Keeping track of every kilometre for tax purposes often feels like finding your way through a complicated puzzle. Sole traders face the challenge of recording every business-related journey, balancing the need for accuracy with the demands of their work.

Recent data highlights the complexity and confusion around tax deductions for vehicle use, underscoring the necessity for a reliable method. Enter the car logbook method: a solution designed to simplify this process, further enhanced by TaxLeopard for seamless tracking and maximizing deductions.

This guide offers a comprehensive overview, helping you understand the importance of maintaining a logbook and how to use it effectively to maximize tax returns.

Why The Car Logbook is Important?

Maintaining a car logbook is critical for sole traders using their vehicles for business purposes. It provides a reliable method to distinguish between personal and business use, essential for claiming work-related car expenses. The ATO requires accurate records, such as the number of kilometres driven and the purpose of each trip, to substantiate claims.

A well-kept logbook can significantly increase tax refunds by allowing sole traders to claim a larger portion of vehicle expenses. It also helps avoid disputes with the taxation office by providing solid evidence of business-related car use.

Furthermore, understanding the logbook method can aid in strategic planning to use a car more efficiently for work, potentially enhancing tax deductions. Keeping a logbook for the required 12 weeks offers a straightforward way to track and claim car expenses accurately.

Using The Logbook Method

The logbook method entails recording every business trip in a logbook to calculate work-related vehicle expenses. Sole traders must log each journey’s purpose, date, and kilometres for a minimum of 12 consecutive weeks. This log serves as the basis for determining the percentage of car use for business, which applies to total vehicle expenses.

Benefits of the Logbook Method:

- Allows for a more accurate and often higher deduction claim than the cents per kilometre method.

- Provides a clear, audited trail of business car use, reducing potential issues with the ATO.

- Enables claims on a broader range of car expenses, including depreciation.

- The percentage of business use established can be used for five years, simplifying future claims.

- Encourages more disciplined tracking of car use, leading to better financial management.

- Assists in identifying opportunities to optimize car use for business, potentially increasing deductions.

Car Expenses and Deductions for Sole Traders

Sole traders can use the logbook method to claim car expenses on their tax returns. This process involves keeping a detailed logbook for a continuous 12-week period to establish the business use percentage of their vehicle.

The Australian Taxation Office (ATO) allows this percentage to calculate work-related car expenses, including fuel, maintenance, and depreciation. Accurate odometer readings are crucial for validating these claims.

By diligently recording every business-related car trip, sole traders can maximize their tax deductions and ensure their logbook is valid for five years, subject to ATO guidelines.

Key Details You Need to Record

When maintaining a vehicle log book, accurately note each car trip. Record the date, odometer readings at start and end, total kilometres, and trip purpose. This method, accepted by the ATO, requires diligence. Keep a logbook for 12 weeks to establish a pattern of business use. This documentation is crucial for claiming car expenses. Whether using a traditional logbook or an app, consistency in recording details validates your claims.

How to Calculate Deductions Using the Logbook

To calculate deductions with the logbook method, first, sum all car expenses for the year. Then, establish your business use percentage by dividing business kilometres by the total kilometres logged. Multiply this percentage by your total car expenses.

(Business Kilometers / Total Kilometers) x Total Car Expenses = Deductible Amount.

This calculation enables you to claim the proportion of vehicle costs that are work-related, potentially maximizing your tax return.

Vehicle Expenses That Can Be Claimed

- Fuel and oil costs

- Repairs and maintenance

- Insurance

- Registration

- Depreciation of the vehicle

- Interest on a car loan

- Lease payments

These expenses can be claimed using the logbook method, provided they are for business-related use. Keep receipts and records to substantiate these claims.

Streamline Your Car Logbook with TaxLeopard

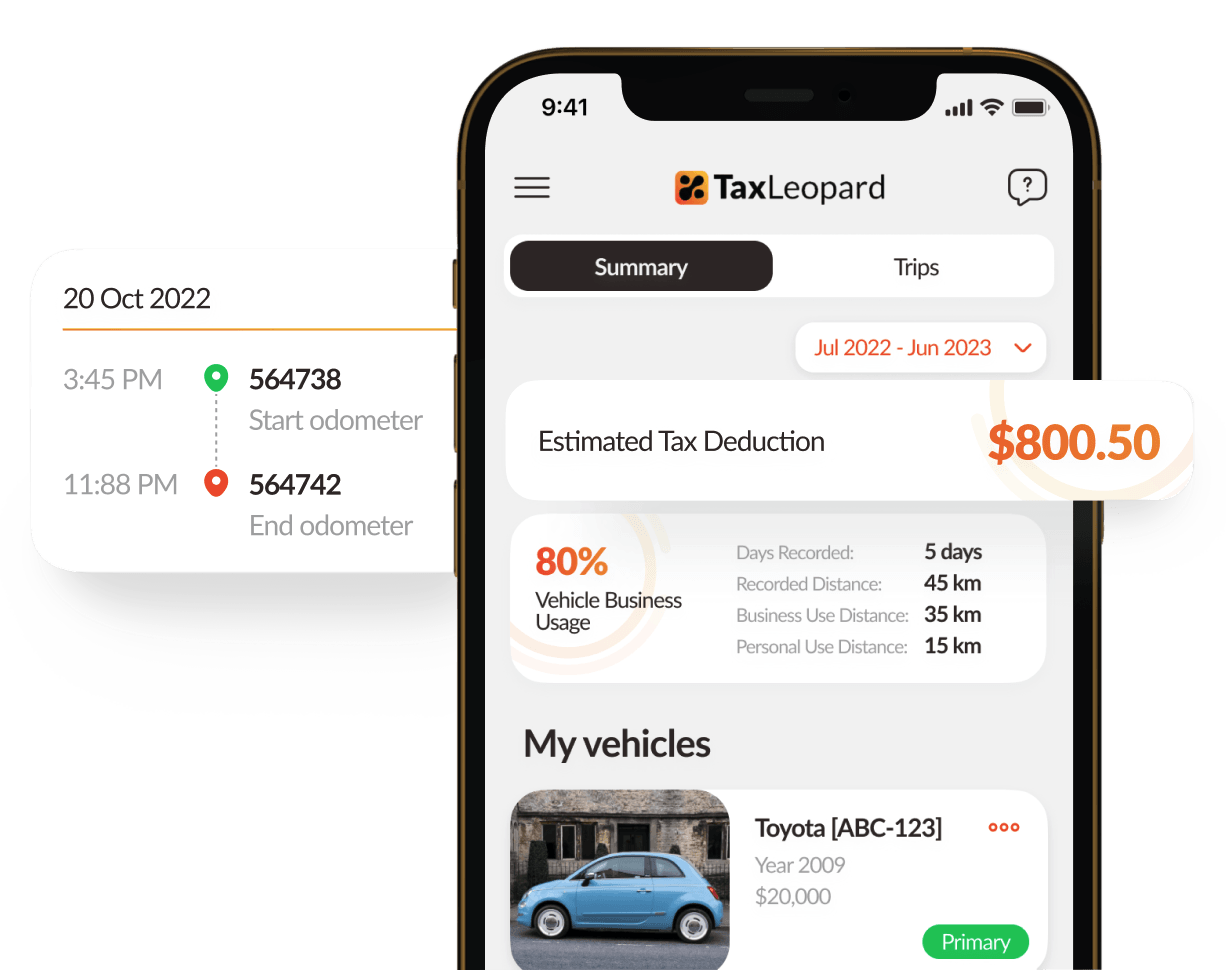

TaxLeopard revolutionizes how sole traders manage their car logbooks. This app simplifies recording trips, distinguishing between private and business travel, and documenting every kilometre. With TaxLeopard, elevate your tax deductions effortlessly.

First, experience seamless trip tracking. Every journey is captured accurately. Then, effortlessly categorize your travels. Business or private? TaxLeopard sorts it in a snap. You’ll get comprehensive records of your kilometres. Detailed. Precise. Ready for review.

The app doesn’t stop there. It’s designed to boost your deductions. More kilometres tracked means potentially higher claims. TaxLeopard ensures you’re equipped with solid records to support your tax return.

Take control of your car expenses and maximize your deductions. Download TaxLeopard today and transform your logbook into a tool for financial success.

Conclusion

The car logbook method stands out as an invaluable tool for sole traders seeking to claim work-related car expenses accurately. It not only ensures compliance with the Australian Taxation Office but also aids in maximizing tax deductions. Have you started recording your car trips yet? How has the logbook method improved your tax return?

FAQs

1. Is the cents per kilometre method different from the logbook method?

Yes, the cents per kilometre method offers a simpler calculation but with a cap on the claimable amount.

2. What happens if I don’t keep a logbook?

Without a logbook, you may be limited to fewer deductions and risk ATO rejection of claims.

3. Can I maintain a logbook for more than one vehicle?

Yes, if you use multiple vehicles for business, you need a separate logbook for each.

4. How does keeping a logbook boost my tax refund?

A detailed logbook enables you to claim the maximum allowable deduction for vehicle-related expenses.

5. What do I need to record in my logbook?

For each trip, record the date, odometer readings at the start and end, purpose, and kilometres travelled.