Taxes—the one word that can send shivers down the spine of even the most confident business owner. As the year comes to a close, company tax return instructions become a crucial compass guiding you through the labyrinth of financial compliance. In this introduction, we embark on a journey to demystify the process, strip away the complexities, and empower you with the knowledge to conquer tax season with confidence.

Navigating the world of taxes, particularly for businesses, is no simple task. Understanding the ins and outs of company tax return instructions is pivotal in maintaining your financial health and ensuring compliance with the law. Whether you’re a seasoned entrepreneur or just starting your business journey, the significance of accurate tax filing remains unwavering.

So, let’s dive in and transform tax season from a daunting challenge into a manageable opportunity for your business’s success.

The Importance of Accurate Tax Filing

Accurate tax filing is the cornerstone of a well-run business. For both small enterprises and large corporations, adhering to company tax return instructions is paramount. It ensures that you are not only compliant with the law but also that your financial records are in order. Accurate tax filing helps in determining the precise amount you owe in taxes or the potential refund you might receive.

Moreover, it’s not just about meeting legal obligations. Accurate tax filing is about financial prudence. By meticulously following company tax return instructions, you can maximize your deductions and credits, ultimately reducing your tax liability. Furthermore, accurate filing safeguards your business against penalties and audits, which can be costly and disruptive. In essence, accurate tax filing is an investment in the financial health and reputation of your business.

Understanding the Basics of Company Tax Returns

To navigate the intricate world of company tax return instructions, it’s essential to grasp the fundamentals. Company tax returns are the financial documents that businesses use to report their income, expenses, deductions, and credits to the tax authorities. The specific forms required depend on the legal structure of your business. For example, corporations, partnerships, or sole proprietors may use different forms, like Form 1120, Form 1065, or Schedule C, respectively.

Understanding the basics of these forms and their associated company tax return instructions is the first step in a successful tax filing process. It involves documenting all sources of income, transparently reporting deductible expenses, and adhering to tax codes and regulations. A solid foundation in the basics of company tax returns sets the stage for accurate and efficient tax filing, ensuring that your business remains in good financial standing and in compliance with the law.

Guide to Filling Out Company Tax Returns

1. Gathering Necessary Documentation:

When it comes to tackling your company tax return instructions, the first step is gathering all the necessary documentation. This isn’t just about paperwork; it’s about ensuring that you have a clear, comprehensive picture of your financial activity for the tax year. Collect profit and loss statements, balance sheets, income statements, and any relevant financial documents. Accurate and organized documentation is the foundation for a successful tax filing. This step sets the stage for the entire process, making it easier to report income and expenses and claim deductions and credits.

2. Filling Out the Appropriate Forms:

The next crucial step in handling your company tax return instructions is to determine which tax forms are appropriate for your business structure and size. Different business types, such as corporations, partnerships, and sole proprietorships, require different forms. For instance, C corporations typically use Form 1120, while partnerships use Form 1065, and sole proprietors complete Schedule C. Selecting the correct forms is vital for an accurate tax return.

3. Reporting Income and Expenses:

One of the central elements of company tax return instructions is the accurate reporting of income and expenses. You must provide a transparent and thorough account of all income sources, from sales and investments to miscellaneous revenue. On the flip side, listing deductible expenses such as operating costs, salaries, office supplies, and other legitimate business expenses is equally crucial. Keep in mind that accurate reporting ensures you are taking advantage of all eligible deductions while staying compliant with tax regulations.

4. Deductions and Credits:

Company tax return instructions provide valuable opportunities for reducing your taxable income through deductions and credits. Deductions are expenses that you can subtract from your total income, effectively lowering your tax liability. These can include rent, utilities, insurance, and business interest expenses. Credits, on the other hand, directly reduce the tax amount you owe. Some common credits for businesses include research and development credits or renewable energy credits. Ensure that you thoroughly explore all available deductions and credits specific to your business to maximize your tax efficiency.

5. Ensuring Compliance:

The final step in your journey through company tax return instructions is ensuring compliance with tax codes and regulations. Staying compliant is not just about avoiding penalties; it’s a matter of maintaining the integrity of your financial operations. Missteps in compliance can lead to costly audits and damage your company’s reputation.

Common Mistakes to Avoid

- Inaccurate Reporting: One of the most common mistakes in company tax return instructions is inaccurate reporting of income and expenses. Failing to report all income sources or misclassifying expenses can lead to tax complications.

- Missing Deadlines: Many businesses overlook the importance of filing their taxes on time. Missing deadlines not only result in penalties but can also strain your company’s financial health.

- Neglecting Deductions: Failing to take advantage of available deductions is another error. Deductions can significantly reduce your tax liability, so overlooking them is a missed opportunity.

- Poor Record Keeping: Inadequate record keeping can make the tax filing process cumbersome. Keep detailed records to ensure accurate reporting.

- Ignoring Compliance: Ignoring tax codes and regulations is risky. Staying compliant is crucial to avoid audits and penalties, making compliance a top priority.

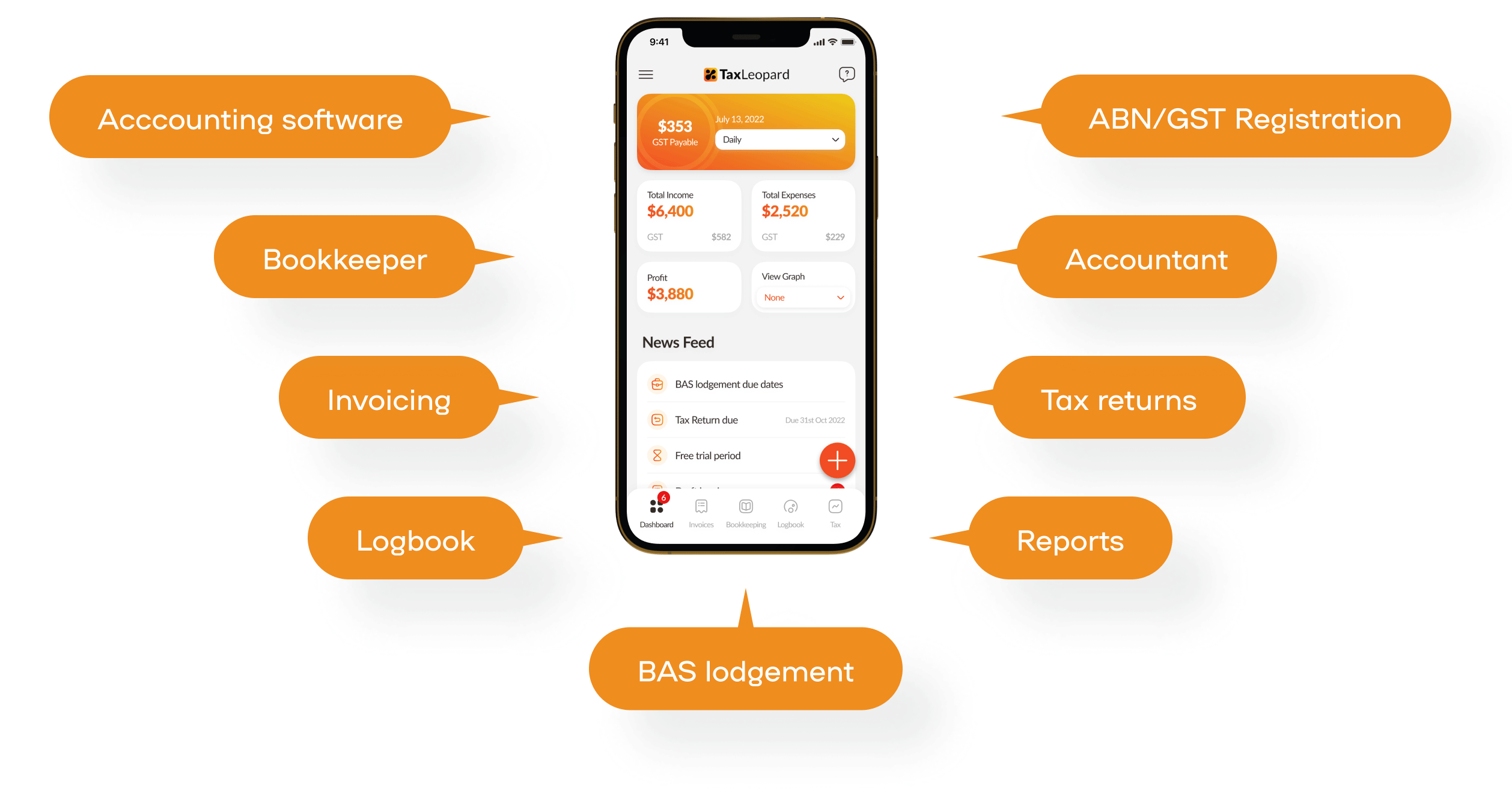

Company Tax Return Instructions with TaxLeopard

Filing your company’s tax return can be a challenging and time-consuming process. However, with the right tools at your disposal, it can become a breeze. TaxLeopard, the all-in-one tax management application, is here to make your tax return experience smoother, more efficient, and virtually stress-free.

While we won’t delve into the specific features of TaxLeopard, let’s focus on how it can revolutionize your approach to company tax return instructions.

- Efficiency at Its Best: TaxLeopard’s intuitive interface and robust functionalities streamline the tax return process. It simplifies data entry, and calculations, and ensures you’re following the latest tax laws to minimize errors and maximize deductions.

- Data Accuracy: One of the most common mistakes in tax filing is data inaccuracies. TaxLeopard is your virtual proofreader, minimizing the risk of miscalculations or missed entries and ensuring your tax return is error-free.

- Compliance Assurance: Staying compliant with tax regulations is a must. TaxLeopard provides real-time updates, ensuring that you are always in compliance with the ever-evolving tax laws.

- Time-Saving: TaxLeopard saves you precious time. With its user-friendly interface, you can complete your tax return more quickly and allocate your time and energy to growing your business.

- Security and Support: Rest assured that your financial data is secure with TaxLeopard’s robust security measures. Additionally, their support team is always ready to assist, should you have questions or need guidance.

- Peace of Mind: Ultimately, TaxLeopard offers peace of mind. It takes the anxiety out of tax season, allowing you to focus on your business’s success while knowing your taxes are in capable hands.

Conclusion

Understanding and adhering to company tax return instructions is pivotal for any business. Accurate tax filing not only ensures legal compliance but also plays a fundamental role in maintaining a healthy financial bottom line. By avoiding common mistakes, staying organized, and seeking professional assistance when needed, you can navigate the complex tax landscape with confidence.

Now, the question that remains is this: How will you implement these insights into your company’s tax filing strategy?

FAQs

Q1. What are the key benefits of accurate tax filing for a company?

Accurate tax filing ensures legal compliance, minimizes tax liabilities, and helps avoid penalties or audits.

Q2. Can I file my company’s taxes without professional help?

Yes, you can, but it’s advisable to consult a tax expert, especially for complex business structures.

Q3. What happens if I miss the tax filing deadline?

Missing the deadline can result in penalties and interest on the unpaid tax amount.

Q4. Are there any tax changes I should be aware of for the current tax year?

It’s essential to stay updated on recent tax law changes that might affect your business.

Q5. What should I do if I receive a tax audit notice from the tax authorities?

Consult with a tax professional immediately to guide you through the audit process.