaction, which may include the seller, buyer, or other parties involved.

3. What are the penalties for misuse of funds in Trust Accounts?

Misuse of funds can result in significant penalties, including fines and the suspension or revocation of the individual’s real estate license.

4. Who is responsible for managing a Real Estate Trust Account?

In Australia, licensed real estate agents or property managers typically manage them.

5. What are the Real Estate Trust Account rules in Australia?

The rules vary by state and territory but generally require the account to be with a licensed financial institution, designated for holding clients’ funds, and for detailed records of all transactions to be kept.