Many small businesses struggle to distinguish between bookkeeping and accounting, often blending the two. This confusion can lead to inefficiencies and missed opportunities in financial management. Bookkeeping focuses on recording daily transactions, laying the groundwork for the more analytical processes of accounting, which interprets these records to guide strategic decision-making. This article will delve into the differences, skills required, and how each function contributes uniquely to business success.

What Is Bookkeeping?

Bookkeeping involves the systematic recording of financial transactions, which are critical for businesses of all sizes. It ensures that records of individual financial transactions are accurate, up-to-date, and comprehensive. Utilizing bookkeeping software, bookkeepers maintain the ledger, handle data entry, and manage payroll and reconciliation processes. This foundation supports business owners in assessing their financial situation and managing cash flow effectively.

Daily Tasks of a Bookkeeper

- Record and update financial transactions.

- Maintain and balance the ledger.

- Manage payroll processing.

- Conduct financial reconciliation.

- Prepare tax returns.

- Ensure accurate data entry.

What Is Accounting?

Accounting builds on the data provided by bookkeeping to interpret, analyse, and present financial data in a way that helps stakeholders make better decisions. Accountants produce financial statements, oversee tax return preparation, and provide insights into the business’s financial health. They use their analytical skills to assess financial situations and predict future financial needs, playing a crucial role in strategic planning.

Strategic Role of Accountants

- Ensure accuracy in financial statements to guide business decisions.

- Analyze financial data to predict future trends and cash flow scenarios.

- Manage payroll and reconciliation processes to maintain financial balance.

- Provide strategic tax planning and optimize tax return filings.

- Interpret financial information to assist business owners in understanding their financial situation.

Key Difference Between Bookkeeping and Accounting

- Bookkeeping focuses on recording daily financial transactions systematically, while accounting involves deeper analysis of these records to provide financial insight.

- A bookkeeper maintains the accuracy of day-to-day data entry and manages ledgers, whereas accountants use this data to generate financial statements.

- Bookkeepers often deal with bank statements and payroll processing, ensuring every transaction is meticulously recorded. Accountants interpret these records to assess financial health and forecast future trends.

- The main objective of bookkeeping is to keep a precise and systematic record, which helps in maintaining financial order. Accounting, however, aims to offer financial advice and strategic planning based on these records.

- Bookkeeping is generally seen as less complex and does not necessarily require a professional certification; accounting, as a highly specialized field, often requires qualifications such as CPA.

- Emerging software tools have revolutionized bookkeeping by automating many traditional tasks while accounting still demands a high level of personalized analysis and expertise.

- While bookkeepers ensure accurate record-keeping and support daily financial operations, accountants provide a broader range of services, including audit support, tax advice, and profit and loss analysis.

- Business owners might hire a bookkeeper for regular financial tracking and an accountant for more complex issues like tax filing and strategic financial planning.

Bookkeeping vs Accounting: Similarities

- Both bookkeeping and accounting are crucial for the successful management of a business’s finances and are essential for making informed decisions.

- Bookkeepers and accountants often work closely together, communicating crucial financial information that supports strategic business operations.

- Technological advancements have influenced both fields, with software now available online that can automate many of the time-consuming tasks traditionally performed by bookkeepers.

- Each practice serves to ensure that financial records are accurate and up-to-date, which is extremely important for the financial well-being of any business.

- Both roles are instrumental in preparing financial reports; bookkeepers compile the preliminary data, and accountants transform this data into detailed reports and forecasts.

How Bookkeeping and Accounting Intersect in Business

Collaboration Between Roles

Bookkeeping and accounting are crucial, interlinked aspects of managing a business’s finances. Bookkeepers maintain detailed records of daily transactions, preparing the groundwork for accountants, who then use this data to analyze financial health and strategic planning.

This systematic collaboration ensures accuracy in financial reports and aids in generating statements that reflect the business’s true financial state. By sharing responsibilities, bookkeepers and accountants help business owners grasp the “big picture” and make informed decisions.

Impact on Financial Health

The role of bookkeeping in keeping accurate records directly influences a company’s financial health. Accountants use these meticulously kept records to prepare profit and loss statements and conduct financial analysis, crucial for strategic decision-making.

This combined effort not only aids in routine compliance, such as tax filing and audit preparation but also supports financial forecasting and budgeting.

Through their partnership, bookkeepers and accountants provide a comprehensive range of services that safeguard and enhance the financial well-being of the business, helping owners to navigate potential challenges effectively.

Choosing Between a Bookkeeper and an Accountant for Your Business

Choosing between a bookkeeper and an accountant depends on your business’s needs. Bookkeepers handle day-to-day financial transactions, ensuring records are precise and systematic. Accountants, on the other hand, delve into financial analysis and generate comprehensive reports such as profit and loss statements. They also offer tailored financial advice and assist with audit preparation and tax filings.

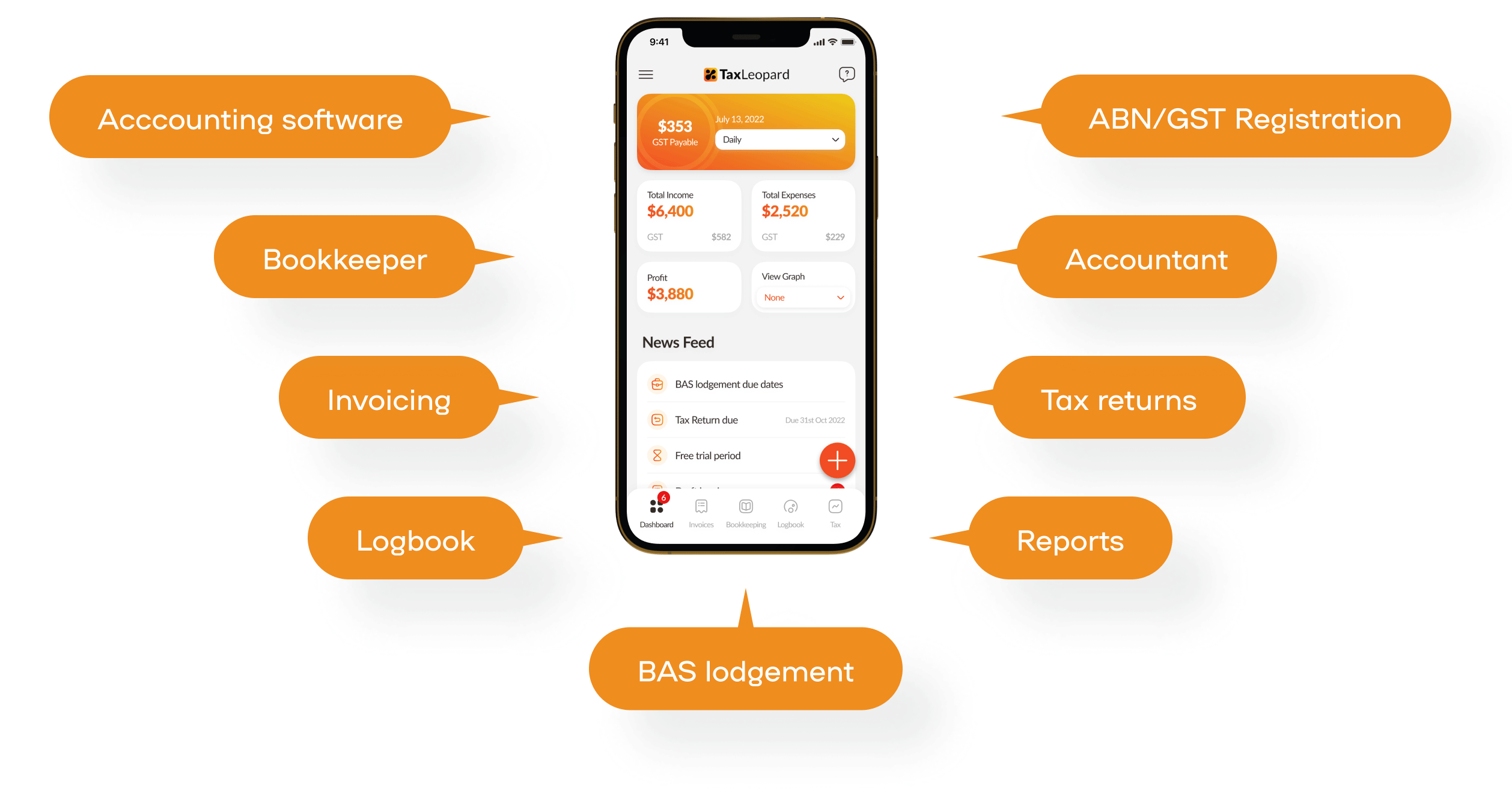

Digital software like TaxLeopard simplifies tasks for both professions. It automates payroll processing, and credit card reconciliation, and generates financial statements efficiently, allowing bookkeepers and accountants to better support their clients.

How TaxLeopard Can Assist Both Bookkeepers and Accountants

TaxLeopard simplifies financial management for bookkeepers and accountants alike. Its software supports accurate record-keeping and comprehensive financial reporting, making it an essential tool for professionals seeking efficient, reliable solutions.

Tools and Features Suited for Bookkeeping

- Seamless bank statements integration

- Payroll processing

- Credit card reconciliation

- Automated recording of financial transactions

Advanced Capabilities for Accountants

- Generating financial statements

- Detailed financial analysis

- Support for audit preparations

- Technological advancements for efficient data handling

Conclusion

Concluding this exploration, understanding the distinct roles of bookkeeping and accounting can vastly improve financial clarity and operational efficiency for any business. Each has its unique place in the financial ecosystem, supporting business owners with accurate data and insightful analysis. Are you currently leveraging both disciplines to optimize your business’s financial health?