In a world where time equals money, the tedious task of manual invoicing stands as a significant bottleneck. Research indicates that traditional invoice processing is not only time-consuming but also prone to human error. Enter e-invoicing, the digital solution revolutionizing this process. Electronic invoicing, automates the entire invoicing process, significantly reducing the need for manual data entry.

By integrating systems that facilitate the exchange of electronic invoice documents between suppliers and buyers, e-invoicing ensures global compliance and improves cash flow. This cloud-based innovation allows businesses of all sizes to process invoices electronically, from validation to payment, streamlining procurement and minimizing paperwork.

E-invoicing software solutions, therefore, offer a compelling answer to the quest for efficiency in modern business practices.

What is E-Invoicing?

E-invoicing, or electronic invoicing, is a digital method for creating, sending, and managing invoices. Unlike traditional paper-based invoicing, it involves sending invoices directly from one business’s financial system to another’s, typically in a standardized electronic format. This process significantly reduces manual efforts and errors, streamlining the invoicing process.

The Importance of E-Invoicing

In modern business, the transition from paper invoices to electronic invoice systems is important. E-invoicing, a cornerstone of digital transformation, streamlines accounts payable and purchase order processes. By automating invoice management, businesses can significantly enhance the real-time visibility of their cash flow. Utilizing e-invoicing software not only digitizes but also archives critical financial data, aiding in efficient workflow management. Supplier relationships are strengthened through timely and accurate e-invoice communications.

Adopting an electronic invoicing solution translates to improved tax compliance, ensuring VAT and other fiscal obligations are met accurately. Moreover, e-invoices contribute to environmental sustainability by reducing the need for physical paper.

How E-Invoicing Works

Technical Overview

It involves converting invoice data into a standardized format that e-invoicing systems can easily process. This digital format, often a compliant PDF or similar file type, ensures the invoice can be automatically read and processed. The essence of electronic invoicing lies in its ability to automate the traditional invoicing process, thereby reducing manual errors and increasing efficiency.

Integration with Business Systems

Integration of electronic invoicing with business systems, such as ERP (Enterprise Resource Planning), facilitates a seamless flow of financial information. This integration allows for real-time updates to cash flow and accounts, enhancing the overall financial health of the organization. An effective e-invoicing solution is designed to integrate effortlessly with existing business processes, ensuring minimal disruption while maximizing the benefits of automation. This holistic approach not only streamlines the invoicing process but also supports comprehensive financial management and compliance reporting, making e-invoicing an indispensable tool in the modern business landscape.

E-Invoicing and Security

E-invoicing software solutions prioritize data protection through robust security protocols. Cloud-based e-invoicing platforms employ encryption and secure channels to exchange electronic invoices, minimizing human error. This ensures that every invoice, whether processed via email or through a supplier portal, remains protected. Automation solutions within these systems significantly reduce risks associated with manual data entry. E-invoicing compliance, especially in handling VAT and GST, is paramount, and these platforms are designed to comply with global electronic invoicing requirements. The entire invoicing process, from invoice generation to validation, is safeguarded, ensuring that businesses of all sizes can confidently use electronic invoicing.

Real-World Benefits of E-Invoicing

- Improved Cash Flow: E-invoicing software enables faster processing of invoices and payments, leading to improved cash flow management. Early payment discounts become more accessible, benefiting both suppliers and buyers.

- Reduced Paperwork: By eliminating paper invoices from the process, e-invoicing significantly reduces the amount of paperwork involved, streamlining the entire invoicing process.

- Cost and Time Efficiency: Businesses can save time and resources by automating their invoicing system. This reduction in manual invoicing and data entry frees up the accounts payable team to focus on more strategic tasks.

- Enhanced Compliance and Accuracy: E-invoicing platforms ensure compliance with country-specific regulations and reduce errors associated with manual invoicing, ensuring invoices are paid on time and accurately.

- Seamless Integration: The best e-invoicing software integrates seamlessly with existing procurement and business systems, allowing organizations to access information easily and process invoices more efficiently.

Future Trends in E-Invoicing

The future of electronic invoicing is shaped by automation solutions and AI integration, promising to further streamline the invoicing process. AI can analyze invoice data, predict trends, and offer insights, leading to more informed business decisions. Globalization is also influencing e-invoicing adoption, with more businesses needing to comply with various global e-invoicing standards, especially for cross-border invoicing.

The use of QR codes will play a significant role in this evolution. QR codes can facilitate quick access to invoice details, streamline payment processes, and enhance security measures.

The exchange of an electronic invoice document between suppliers and buyers internationally will become smoother, facilitated by platforms that are increasingly customizable and capable of handling diverse, country-specific requirements. This evolution signifies a move towards a more connected and efficient global business environment.

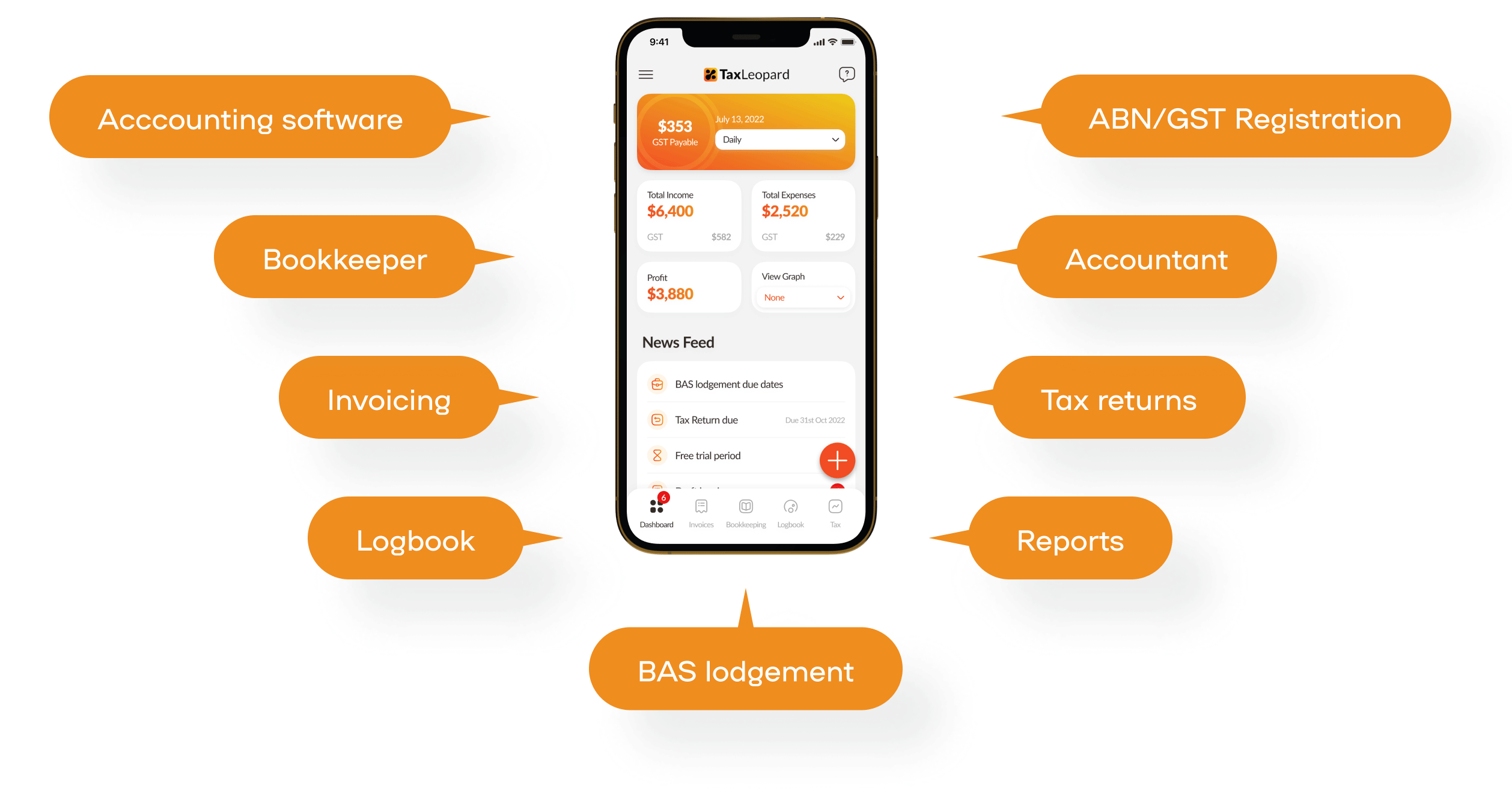

TaxLeopard: The Best E-Invoicing Software for Businesses

TaxLeopard is an exceptional e-invoicing software specifically designed for businesses. It offers a comprehensive solution for managing invoices and automating key accounting processes. Key features include:

- Streamlined Invoice Processing: Automates and simplifies the invoice management process, saving valuable time.

- Enhanced Cash Flow Management: Improves cash flow by facilitating quicker invoice processing and payment.

- Automation of Accounts Payable: Offers efficient automation solutions for AP processes, reducing manual efforts.

- Tax Compliance: Ensures compliance with tax regulations through electronic invoice management, making it easier to handle tax obligations.

- Seamless Transition from Traditional Invoicing: Facilitates an easy switch from traditional to electronic invoicing systems.

- Integration Capabilities: Seamlessly integrates with existing business systems for better invoice handling.

- User-Friendly Interface: Designed to be easy to use, enabling businesses to adopt e-invoicing effortlessly.

- Cost and Time Efficiency: Helps businesses save on resources and time, contributing to overall operational efficiency.

TaxLeopard is an ideal choice for businesses looking to simplify their invoicing process and enhance their financial operations.

Conclusion

E-invoicing stands as a beacon of efficiency in the modern business landscape. By eliminating the cumbersome manual invoicing process, it opens doors to faster payments, better tax compliance, and overall improved financial management. This digital shift not only saves time but also significantly reduces errors associated with traditional invoicing methods.

With features like early payment discounts and customizable invoicing solutions, electronic invoicing caters to diverse business needs, ensuring seamless, end-to-end invoice management. As organizations continue to adopt e-invoicing, they experience a substantial improvement in their cash flow and overall operational efficiency.

Isn’t it time to consider how e-invoicing could transform your business’s approach to financial transactions?

FAQs

1. Can e-invoicing save my business money?

Yes, replacing paper invoices with e-invoices can lead to significant cost savings, including reduced errors and less time spent on invoice management.

2. How secure is electronic invoicing compared to traditional methods?

It offers enhanced security over traditional methods, reducing risks like email scams and ransomware attacks.

3. Does e-invoicing improve payment times?

Yes, the ease and accuracy of electronic invoicing lead to faster invoicing and payments, reducing the risk of delays.

4. How do I find accredited e-invoicing service providers in Australia?

You can identify accredited e-invoicing service providers by checking the relevant ATO webpage or by inquiring directly with your software provider.

5. What is the potential future of electronic invoicing in Australia?

It is expected that electronic invoicing will become increasingly integrated into Australian business practices, with more products supporting it becoming available.