Are you starting a new business adventure in Australia or looking to give your existing enterprise an official stamp of legitimacy? Then you’ll need to navigate the process of applying for an Australian Business Number (ABN). An ABN is more than just a set of digits; it’s your business’s distinct identity in the eyes of the Australian government and your clients. One of the important steps for anyone looking to establish a business in Australia is obtaining an Australian Business Number. But how long does it take to get an ABN? In this, we will go through the process, providing insights, tips, and answers to frequently asked questions. So, let’s get started!

What is an ABN?

Before getting into the timeline, let’s grasp the fundamentals. An ABN, short for Australian Business Number, is a unique 11-digit identifier issued by the Australian Taxation Office (ATO) to businesses operating within the country. It’s essential for tax and business purposes, and nearly all businesses need one.

What are the requirements for an ABN?

Obtaining an Australian Business Number is a crucial step for anyone looking to operate a business in Australia. To secure this unique identifier, you must meet certain requirements set forth by the Australian Taxation Office (ATO). Here’s a concise overview of the key requirements for obtaining an ABN:

- Business Entity: You must be running a legitimate business entity. This includes sole traders, partnerships, companies, trusts, and more.

- Operating in Australia: Your business must either be located in Australia or actively conduct business within the country.

- Tax Obligations: You should be ready to meet your tax obligations, such as filing annual tax returns and complying with the Goods and Services Tax (GST) regulations, if applicable.

- Identity and Legal Name: You need to provide accurate personal details and the legal name of your business.

- Business Structure: Depending on your business structure, additional documentation might be required. For example, companies must have an Australian Company Number (ACN).

- Reason for ABN: You should have a valid reason for applying for an ABN, such as starting a new business or changing your business structure.

By meeting these requirements, you’ll be on your way to obtaining an ABN, a fundamental step towards establishing and operating a business in Australia.

How to apply for an ABN?

Step 1: Gather Your Information

Documentation Requirements

To initiate the ABN application process, you’ll need to gather specific information. Here’s what you should have on hand:

- Personal Details: Your full name, date of birth, and contact information.

- Business Details: The name, structure, and address of your business.

- Reason for Applying: Explain why you need an ABN, such as when starting a new business or changing your business structure.

Step 2: Choose the Application Method

Online vs. Paper Application

The next decision to make is how you want to apply for your ABN. You have two options:

- Online Application: This is the quickest method and can be completed on the ATO website. It usually takes around 20 minutes to complete.

- Paper Application: If you prefer the traditional route, you can fill out a paper form and mail it to the ATO. This process typically takes longer due to mail processing times.

Step 3: Verification Process

Timeframe for Verification

Once you’ve submitted your application, the ATO will begin the verification process. This involves cross-referencing your information with various government databases. The timeframe for this step can vary, but it generally takes about 20 business days.

Step 4: ABN Issuance

Receiving Your ABN

Congratulations! You’ve successfully passed the verification process, and now it’s time to receive your ABN. The ATO will issue your (Australian Business Number) via your preferred contact method, whether by email or post. This typically takes around 28 days from the date of application.

How long does it take to get an ABN?

The timeframe to acquire an Australian Business Number (ABN) typically varies. When applying online, it usually takes about 20 minutes to complete the application. After submission, the Australian Taxation Office (ATO) initiates a verification process, which can take approximately 20 business days. Once approved, you can expect to receive your ABN in about 28 days, either via email or postal mail. Keep in mind that the processing time may fluctuate depending on factors like application volume and the accuracy of the information provided. It’s advisable to apply well in advance of when you plan to commence business activities to ensure a smooth start.

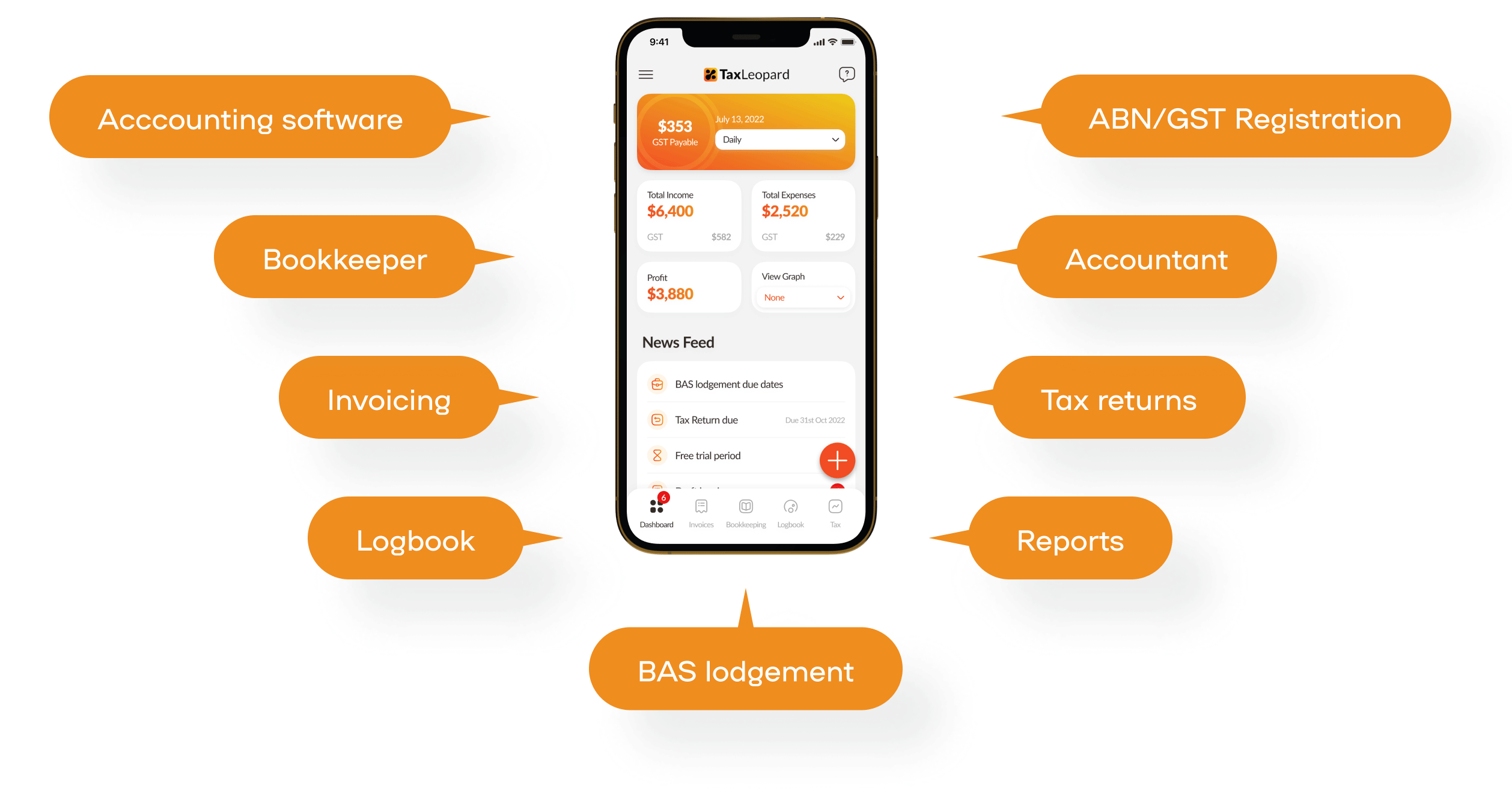

TaxLeopard: The Optimal Solution for ABN Registration and Tax Needs

As you consider applying for an ABN, it’s essential to have a reliable platform to assist with the registration process and manage tax-related responsibilities. TaxLeopard is that platform, tailor-made for the distinct needs of yoga instructors and personal trainers.

TaxLeopard is an online service that not only simplifies tax preparation and filing but also offers a suite of features like invoicing, tax returns, logbooks, and detailed reports. With a team of seasoned tax specialists, they ensure that you navigate the complexities of tax rules seamlessly, ensuring every filing is compliant with the set regulations.

Conclusion

In summary, the time it takes to get an ABN in Australia depends on several factors, including the application method and the verification process. On average, you can expect the entire process to take approximately 1 to 2 months. It’s important to ensure that you provide accurate and complete information to expedite the process.

Now that you’re equipped with a better understanding of how long it takes to get an ABN, you can confidently take the necessary steps to acquire this essential identifier for your business.

FAQs

1. Can I apply for an (Australian Business Number) before starting my business?

Yes, you can apply for an ABN before starting your business. It’s a good idea to do so, as it’s often required for various business-related activities.

2. Is there a fee for obtaining an (Australian Business Number)?

No, applying for an ABN is free. Be cautious of third-party websites that charge fees for this service.

3. Can I check the status of my ABN application?

Yes, you can check the status of your ABN application on the ATO website using your reference number.

4. What happens if my ABN application is rejected?

The company will send you a notice explaining the reasons if they reject your application. You can rectify the issues and reapply.

5. Do I need an (Australian Business Number) for a sole trader business?

Yes, if you are operating as a sole trader, it’s essential to have an ABN for tax and business purposes.