Lodging a Business Activity Statement (BAS) can be a daunting task for many business owners. Many small businesses struggle with accurate BAS reporting, leading to unnecessary stress and potential penalties. To tackle this challenge, it’s essential to understand the basics of BAS lodgement. This includes knowing the due dates, calculating GST, PAYG withholding tax, and other tax liabilities.

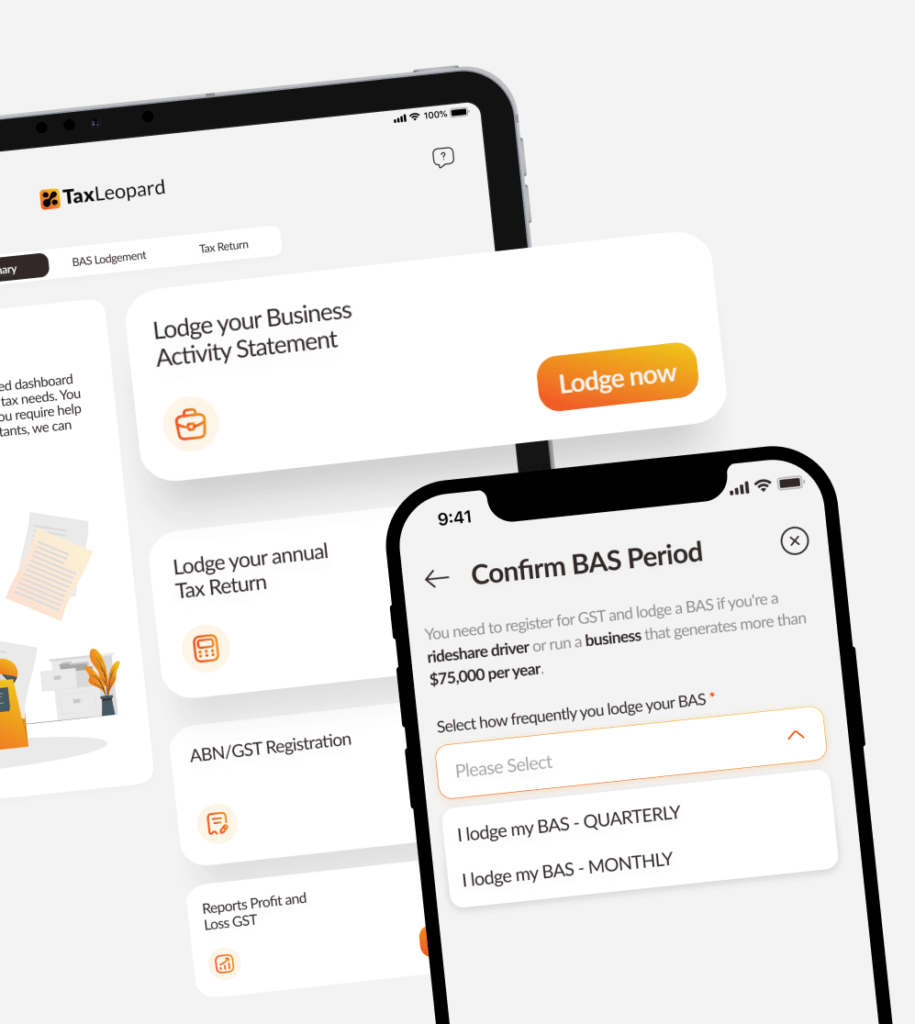

Additionally, choose the right method to lodge your Business Activity Statement, whether through the ATO’s Business Portal or a registered tax agent. For expert assistance with accounting services and BAS lodgement, consider using TaxLeopard, renowned for its top-notch solutions in managing your business finances efficiently.

This article provides a comprehensive guide to simplify the BAS lodgement process and ensure you meet your obligations on time.

What is BAS?

A Business Activity Statement (BAS) serves as a critical document for businesses in Australia, encapsulating essential tax information. Primarily, it reports and pays the Goods and Services Tax (GST), Pay As You Go (PAYG) instalments, PAYG withholding tax, and other tax obligations. Its comprehensive nature ensures that businesses remain compliant with the Australian Tax Office (ATO) requirements. It plays a pivotal role in streamlining tax reporting and payment processes, making it an indispensable tool for efficient financial management in businesses.

Preparing for BAS Lodgement

To prepare for lodgement, start by gathering relevant financial records. Understand the due dates for lodging and paying your BAS, as these vary depending on your business size and reporting period. Use the ATO’s guide to fill out the BAS form accurately. Calculate your GST turnover and determine if you’re required to lodge quarterly or annually.

For accurate reporting, use TaxLeopard for BAS lodgement and overall tax reporting and records. With TaxLeopard, you can effortlessly track income and expenses, ensuring all tax liabilities such as PAYG withholding tax and income tax instalment are included in your BAS. Start simplifying your tax management with TaxLeopard.

Lastly, set reminders to lodge and pay on time to avoid penalties.

Calculate GST, PAYG, and Other Obligations:

Calculating GST involves summing the GST collected on sales and subtracting the GST paid on purchases. For PAYG, calculate the tax withheld from employee wages. If applicable, determine your income tax instalment based on your expected tax for the year.

For businesses registered for GST, report these amounts in the BAS statement. Use the ATO’s tools or consult a tax agent for assistance. Remember, sole traders and unregistered businesses have different obligations.

Regularly review your tax invoices and financial records to ensure accurate calculations for your BAS reporting.

BAS Due Dates 2024

Staying on top of the due dates for paying and lodging your BAS is crucial for business compliance. The due dates can vary depending on your reporting period.

-

- Quarterly Lodgement Deadlines: Businesses must submit their BAS by the 28th day following the end of each quarter. For the 2024 financial year, the due dates are July 28 (Q1), October 28 (Q2), February 28 (Q4), and April 28 (Q4). If the due date falls on a weekend or public holiday, you can lodge and pay on the next business day.

-

- Monthly Lodgement Deadlines: If you’re required to lodge monthly, it is due on the 21st day of the month following the reporting period. For 2024, this means the deadlines are February 21, March 21, April 21, and so on, up to January 21, 2025. Again, if the 21st is a weekend or public holiday, the deadline extends to the next business day.

-

- Annual Lodgement Deadlines: If you’re eligible for annual reporting, your BAS for the full 2024 financial year is due by February 28, 2025. However, if you use a tax agent or BAS agent, you may have a different due date. Check with your agent or the ATO for your specific deadline.

How to Lodge Your BAS?

Online Lodgement through the ATO Business Portal:

To lodge a BAS online, businesses can use the ATO’s Business Portal. First, you need to register for GST and obtain an AUSkey. Once logged in, select the “Lodge BAS” option, and fill out the BAS form with your GST turnover, tax liabilities, and PAYG withholding tax details. Ensure all information is accurate before submitting.

Lodging via a Registered Tax Agent or BAS Agent:

Businesses can choose to lodge their Business Activity Statement through a tax agent or BAS agent registered with the Tax Practitioners Board (TPB). Agents can provide advice, complete a BAS on behalf of the business, and help meet the due date for lodging and paying. Ensure your agent is authorized to lodge BAS services.

Paper Lodgement for Eligible Businesses:

Eligible businesses can lodge their Business Activity Statement using a paper form. This method is suitable for businesses with simple tax affairs or those not registered for GST. Fill out the Business Activity Statement form, calculate your GST and PAYG instalments, and mail it to the ATO. Remember to lodge and pay on time to avoid penalties.

How to Pay Your BAS?

To pay your BAS, first calculate the amounts for GST, PAYG withholding tax, and other tax liabilities. Use the ATO’s Business Activity Statement form, which varies depending on your business size and reporting period. Lodge the BAS by the due date, either quarterly or monthly. The Australian Taxation Office (ATO) offers multiple payment methods. These include BPAY, credit or debit cards, and direct credit. Payment can also be made by mail with a cheque.

Common Mistakes to Avoid in BAS Reporting

-

- Neglecting to report all GST transactions, leads to inaccurate liability.

-

- Confusing GST-free and input-taxed sales, resulting in incorrect GST claims.

-

- Incorrectly classifying business purchases as personal expenses, leading to overclaimed GST credits.

-

- Failing to reconcile BAS figures with financial records, causing discrepancies.

-

- Neglecting PAYG withholdings and instalments, leading to underreported income tax obligations.

-

- Overlooking fringe benefits tax or fuel tax credits leads to inaccuracies in BAS.

-

- Ensure accurate record-keeping and understand GST classifications to avoid these mistakes.

-

- Regularly reconcile and consult a BAS agent or use accounting software for precise reporting.

Avoiding these mistakes can save time, reduce stress, and prevent potential financial penalties. It’s often beneficial to consult with a tax professional or utilize reliable accounting software to ensure accurate BAS reporting.

Simplify Your BAS Lodgement with TaxLeopard

Managing your Business Activity Statement doesn’t have to be a headache. Discover the simplicity and efficiency of TaxLeopard, the premier accounting app designed to streamline your BAS lodgement process. With TaxLeopard, you can say goodbye to the confusion and chaos of traditional methods. Our user-friendly platform guides you through each step, ensuring accuracy and compliance with the Australian Taxation Office (ATO) requirements. Get Started Now!

Why choose TaxLeopard for your BAS Lodgement?

-

- Ease of Use: Navigate through your BAS lodgement with an intuitive interface that makes tax management accessible to everyone, from seasoned accountants to small business owners.

-

- Time-Saving Features: Automated calculations and pre-filled fields reduce manual input, saving you precious time and minimizing errors.

-

- Real-Time Updates: Stay informed with live data syncing, ensuring your financial information is always up-to-date and accurate.

-

- Secure and Reliable: Trust in a platform that prioritizes your security, with robust encryption and data protection measures.

-

- Expert Support: Access professional assistance whenever you need it, with a dedicated support team ready to help you navigate any challenges.

Don’t let BAS lodgement be a burden on your business. Choose TaxLeopard and experience the ease and confidence of managing your taxes with the best in the business. Sign in today and take the first step towards a hassle-free tax season.

Conclusion

Timely and accurate BAS lodgement is vital for maintaining compliance and avoiding penalties. By following the steps outlined in this guide, you can confidently lodge and keep your business finances in check. Remember to stay updated with the ATO’s regulations and seek professional advice if needed. Have you found a method that works best for your business when lodging your BAS?

FAQs

1. Who needs to lodge a BAS?

Businesses registered for GST with an annual income of $75,000 or more, or not-for-profit organizations with an income of $150,000 or more, are required to lodge a Business Activity Statement.

2. Can I lodge a ‘nil’ BAS if I have nothing to report?

Yes, if you have no transactions to report for a period, you can lodge a ‘nil’ BAS online or by phone.

3. What are the penalties for submitting late?

Penalties for late lodgement include a late lodgement penalty ranging from $210 to $1,050, depending on the delay, and a General Interest Charge (GIC) on unpaid amounts.

4. Can I get an extension for lodging my BAS?

Yes, you can receive an additional two weeks to lodge and pay your BAS if you lodge electronically. Schools and associated bodies receive a deferral for their December activity statement.

5. What should I do if I make a mistake on my Business Activity Statement?

If you make a mistake, you can correct it on your next one or revise the original BAS. Conditions apply depending on the type of error.