The end of the financial year can feel like a maze without a map. Many Australians find themselves scrambling to organise receipts, maximise deductions, and finalise their tax returns before the 30 June deadline. A large number of individuals and businesses could benefit from a structured approach to tackle this period. The solution lies in a comprehensive checklist and awareness of key dates, ensuring you’re prepared for the End of Financial Year 2023-24. This guide offers a detailed roadmap, from organising your documents to lodging your income tax returns with the ATO, ensuring you maximise your return and comply with Australian taxation laws.

Overview of the Financial Year in Australia

In Australia, the financial year or fiscal year starts on 1 July and ends on 30 June of the following year. This period is crucial for individuals and businesses to manage their finances, including income, expenses, and tax obligations. Financial reporting during this time allows for a comprehensive review of the past year’s financial activities. Small businesses and individuals need to gather financial records and prepare for tax lodgment. The Australian financial year dictates the accounting period for tax purposes, influencing how businesses plan their budgeting and financial strategies for the year ahead.

Importance of the End of Financial Year (EOFY)

The end of the financial year is a significant milestone for Australian businesses and individuals, marking a time to complete a tax return and lodge it with the Australian Taxation Office (ATO). It’s an opportunity to review your finances, claim deductions on taxable income, and strategize for reducing your tax bill. Businesses perform stocktakes, review asset purchases, and ensure compliance with single-touch payroll requirements. The EOFY checklist helps in organizing documents, finalizing business income and expenses, and preparing for financial reporting. This period also offers a chance to restructure your business, boost retirement savings through superannuation contributions, and set goals for the next financial year.

Key Dates for EOFY 2023-24

The end of the financial year (EOFY) is an important period for Australian individuals and businesses, marking the transition from one fiscal period to the next. It runs from 1 July to 30 June annually, with the EOFY 2023-24 closing on 30 June 2024. This time is pivotal for financial reporting, tax lodgment, and preparing for the year ahead. Here are the key dates and activities to help you manage your tax obligations and financial planning efficiently.

Throughout the Year

- Regularly review your finances to ensure you’re on track.

- Keep accurate financial records, including business income and expenses, to simplify EOFY processes.

- Consider asset purchases or restructuring your business to optimize tax positions.

31st March

- Small businesses should complete a stocktake if required by tax laws.

30th June

- The financial year 2023-24 ends.

- Final day to claim deductions for business expenses incurred during the year.

- Consider making contributions to your superannuation to boost your retirement savings and potentially reduce your tax bill.

1st July

- Start preparing your documents for tax lodgment.

- Gather payment summaries, financial statements, and records of business expenses and deductions.

14th July

- Employers must issue PAYG withholding payment summaries to all employees.

28th July

- Quarterly super guarantee contributions for the June quarter are due.

14th August

- Businesses using Single Touch Payroll (STP) need to finalise their data for the ATO.

31st October

- Deadline for individuals and businesses not using a registered tax agent to lodge their tax returns.

- Last day to lodge your tax return for the financial year if lodging yourself.

End of Financial Year Checklist

As the financial year from 1 July to 30 June draws to a close, businesses and individuals alike need to prepare for the EOFY. This period is crucial for financial reporting, tax lodgment, and setting the stage for the next financial year. Here’s a comprehensive checklist to help you manage your tax obligations and financial planning efficiently.

Review Your Finances:

- Assess your business income and expenses to understand your financial performance over the past year.

- Conduct a stocktake if your business holds inventory, as this may affect your taxable income.

Organise Financial Records:

- Ensure all financial records, including income, expenses, and bank statements, are up-to-date and accurate.

- Gather payment summaries, including PAYG withholding payment summaries, and single-touch payroll reports.

Tax Planning and Deductions:

- Identify potential deductions to reduce your taxable income. Common deductions include business expenses, asset purchases, and charitable donations.

- Consider making contributions to your superannuation to boost your retirement savings and potentially reduce your tax bill.

Lodgment Preparation:

- Check the ATO website for any changes in tax laws that may affect your tax return.

- Decide if you need to lodge an individual tax return or a business tax return, based on your circumstances.

EOFY Checklist for Tax Lodgment:

- Finalise your accounts and prepare financial statements, including the balance sheet and profit and loss statement.

- Review and claim deductions accurately to ensure you’re not missing out on any tax benefits.

Plan for the New Financial Year:

- Set financial goals for the year ahead, considering any changes in your business structure or strategy.

- Update your budget and financial forecasts based on your review of the past year and the outlook for the next year.

Getting Ready for Tax Season

As the Australian financial year from 1 July to 30 June ends, it’s crucial to start preparing for tax season. Business owners and individuals need to gather financial records, including business income and expenses, and complete a tax return. Checking the ATO website can provide guidance on lodgment deadlines. For those employing others, finalising PAYG withholding payment summaries is essential. This period is also an opportunity to review your finances and ensure all deductible expenses are accounted for, setting a solid foundation for the next financial year.

Strategies to Reduce Your Tax Bill

- Claim deductions for all eligible business expenses to lower taxable income.

- Contribute to your superannuation to boost retirement savings and potentially reduce your tax.

- Conduct a stocktake to identify any asset purchases that may be eligible for immediate deduction.

- Review and claim any work-related expenses to maximize tax returns.

- Consider restructuring your business if it may lead to tax efficiencies.

Preparing for the New Financial Year

With the new financial year starting on 1 July, it’s time to set goals for the year ahead. This involves updating financial records and planning for any changes in tax laws that may affect your business. Small businesses may decide to change their business structure or restructure to optimize for growth and tax benefits. Implementing systems like single-touch payroll can streamline financial reporting. Additionally, planning asset purchases and understanding how to manage your taxes can significantly impact your financial health. This preparation ensures you’re ready to tackle the financial year 2024 with confidence.

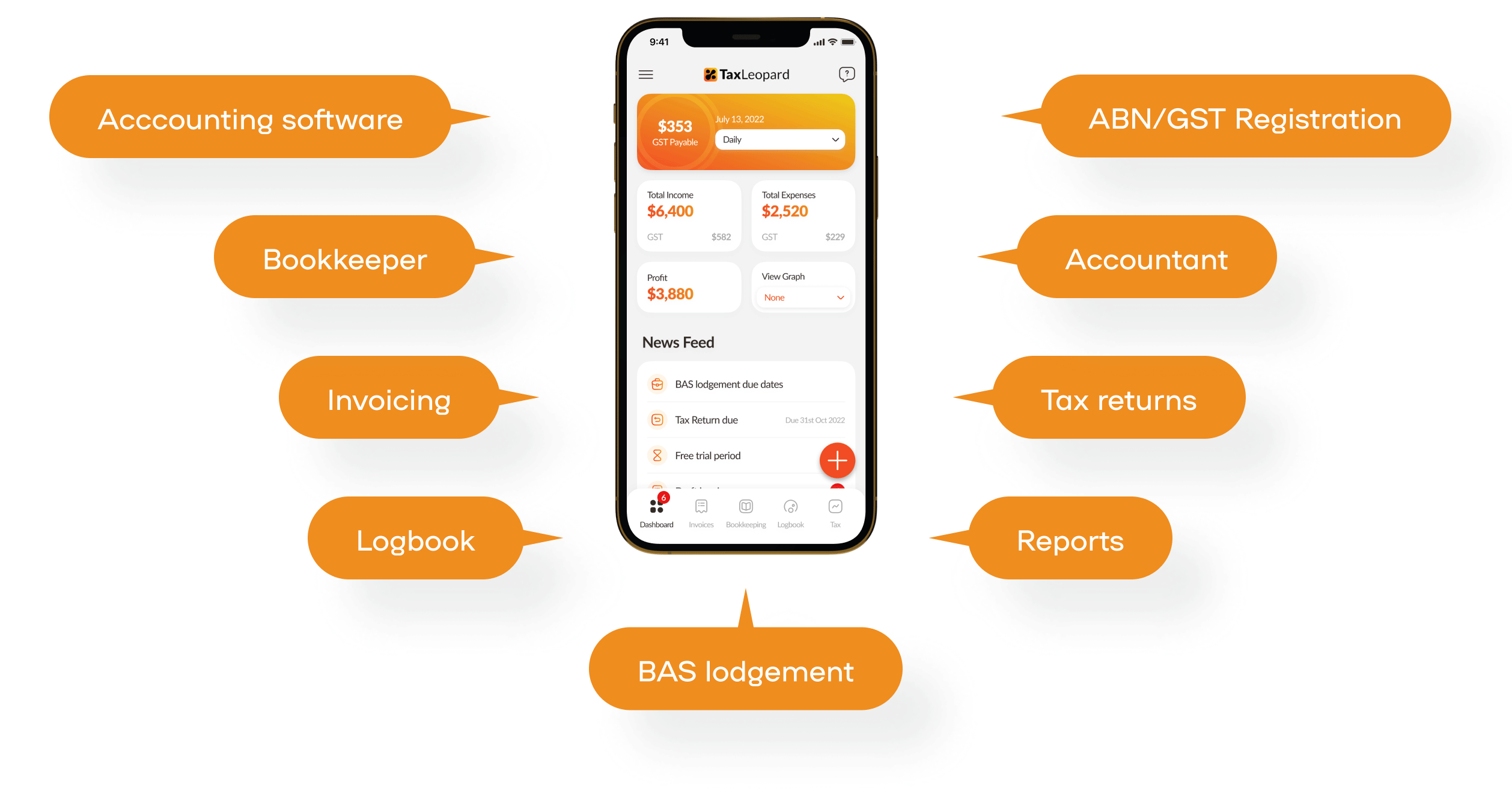

TaxLeopard: Revolutionizing EOFY with Ease and Efficiency

As businesses approach the end of the financial year 2023, the landscape of accounting and tax preparation becomes increasingly complex. This period is crucial, and navigating it successfully requires precision, efficiency, and a comprehensive understanding of financial intricacies. Amidst this challenging terrain, TaxLeopard emerges as a beacon of ease and reliability, revolutionizing the way businesses handle their end-of-year financial obligations.

TaxLeopard isn’t just another application; it’s a comprehensive solution designed to streamline and simplify the financial year-end process. In a world where time is a precious commodity, TaxLeopard offers a seamless experience, freeing business owners from the time-consuming tasks that often accompany the end of the fiscal year.

Conclusion

As the End of Financial Year 2023-24 approaches, remember that preparation is key to navigating tax time smoothly. By following our checklist and keeping key dates in mind, you can ensure that your financial affairs are in order, potentially maximising your deductions and minimising stress. Whether you’re an individual or a business owner, this guide aims to simplify the process. Have you considered how changes in this year’s tax laws might affect your returns?

FAQs

1. Can I lodge my tax return for 2023-24 online?

Yes, you can lodge your tax return online via the ATO website using myTax.

2. What is the deadline for lodging 2023-24 tax returns?

The deadline for lodging your tax return is 31 October 2024, unless you’re using a tax agent.

3. How do I know if I need to lodge a tax return for 2023-24?

Check the ATO website or consult a tax agent to determine if you’re required to lodge a return.

4. What happens if I lodge my tax return late for 2023-24?

You may incur a penalty or interest charge from the ATO for late lodgment.

5. Can I get help from an accountant for EOFY 2023-24?

Yes, an accountant or registered tax agent can provide advice and help lodge your return.