Bookkeeping, often perceived as the mundane crunching of numbers, is a vital lifeline for businesses of all sizes. It’s the art and science of systematically recording financial transactions, a process that forms the foundation for insightful financial decision-making. In this complete guide, we delve into the intricate world of bookkeeping, shedding light on its principles, practices, and profound impact on business health.

Whether you’re a budding entrepreneur, a seasoned business owner, or simply curious about the financial workings of a company, understanding the essentials of bookkeeping is a crucial step toward financial literacy and business acumen. Join us as we navigate through the complexities of bookkeeping, unraveling its mysteries, and highlighting its indispensable role in the world of business.

Introduction to Bookkeeping

Bookkeeping is the systematic recording and organization of financial transactions in a business. It’s a key part of the accounting process, providing the data needed for financial reporting and analysis. Accurate bookkeeping is vital for tracking the financial health of a business, aiding in budgeting, and ensuring compliance with regulations. It involves maintaining detailed records of income and expenses, which are crucial for effective financial planning and decision-making. As the backbone of a business’s financial framework, bookkeeping helps identify monetary patterns and growth opportunities.

Basic Principles of Bookkeeping

Debits and Credits

Debits and credits are used to ensure that the accounting equation stays in balance. Essentially, debits are entries that increase asset or expense accounts or decrease liability, revenue, or equity accounts. Conversely, credits do the opposite: they decrease asset or expense accounts and increase liability, revenue, or equity accounts. It’s a system of opposites and balances, where for every action (debit), there is an equal and opposite reaction (credit). This principle is crucial for maintaining accurate and reliable financial records.

The Accounting Equation

The accounting equation forms the cornerstone of the bookkeeping system. It states that Assets = Liabilities + Equity. This equation is key to understanding the financial position of a business at any given time. It ensures that all financial transactions are recorded in such a way that the business’s balance sheet remains balanced. Here’s a closer look at its components:

- Assets: These are resources that a company owns with monetary value, such as cash, inventory, and equipment.

- Liabilities: These are obligations or debts owed by the business to others, such as loans or accounts payable.

- Equity: This represents the owner’s interest in the business after all liabilities have been deducted from the assets.

Types of Bookkeeping Systems

Single-Entry System

The single-entry bookkeeping system is a straightforward method, primarily suited for small businesses with limited transactions. In this system:

- Transactions are recorded once, either as income or expense.

- It provides a simple way to keep track of cash flow.

- However, it lacks the complexity needed for larger businesses.

Double-Entry System

The double-entry bookkeeping system is more comprehensive and involves recording each transaction in two accounts – as a debit in one and a credit in another. This system:

- Ensures the accounting equation (Assets = Liabilities + Equity) always balances.

- Provides a complete financial picture of the business.

- Reduces errors and omissions, enhancing the accuracy of financial records.

Both systems have unique advantages and are chosen based on the specific needs and scale of the business. The single-entry system offers simplicity and ease of use, making it ideal for smaller enterprises with straightforward financial transactions. On the other hand, the double-entry system, with its detailed and balanced approach, is better suited for larger organizations that require a more comprehensive view of their financial health.

Key Components of Bookkeeping

Bookkeeping, an integral aspect of financial management, comprises several key components. These include:

- Recording Transactions: The cornerstone of bookkeeping is the systematic recording of financial transactions. This process ensures every monetary action is accounted for, providing a clear financial history.

- Managing Journals and Ledgers: Journals initially record transactions, which are later transferred to ledgers. While journals capture day-to-day financial activities, ledgers categorize these entries, facilitating organized record-keeping.

- Financial Statements: Bookkeeping culminates in the preparation of financial statements like the balance sheet, income statement, and cash flow statement. These documents reflect the business’s financial health, aiding in strategic decision-making.

- Reconciliation: Regular reconciliation of bank statements with book records is vital. It helps in identifying discrepancies, preventing financial inaccuracies, and ensuring compliance.

- Budgeting and Forecasting: Effective bookkeeping enables accurate budgeting and financial forecasting. By analyzing past data, businesses can predict future financial trends and make informed decisions.

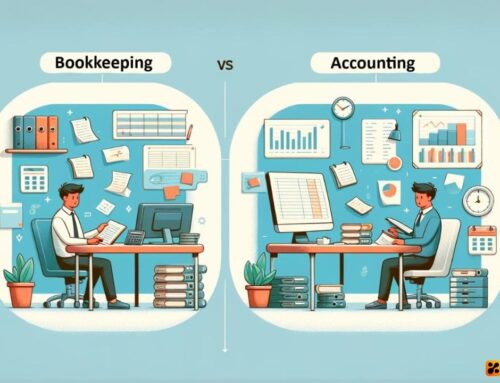

Bookkeeping vs. Accounting: Understanding the Difference

Although often used interchangeably, bookkeeping and accounting are distinct disciplines within the broader scope of financial management. The primary differences are:

- Focus and Function: Bookkeeping is primarily concerned with the accurate recording of financial transactions. In contrast, accounting involves interpreting, classifying, analyzing, reporting, and summarizing financial data.

- Decision Making: Bookkeeping does not typically include an analytical component; it’s more about maintaining records. Accounting, however, provides insights based on bookkeeping data, aiding in decision-making.

- Skills Required: Bookkeeping generally requires basic accounting skills for recording transactions, whereas accounting demands a deeper understanding of financial principles to analyze and interpret financial data.

- Reporting: Bookkeepers prepare the initial documents, like ledgers and journals. Accountants use these documents to create financial reports and statements that help stakeholders understand the business’s financial status.

- Regulatory Role: Accounting plays a crucial role in tax preparation and ensuring compliance with various financial regulations. Bookkeeping supports this by providing accurate and timely records.

Understanding these differences is vital for businesses to effectively organize their financial practices and ensure they meet their reporting and analytical needs.

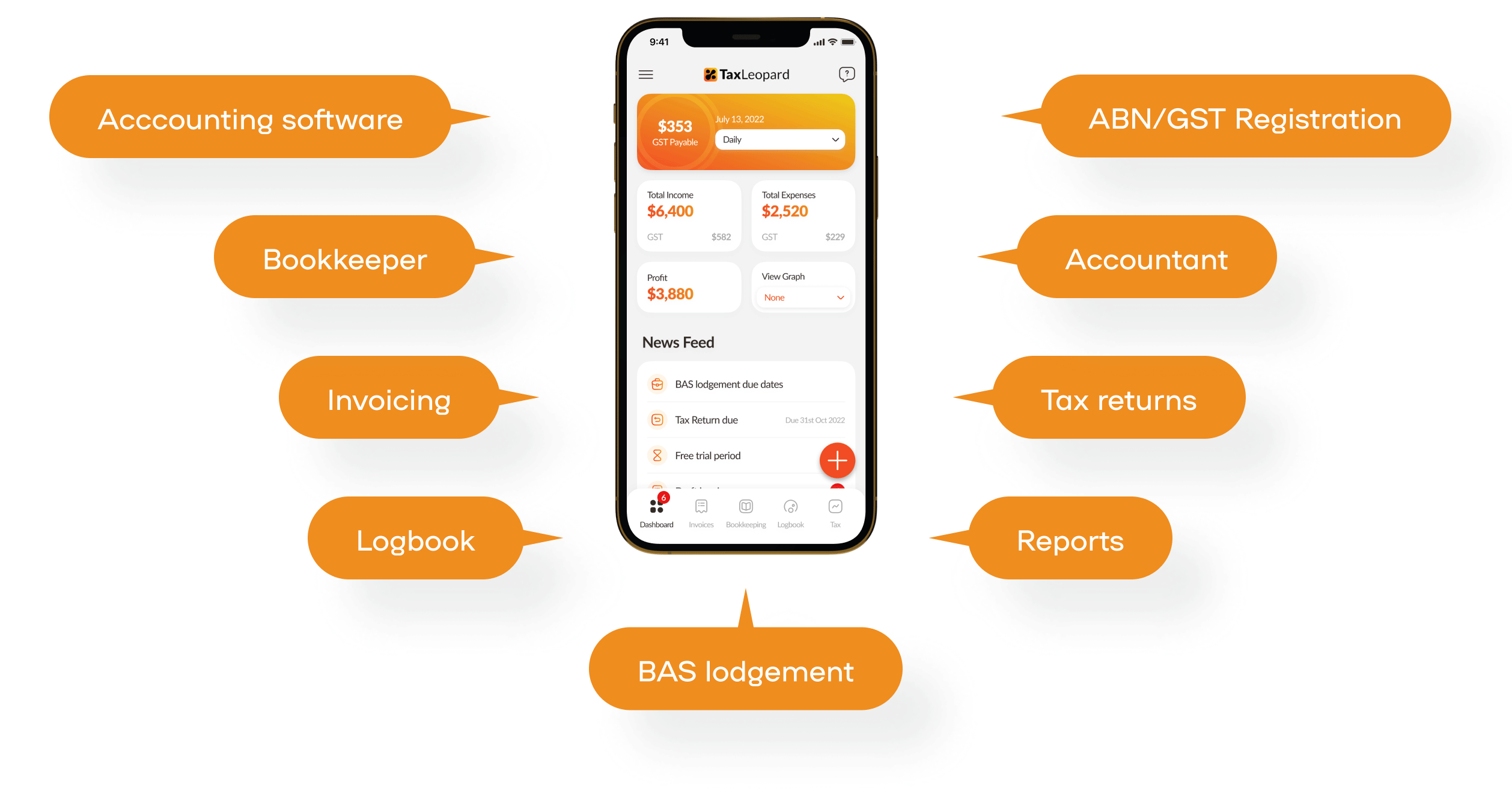

TaxLeopard: Your Ultimate Bookkeeping Solution

Efficient bookkeeping is not just a necessity but a driver of success. That’s where TaxLeopard comes in, offering a comprehensive solution tailored to meet all your bookkeeping needs. Here’s why TaxLeopard stands out as the best choice for your business:

- Versatile Bookkeeping: TaxLeopard’s bookkeeping feature is designed to simplify your financial management. Whether you’re tracking expenses or managing receipts, this application ensures that every financial aspect is recorded meticulously, providing you with a clear and accurate financial picture.

- Streamlined Invoicing: Creating and managing invoices can be time-consuming. TaxLeopard offers an invoicing system that is not only easy to use but also efficient, ensuring your billing processes are seamless and professional.

- Effortless Logbook Management: Keeping track of business-related travel and expenses is effortless with TaxLeopard’s logbook feature. It’s an essential tool for businesses that require meticulous record-keeping for travel and expense claims.

- BAS Lodgement Simplified: Business Activity Statement (BAS) lodgement can be a complex task. TaxLeopard simplifies this process, ensuring you stay compliant with ATO regulations without the stress.

- Comprehensive Reporting: With TaxLeopard, you gain access to detailed reports that offer insights into your business’s financial health. This feature allows for informed decision-making and strategic financial planning.

- Efficient Tax Return Processing: Tax season can be daunting, but TaxLeopard makes it easier. The app streamlines the tax return process, saving you time and ensuring accuracy in your filings.

- Professional Accountant Access: For those times when you need expert advice, TaxLeopard provides access to professional accountants. This feature ensures that you have guidance and support for more complex financial queries.

- ABN/GST Registration Assistance: If you’re starting a new business or need to manage your GST registration, TaxLeopard has you covered. The application simplifies these processes, making it easier for you to focus on running your business.

In a world where time is money and accuracy is paramount, TaxLeopard is more than just an application; it’s a partner in your business’s financial management. With its comprehensive features and user-friendly interface, TaxLeopard is the solution you need for streamlined, stress-free bookkeeping. Experience the difference today, and take your business to new heights of efficiency and financial clarity.