For sole traders, grappling with tax regulations can prove to be a difficult task. Recent studies indicate that a significant number of small business owners struggle to understand their tax obligations, leading to potential financial setbacks.

The tax rate for sole traders directly influences your business’s financial health, dictating how much of your hard-earned income goes to the government.

This article provides a comprehensive guide to understanding how the sole trader tax rate impacts your business, ensuring you’re well-equipped to manage your tax responsibilities effectively.

What is Sole Trading?

Sole trading is a business structure where an individual operates a business under their name. As a sole trader, you are responsible for all aspects of the business, including its debts and liabilities. This structure offers simplicity and control, allowing you to make decisions quickly. However, it also means that your assets are at risk if the business faces financial difficulties. When it comes to tax obligations, sole traders must lodge an individual tax return and pay tax at the individual tax rate on their business income.

Business Structures in Australia

There are 5 common business structures in Australia:

1. Sole Trader:

- The simplest form of business structure.

- Individual operates the business and is personally liable for all aspects.

- Must lodge an individual tax return and pay tax at the personal income tax rate.

2. Partnership:

- Two or more individuals or entities run a business together.

- Each partner is responsible for their share of the business’s profits, losses, and liabilities.

- Partnerships must lodge a partnership tax return, but each partner pays tax on their share of the net income.

3. Company:

- A separate legal entity from its owners (shareholders).

- Owners have limited liability, meaning their assets are protected.

- Companies pay tax on their profits at the company tax rate and must lodge a company tax return.

4. Trust:

- A structure where a trustee holds property or income for the benefit of others (beneficiaries).

- The trust itself does not pay tax, but the beneficiaries pay tax on their share of the trust’s income.

5. Cooperative:

- An organization owned and operated by its members for their mutual benefit.

- Members have a say in the cooperative’s operations and share in the profits.

- Cooperatives are taxed similarly to companies but have specific rules and regulations.

- Sole Trader Tax Rates For The 2023-24 Financial Year

Sole Trader Tax Rates for 2023-24

Sole traders pay tax at individual income tax rates for the 2023-24 financial year. As a sole trader, your business income is added to your income and taxed accordingly. It’s important to keep track of business expenses, as they can reduce your overall tax liability. The Australian Tax Office requires sole traders to lodge an individual tax return each year, reporting both personal and business income. Tax concessions may be available to help lower your tax bill. Remember, staying on top of your tax obligations is crucial for running a successful business as a sole trader.

The following tax rates and brackets apply to sole traders:

| Taxable income | Tax on this income |

|---|---|

| 0 – $18,200 | Nil |

| $18,201 – $45,000 | 19 cents for each $1 over $18,200 |

| $45,001 – $120,000 | $5,092 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000 | $29,467 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $51,667 plus 45 cents for each $1 over $180,000 |

How is a Sole Trader Taxed?

A sole trader’s tax is calculated based on their tax rate, which depends on their total income from business activities and other sources. As a sole trader, you’re required to lodge an individual tax return, reporting your business income under the sole trader business structure. You can claim tax deductions for expenses related to your business activity, potentially reducing your tax bill.

It’s essential to understand your tax obligations, including the need to pay Goods and Services Tax (GST) if applicable and make Pay As You Go (PAYG) instalments for your anticipated tax liability. Consulting a registered tax agent can guide managing your tax affairs efficiently.

The Impact of Sole Trader Tax Rate on Your Business

Operating as a sole trader in Australia brings a unique set of tax obligations. The tax rate for sole traders is equivalent to the individual income tax rate, which means your business income directly influences your tax liability. Understanding these tax rates is crucial for effective financial planning.

Key aspects to consider include:

- Business Expenses: As a sole trader, you can deduct legitimate business expenses from your taxable income. This can potentially lower your overall tax bill.

- Income Tax Rate: The tax rate for sole traders is based on total income. This includes both personal and business earnings.

- GST: Sole traders with a turnover exceeding $75,000 must register for and pay the Goods and Services Tax (GST). This adds another layer to your tax responsibilities.

Tips to Manage Your Sole Trader Tax Rate

- Stay Organized: Keep accurate records of your business activity and income to ensure you pay the correct amount of ta

- Understand Your Obligations: Familiarize yourself with the tax obligations for sole traders, including income tax, goods and services tax (GST), and pay-as-you-go (PAYG) instalments.

- Use Tax-Deductible Expenses: Reduce your taxable income by claiming valid business expenses, such as equipment purchases or professional fees.

- Keep Up with Installments: Make regular PAYG instalments to avoid a large tax bill at the end of the financial year.

- Lodge Your Tax Return Timely: Submit your tax return, including your business income and deductions, before the deadline to avoid penalties.

- Seek Professional Advice: Consult a registered tax agent for personalized advice on managing your tax rate and obligations.

- Understand Your Tax Rate: Be aware of the current tax rates for sole traders and how they apply to your business income.

- Plan for Tax Payments: Set aside funds regularly to cover your tax liabilities, ensuring you’re not caught off guard when payments are due.

- Review Your Business Structure: Consider if remaining a sole trader is the most tax-efficient structure for your business, or if it’s time to explore other options like forming a company.

- Stay Informed: Keep updated with any changes in tax legislation that may affect sole traders, such as adjustments to tax rates or reporting requirements.

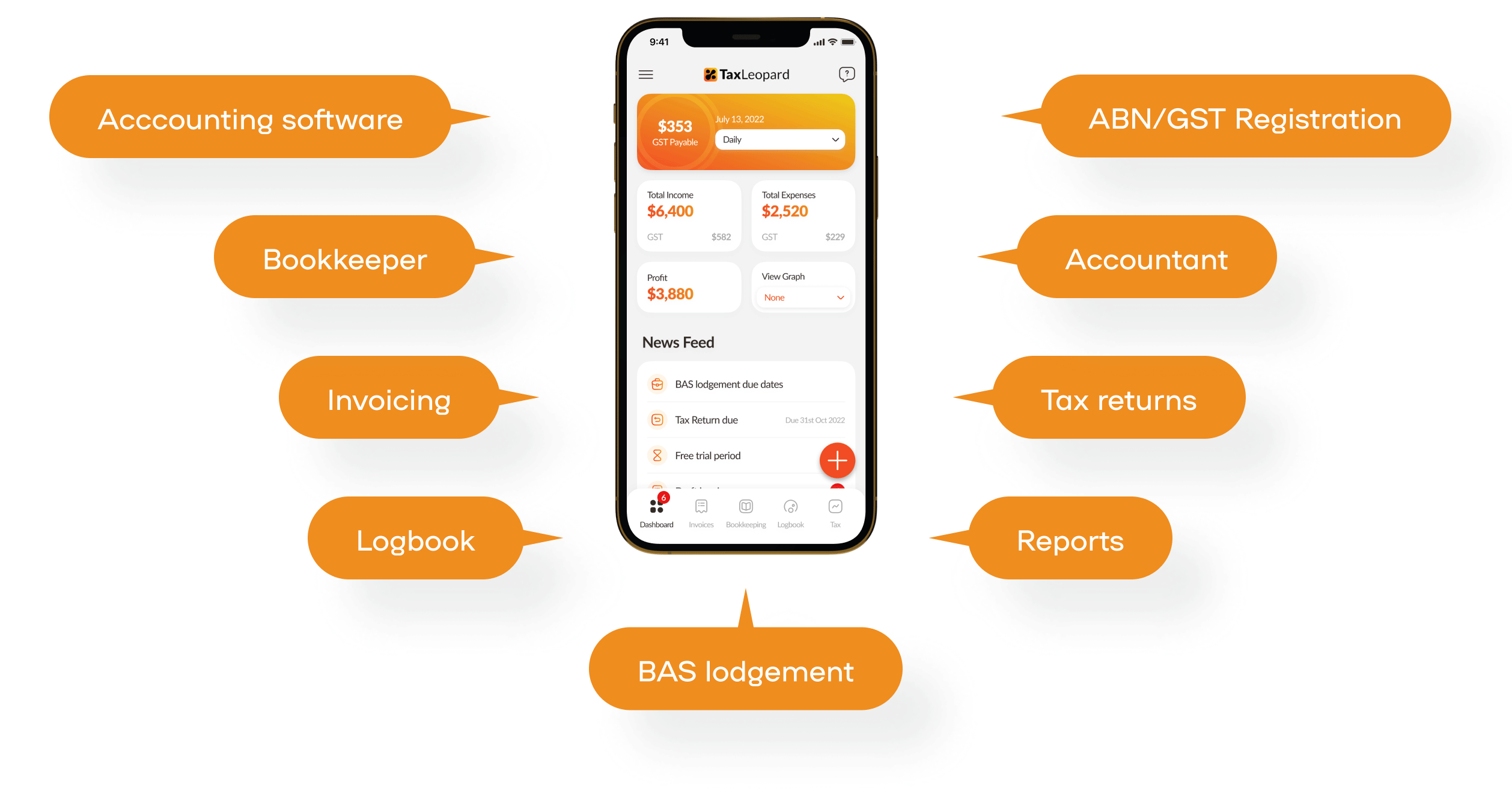

How TaxLeopard Helps Sole Traders?

TaxLeopard offers significant advantages to sole traders by streamlining tax management processes, enhancing financial accuracy, and ensuring compliance with regulatory requirements. By automating key tasks such as bookkeeping, BAS lodgment, and tax return preparation, the app allows sole traders to focus on their core business activities.

TaxLeopard offers significant advantages to sole traders by streamlining tax management processes, enhancing financial accuracy, and ensuring compliance with regulatory requirements. By automating key tasks such as bookkeeping, BAS lodgment, and tax return preparation, the app allows sole traders to focus on their core business activities.

The provision of professional accounting support and insightful financial reports further empowers sole traders to make informed decisions and optimize their tax outcomes.

Overall, TaxLeopard serves as a valuable tool in simplifying tax responsibilities and facilitating business growth for sole traders.

Conclusion

Sole traders are taxed at individual income tax rates, with business income added to their income. Keeping accurate records of income and expenses is vital for calculating your tax liability. Understanding the sole trader tax rate is crucial for managing your business’s finances and ensuring compliance with tax laws. By staying informed and seeking professional advice when necessary, you can navigate the tax landscape with confidence. How has your experience been with managing taxes as a sole trader?

FAQs

1. Can sole traders claim business expenses to reduce their taxes?

Yes, sole traders can deduct legitimate business expenses from their income to lower their taxable income and tax liability.

2. What are the key tax differences between a sole trader and a company?

The main difference is that sole traders are taxed at individual rates on their total income, while companies are taxed at the company tax rate on their profits.

3. How can sole traders estimate their tax bill?

Sole traders can use an income tax calculator or consult with an accountant to estimate their tax based on their income and expenses.

4. What tax concessions are available for sole traders?

Sole traders may be eligible for small business tax concessions, which can help reduce their overall tax liability.

5. How does the GST affect sole traders?

Sole traders with a turnover exceeding the GST threshold must register for GST, collect it on taxable sales, and lodge regular BAS statements.