Dipping your toes into the entrepreneurial world? The thrill of starting your own business is unmatched, but the administrative hoops can sometimes dampen the excitement. In Australia, if you’re gearing up to kickstart your business journey alone, one of the first steps you’ll encounter is getting a sole trader ABN.

This unique 11-digit number, known as the Australian Business Number, is the golden ticket for individual business operators, acting as your business’s identity for various transactions and tax purposes.

But how do you go about securing this crucial number? Whether you’re a seasoned businessperson branching out or a newbie with a fresh idea, this guide will walk you through the streamlined process, ensuring your venture begins on the right regulatory footing.

What is a Sole Trader ABN?

Definition of a Sole Trader

A sole trader refers to an individual who operates and runs their own business. Unlike companies or partnerships, the sole trader structure is simple. It doesn’t differentiate the business entity from the owner. In essence, as a sole trader, you are the business. This means that you are responsible for all business decisions, finances, and any potential liabilities. It offers an uncomplicated way to start a business but comes with the responsibility of managing every aspect of that business personally.

Understanding ABN

The ABN, or Australian Business Number, acts as a unique identifier for businesses in Australia. It’s an 11-digit number that serves a myriad of purposes. For one, it allows the wider public and other businesses to verify your business details. It also facilitates various tax and business activities, ensuring you’re recognized as a legitimate business entity in Australia. When you have an ABN, it becomes easier to avoid withholding tax on payments you receive, claim GST credits, and ensure smooth transactions with other businesses.

Benefits of Registering as a Sole Trader ABN

Financial Advantages

One of the notable benefits of operating as a sole trader with an ABN is the financial simplicity. As a sole trader, your personal and business finances are intertwined, which can make financial management straightforward. There’s no mandatory need for separate business bank accounts or intricate accounting systems, although many recommend having distinct accounts for clarity. Additionally, should the business face financial difficulties, addressing them can be straightforward without the complex bureaucracy that companies might have.

Simplicity and Flexibility

Being a sole trader offers unparalleled flexibility. With no board of directors or partners to consult, decision-making becomes swift, allowing you to adapt to changes rapidly. This adaptability can be crucial, especially in industries that are volatile or where trends shift quickly. Moreover, administrative burdens are reduced. There are fewer reporting requirements and legal obligations compared to larger corporate structures. This simplicity allows you to focus more on the core operations of your business.

Taxation Benefits

Taxation is an area where sole traders can see some benefits. The tax returns for sole traders are relatively uncomplicated. You’ll declare your business income (or loss) in your tax return. Additionally, you might be eligible for certain tax deductions that can decrease your taxable income. Expenses directly related to earning your business income, like travel, equipment, or home office costs, can often be claimed, optimizing your tax situation.

Steps to Register as a Sole Trader ABN

1. Preliminary Research:

Before you even think of registering, it’s imperative to ensure you check all the required boxes. Are you an Australian resident with intentions to start a business? Do you have a clear business plan? Remember, obtaining a sole trader’s ABN isn’t just about the registration; it’s about being genuinely prepared to run a business. Dive deep into understanding the market, evaluating your business idea, and researching the requirements specific to your industry.

2. Gathering Necessary Documents:

Paperwork can be a bane, but in this case, it’s your ticket to smooth registration. Ensure you have identification documents like a passport or driver’s license, proof of your business address, and your Tax File Number. It’s better to be overprepared than to realize mid-process that you’re missing something crucial.

3. Online Registration Process:

The digital age has made many tasks, including this one, significantly easier. Head over to the Australian Business Register website. Here, you’ll navigate through the process, selecting ‘Sole Trader’ as your entity type, and input all the necessary details. Ensure you double-check everything before submission.

4. Await Confirmation:

It’s a waiting game now. The confirmation usually takes a few days, so be patient. This time will give you a moment to prepare for the next steps of your business journey.

Common Mistakes to Avoid

- Not Updating Details: One of the most common oversights is forgetting to update personal or business details on the Australian Business Register. Whether it’s a change in your address, phone number, or other relevant details, always keep them current.

- Mixing Finances: A frequent pitfall for sole traders is blending personal and business finances. While not mandatory, having separate accounts for business and personal use ensures clarity, especially during tax assessments.

- Neglecting Record-Keeping: Proper record-keeping is crucial for any business. Failing to maintain accurate financial records can lead to complications during tax season and might even result in penalties.

- Overlooking Licensing and Permits: Depending on your industry, you might need specific licenses or permits. Neglecting to obtain or renew these can lead to legal troubles and disruptions in business operations.

- Inadequate Market Research: While it’s exhilarating to launch a business based on a passion or an idea, skipping thorough market research can be detrimental. Not understanding your target audience or the current market conditions might lead to poor business decisions.

Get Connected with TaxLeopard

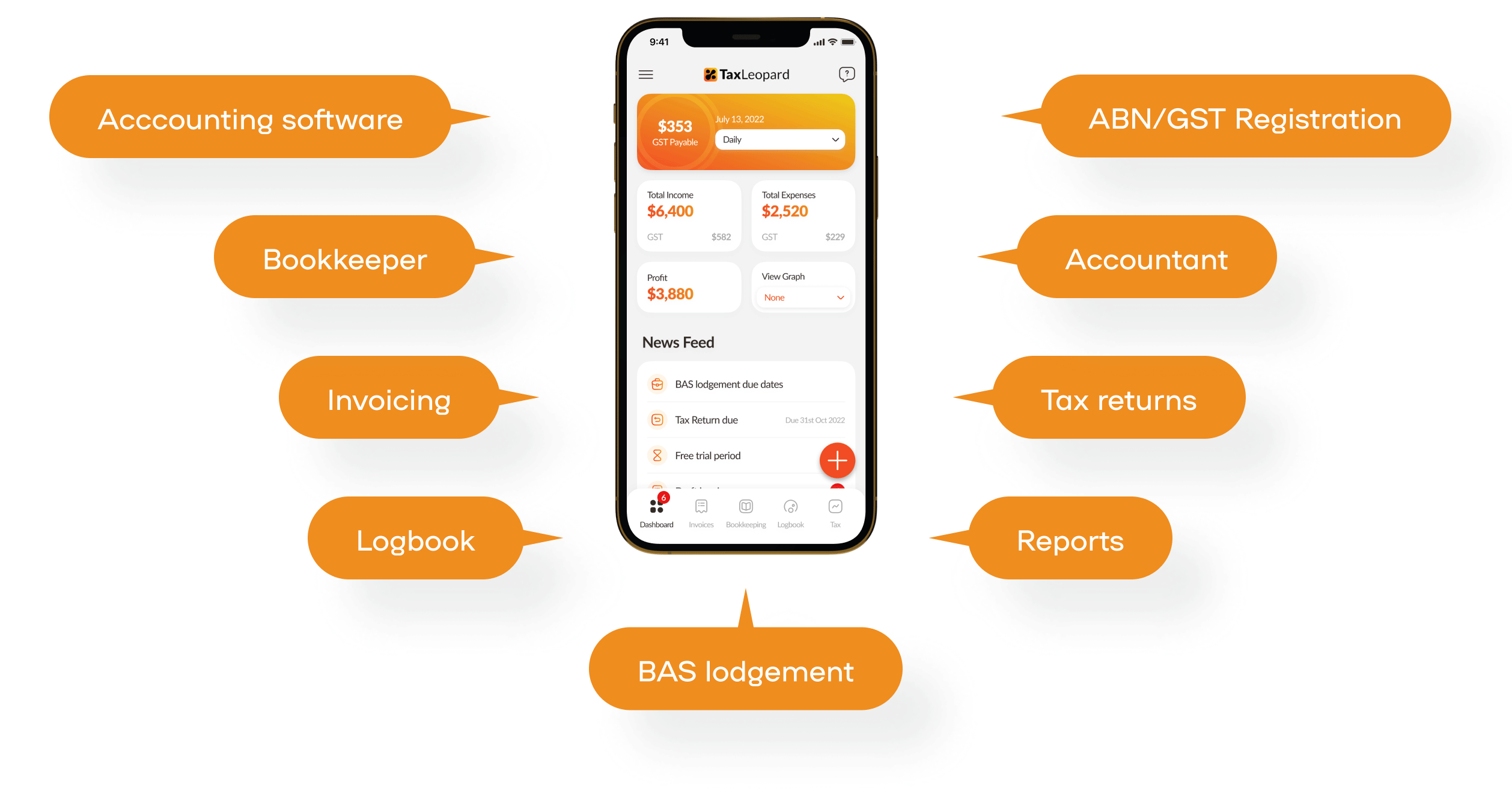

The journey of entrepreneurship is an exhilarating one. But like every journey, it starts with a single, essential step. In Australia, if you’re keen on running a business solo, that step is getting a sole trader’s ABN (Australian Business Number). While it might seem like a maze of paperwork and processes, there’s a tool that promises to simplify it all: TaxLeopard.

Why TaxLeopard?

Navigating the world of business regulations can be a challenging endeavour. TaxLeopard emerges as a beacon of simplicity amidst the chaos. It’s more than just an application; it’s your virtual business companion. Here’s why:

Conclusion

Starting a business, especially as a sole trader, can seem daunting. But with the right tools, like TaxLeopard, it becomes a streamlined process. From securing your sole trader ABN to managing your day-to-day financial tasks, TaxLeopard is the one-stop solution for budding entrepreneurs. Why navigate the business world alone when you can have a trusted companion by your side? Embrace the simplicity, efficiency, and expertise of TaxLeopard and set your business up for success.

FAQs

1. What’s the difference between a sole trader and a company?

A sole trader is an individual running a business, bearing all responsibilities. A company, on the other hand, is a separate legal entity, offering liability protection to its owners.

2. Do I need any specific licenses or permits as a sole trader?

This depends on your business type. Some industries require special permits or licenses, so it’s essential to research the specific requirements for your field.

3. Is it mandatory for a sole trader to have a separate business bank account?

No, but it’s recommended. A separate account makes it easier to manage finances and ensures clarity during tax times.

4. How often should I update my ABN details?

Whenever there’s a change in your business or personal details, it’s crucial to update them on the Australian Business Register.

5. Can I hire employees as a sole trader?

Absolutely! As a sole trader, you can hire employees. Just ensure you adhere to all employment laws and regulations.