Keeping track of driving hours can be a hassle, especially for learner drivers and their supervisors. Manual log entries often lead to errors and non-compliance issues. Enter TaxLeopard, the leading digital logbook app for 2024. Designed for ease of use, this app transforms the logging process into a simple, efficient task.

It supports PDF exports, ensuring compliance and ease of sharing. Whether you’re a supervisor overseeing a learner driver or someone managing their driving logs, TaxLeopard provides a reliable solution. Dive into our complete guide to discover how TaxLeopard can streamline your logbook management.

What Is a Digital Logbook?

A digital logbook, also known as an electronic logbook, is an application that facilitates the systematic recording of data. Typically used in various domains like driving hours for learner drivers, shift work, or car maintenance, this app replaces traditional paper logbooks.

It ensures accurate, compliant record-keeping, streamlines the management of logbook entries, and supports both personal and business use. Crucially, it offers features like offline access and syncing when an internet connection is available, making it a versatile tool for users on the go.

Evolution of Logbooks: From Paper to Digital

The transformation from paper logbooks to digital versions marks a significant leap in efficiency and compliance. Initially, individuals and businesses recorded details manually, which was time-consuming and prone to errors. The shift began as technology advanced, allowing for the creation of apps that not only store data but also ensure compliance with relevant laws and regulations.

Modern digital logbooks offer enhanced features like automatic backups, real-time updates, and integration with other software, facilitating a more seamless and reliable way to manage critical records.

Features to Look for in the Best Digital Logbook App

1. User-Friendly Interface:

The best digital logbook apps boast an intuitive interface that makes them easy to use for everyone, from learners to seasoned professionals. The ability to quickly add entries and retrieve information helps users stay organized without extensive training.

2. Comprehensive Record-Keeping Capabilities:

Look for apps that offer detailed tracking of relevant activities. For driving logs, this might include hours of driving practice, supervising driver details, and automatic calculation of distances like the cents per km rate.

3. Robust Security and Compliance:

Ensure the app adheres to applicable regulations, such as those set by the ATO for business logs or driving tests. Security features should protect personal information and support compliance effortlessly.

4. Offline Functionality:

An essential feature for those in areas with unstable internet connections. The ability to log information offline and sync later ensures continuous, uninterrupted access to the logbook.

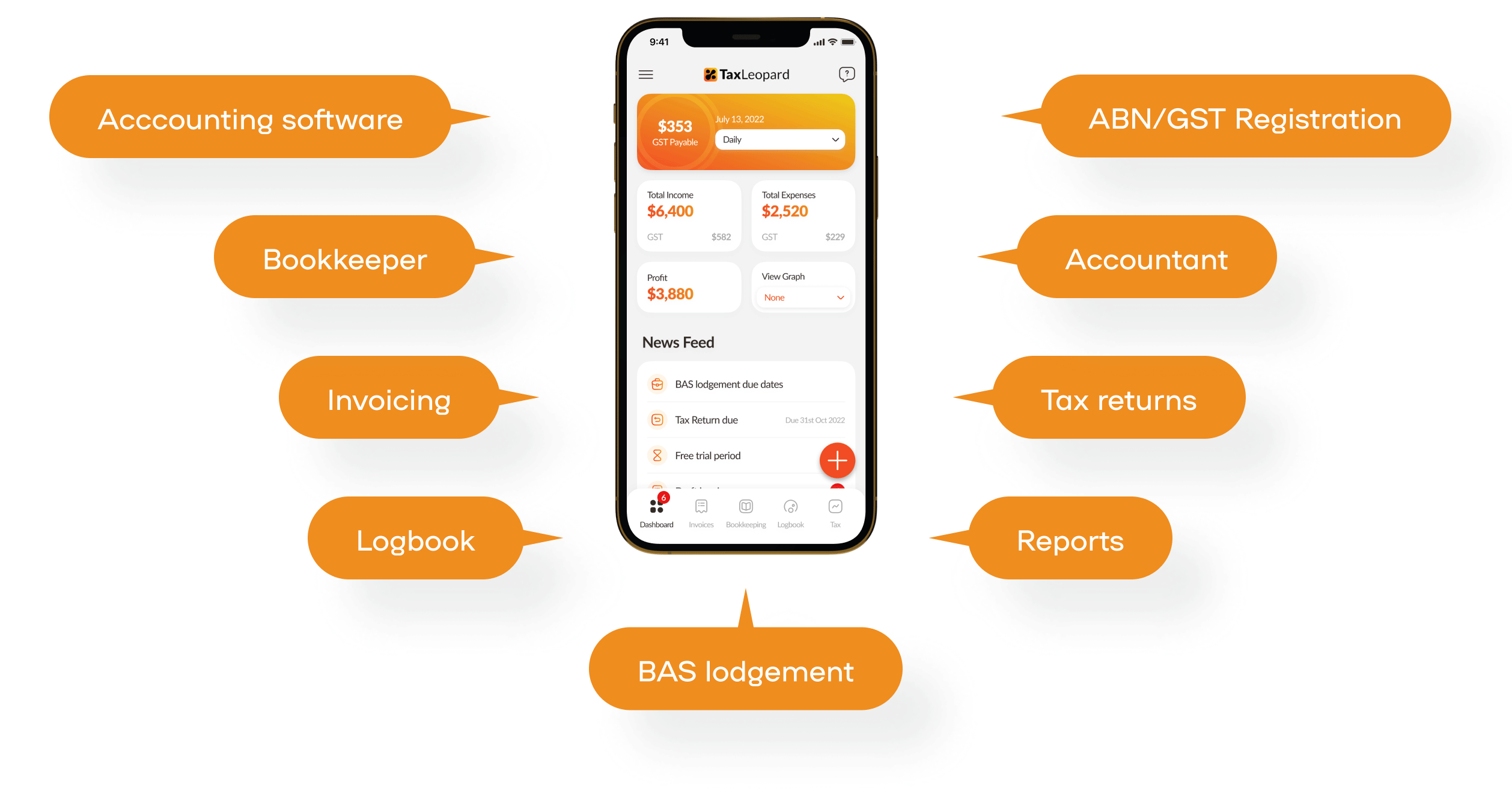

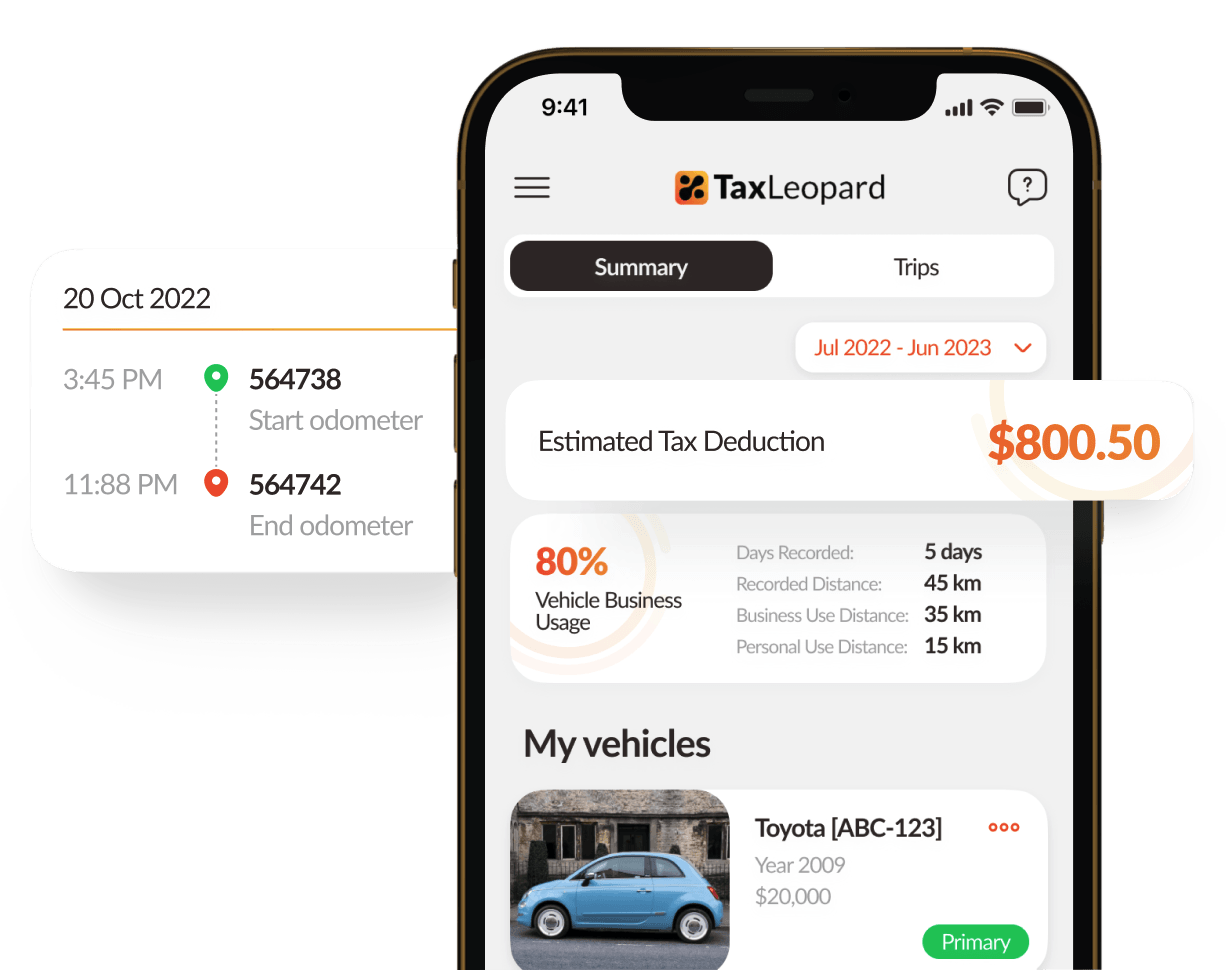

TaxLeopard: Simplify Your Logbook Management Now

TaxLeopard offers a seamless way to manage digital logbooks for personal or business use. Its intuitive app ensures that driving hours, car maintenance, and compliance records are all easily maintained. Whether offline or online, TaxLeopard provides a robust solution for license-ready record-keeping.

With features like driving hour trackers and comprehensive logbook entries, this app caters to both learner drivers aiming for 120 hours of practice and experienced drivers monitoring business trips.

Advantages of Using TaxLeopard

Streamlined Data Entry and Access:

TaxLeopard offers a user-friendly interface that makes logging hours or tracking business trips straightforward. With features like a driving hours tracker and the ability to register types of data quickly, users save time and reduce errors. The app’s design ensures that whether you’re a learner logging practice hours or a professional recording trip details, the process is hassle-free.

Superior Data Security and Compliance Features:

Security and compliance are paramount in logbook management. TaxLeopard provides robust data protection, ensuring personal information and logbook entries are safeguarded against unauthorized access. It complies fully with laws and regulations, making it ideal for those needing meticulous record-keeping for audits or legal requirements. Whether you’re supervising a learner driver or tracking shift work, TaxLeopard maintains high compliance standards.

Advanced Features of Taxleopard

Customization Options for Diverse Needs:

Taxleopard offers extensive customization options to cater to the diverse needs of its users. Whether you’re a business owner using your car for client visits or a freelancer needing to track kilometres for work-related trips, Taxleopard adapts to your specific requirements. It supports various methods, like the cents per km method or the log book method, providing flexibility in how you record and report your car-related expenses. The tool also allows for adjustments if circumstances change, ensuring your logbook always reflects your current situation.

Security and Data Integrity in Logbook Maintenance:

In the realm of digital logbooks, security and data integrity are paramount. Taxleopard addresses these concerns by offering robust security features to protect your data. It safeguards against the risk of losing, a common issue with paper log books. With features like cloud storage and encrypted data transfer, Taxleopard ensures that your driving logs and personal information remain secure and accessible only to you. This reassurance is crucial, especially when using the myDeductions tool in the ATO app for tax purposes, where accuracy and data integrity are non-negotiable.

To Wrap Up

As we look ahead to 2024, embracing the shift from paper logs to digital solutions is more crucial than ever. TaxLeopard exemplifies this transition, offering an easy-to-use platform that ensures accuracy and compliance. It’s not just a logbook; it’s a comprehensive tool for supervisors and learner drivers alike. Ready to experience the convenience and reliability of TaxLeopard? How will TaxLeopard change the way you manage your driving records?