Managing finances during the Australian financial year can be challenging. Many individuals and businesses struggle with key tax dates, end-of-financial-year obligations, and ensuring compliance. Research indicates that numerous taxpayers miss crucial deadlines. This results in penalties and stress. A clear understanding of the financial year from 1 July to 30 June is essential. It helps streamline tax reporting and lodgement processes.

This guide provides comprehensive insights into the Australian tax year. It covers key dates, tax rates, and the process of lodging a tax return. With detailed information, managing your financial performance becomes simpler and more efficient. Continue reading for a complete guide on navigating the Australian financial year.

The Importance of the Australian Financial Year

The Australian financial year runs from 1 July to 30 June. This period is crucial for financial reporting and taxation. Individuals and businesses must lodge tax returns, including income tax returns, to the Australian Taxation Office (ATO). Key dates include 31 October for individual tax returns and 28 February for company tax returns.

Understanding these dates ensures compliance with Australian tax laws. Proper financial management during this period affects income tax calculations and financial health. Sole traders and businesses must also submit Business Activity Statements (BAS) and GST information accurately. This fiscal year framework ensures orderly financial administration.

Key Dates and Deadlines:

Start and End Dates:

The Australian financial year starts on 1 July and ends on 30 June. This period is crucial for tax purposes, with all income tax returns due by 31 October. For the fiscal year 2023-2024, key tax dates include 1 July 2023 and 30 June 2024.

Key EOFY Dates for Small Businesses

The end of the financial year (EOFY) in Australia runs from 1 July to 30 June. For small businesses, critical dates include 30 June 2024 for finalizing financial records and 31 October for lodging individual tax returns. The deadline for company tax returns and GST returns also falls around this time. Small businesses should ensure all business activity statements and financial reporting are completed by 28 February. It’s important to work with a tax agent to ensure compliance with Australian Taxation Office (ATO) requirements.

How Does The Financial Year Impact Taxation?

The financial year in Australia, running from 1 July to 30 June, directly influences taxation. Income tax returns must be lodged for the previous fiscal year by 31 October. Businesses and individuals need to report all taxable income, which includes earnings from various sources. The ATO uses this information to determine tax liabilities. GST and business activity statements are also affected, requiring regular updates throughout the year. Accurate financial reporting is essential for avoiding penalties and ensuring compliance with taxation laws. The financial year-end marks a critical period for assessing and managing tax obligations.

Tax Obligations and Compliance

Tax obligations in Australia require understanding the financial year, which begins on 1 July and ends on 30 June. Businesses and individuals must lodge a tax return each year by the due date for income tax returns. Key tax dates include the start and end of the financial year, with essential EOFY lodgement dates for small businesses.

Financial statements must be prepared accurately, and expenses for the financial year should be recorded meticulously. Engaging a registered tax agent or accountant can help ensure compliance. It is vital to submit your tax return and pay tax owed to avoid penalties.

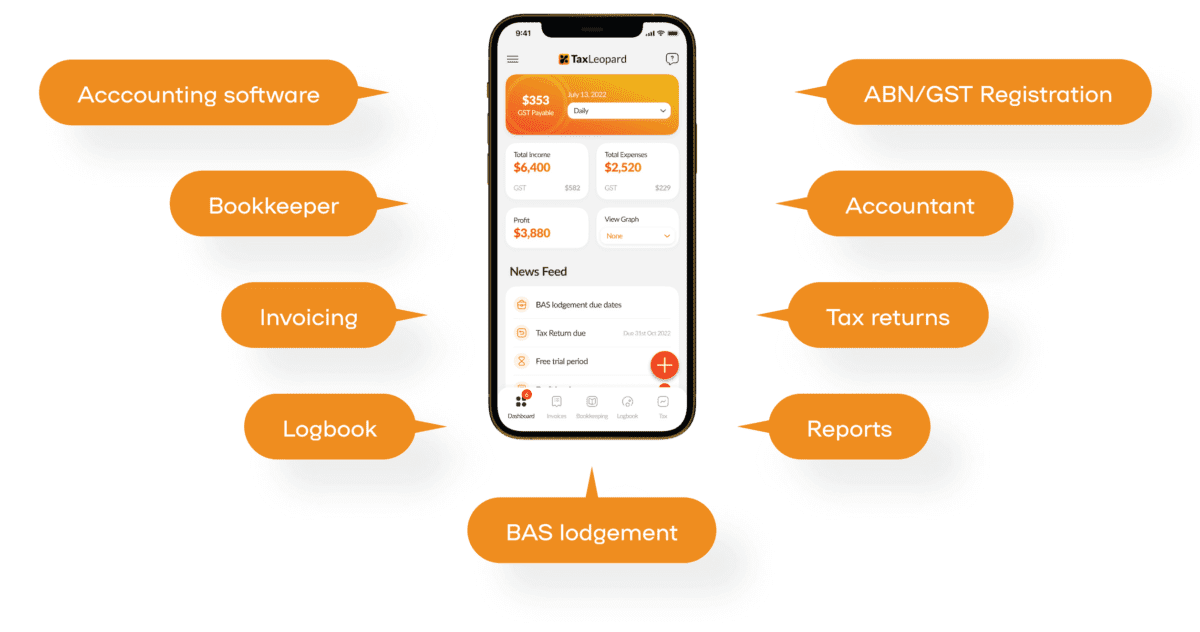

Streamline Your Financial Tasks With TaxLeopard

Managing your finances during the Australian financial year can be challenging, but with TaxLeopard, the process becomes seamless. TaxLeopard is a one-stop accounting software with CPA accountants specifically designed for self-employed individuals and contractors in Australia.

Stay on top of your finances this Australian Financial Year with TaxLeopard. Simplify your tax management and ensure compliance effortlessly. Try TaxLeopard today and streamline your financial tasks!

Conclusion

Understanding the Australian financial year is essential for accurate tax reporting. It begins on 1 July and ends on 30 June. Key dates, such as EOFY lodgement dates for small businesses, must be noted. The tax return process involves collecting financial statements, calculating business income and expenses, and possibly engaging a registered tax agent. Compliance with tax obligations ensures that personal income tax, business tax returns, and income tax returns for companies are submitted on time. Are you ready to manage your taxes effectively this financial year?

FAQs

1. How can I lodge a tax return?

Returns can be lodged online via myGov or by using a registered tax agent.

2. What expenses can I claim for the financial year?

Claimable expenses include work-related costs, business expenses, and certain deductions.

3. What happens if I miss the lodgement deadline?

Missing the deadline can result in penalties and interest charges from the ATO.

4. How do I handle personal income tax?

Personal income tax must be reported annually, with the tax return due by 31 October.

5. Do I need a registered tax agent?

While not mandatory, a registered tax agent can help ensure compliance and accuracy.