Have you ever glanced at your bank statement and wondered, “Is there GST on bank fees?” If you’re like most Australians, you probably have. With banks integral to our everyday lives and GST impacting a wide range of our transactions, understanding the relationship between the two becomes paramount. Let’s delve into the nuances of GST and its implications on bank fees. Let’s dive deep into the world of banking and taxes to find out!

What is GST?

GST, standing for Goods and Services Tax, is a pervasive 10% tax levied on a majority of goods, services, and other items sold or consumed within Australia’s borders. Instituted in 2000, this tax superseded various other state and territory taxes, ushering in an era of uniform taxation across the nation. It aims to simplify the taxation process while ensuring the government’s revenue stream. How GST works in Australia.

Understanding Bank Fees

Banking in Australia, like elsewhere, involves various fees. These charges, depending on the service or transaction, can vary. They can range from account maintenance fees, overdraft charges, or even fees levied for using an ATM outside one’s banking network. Being aware of these fees is essential, as they can accumulate and impact an individual’s financial health. Australians pay different amounts based on their banking activities.

Types of Bank Fees

There are several fees that banks levy:

- Monthly maintenance fees

- Transaction fees

- Overdraft fees

- ATM charges outside the bank’s network

- And more…

Common Fee Examples: Imagine stepping into a café, only to realize you’re short on cash. You spot an ATM, albeit not from your bank, and make a withdrawal. The joy of having cash is short-lived when you later spot a $2 fee on your bank statement for using an out-of-network ATM. That’s a classic example of a bank fee. Others might include fees for paper statements or even transferring money overseas.

GST and Bank Fees: The Connection

So, the burning question – “is there GST on bank fees?”

Are Bank Fees Exempted?

When it comes to the intersection of GST and bank fees, the answer tilts in favor of the consumers. The majority of bank fees in Australia are not subject to GST. This exemption is primarily because most financial services, including those related to credits, loans, and deposit accounts, are input-taxed. As a result, while the bank does not charge GST on these fees, it also can’t claim GST credits related to them.

Reasons for the Exemption: Australia’s financial services sector is complex, and valuing financial transactions for GST purposes poses challenges. Hence, the Australian government decided to exclude most financial supplies from GST to streamline the taxation process. The aim was to ensure that the system remained straightforward and manageable, avoiding the complications that arise when assigning value to intangible financial transactions. By keeping the majority of financial services GST-free, the taxation process remains less cumbersome for both banks and regulators.

Implications for Australian Consumers

While at first glance it might seem beneficial for Australian consumers that most bank fees don’t carry GST, the implications are nuanced. Since banks can’t claim GST credits on most of their financial supplies, the costs might be absorbed elsewhere. This could potentially result in higher fees or lower interest rates on deposits. However, it also spares consumers the direct burden of additional GST on banking services, striking a balance between affordability and operational sustainability for financial institutions.

How It Affects Everyday Banking

Does it mean higher fees? Not necessarily. But it does mean banks have to factor in GST costs when setting fees or deciding on interest rates for loans and deposits. The absence of GST on bank fees indirectly shapes how banks structure their fees and interest rates. Though you might not see GST listed on your fees, other charges might be subtly adjusted to account for the bank’s inability to claim GST credits. For example, fees on overseas transactions or services that do attract GST might be slightly higher. Additionally, when considering loans or deposit rates, banks might factor in these GST implications, which could marginally influence the rates offered to consumers.

Future Predictions: The financial landscape is ever-evolving, and tax policies might change to reflect new realities. While the current system of keeping most bank fees GST-free in Australia simplifies the taxation process, economic shifts or policy reviews might lead to adjustments in the future. However, any change would need careful consideration of its impact on consumers, banks, and the broader economy. For now, given the intricacies of the financial sector, it’s unlikely that Australia will introduce GST on most bank fees in the near future.

Discover with TaxLeopard!

Navigating the financial intricacies of the Australian landscape can often feel like walking through a maze. One question that often crops up is: “Is there GST on bank fees?” With so many variables in play, it can be challenging to determine where GST is applied and where it isn’t. Enter TaxLeopard, the ultimate solution to all your tax-related quandaries.

Why TaxLeopard is the Ultimate Solution

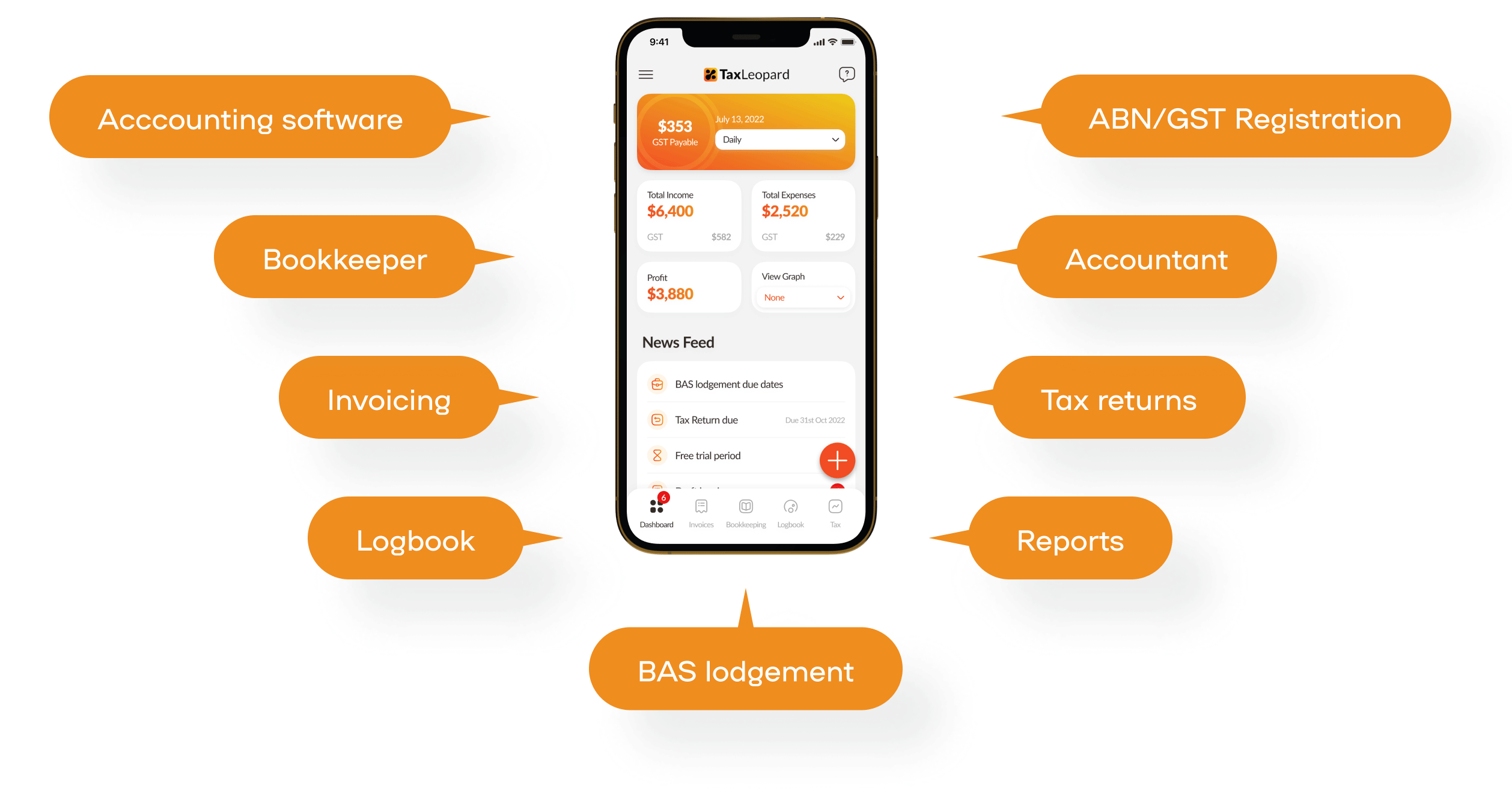

Now, while understanding the GST exemption on bank fees is simple enough, many other financial scenarios require clarity. That’s where TaxLeopard leaps into action.

With TaxLeopard, you have a robust, user-friendly application that caters to all your tax needs. So, why remain lost in the tax jungle when you can stride confidently with TaxLeopard by your side? Make the switch today and experience hassle-free tax management like never before!

Conclusion

The topic of GST on bank fees in Australia is an intriguing intersection of finance and taxation. While most bank fees remain exempt from the 10% Goods and Services Tax, it’s essential to understand that this exemption is a result of the complexities in valuing financial transactions for GST purposes. Although consumers don’t directly pay GST on many banking fees, banks may adjust other charges to compensate. As financial landscapes evolve, we will have to wait and see if this approach continues, but for now, Australians can expect that most of their bank fees will remain GST-free.

FAQs

1. Is there GST on bank fees in Australia?

No, most bank fees in Australia don’t have GST.

2. When was GST implemented in Australia?

Australia introduced GST in July 2000.

3. Why don’t banks charge GST on fees?

Most financial supplies are input taxed, making them exempt from GST.

4. Do other countries have GST on bank fees?

The tax treatment of bank fees varies from country to country.

5. Are all financial services exempt from GST?

Not all, but a majority of financial supplies are exempt from GST in Australia.