Having difficulty keeping up with the financial management of your sole trader business? Many sole traders face challenges in handling accounting tasks efficiently. Accounting software significantly reduces the time spent on financial admin, allowing more focus on business growth. This guide offers a deep dive into the best practices for sole trader accounting, from choosing the right software to optimizing tax returns. Delve into a comprehensive resource tailored to streamline your financial operations, all detailed in this article.

Essentials of Sole Trader Accounting

1. Choosing the Right Accounting Software:

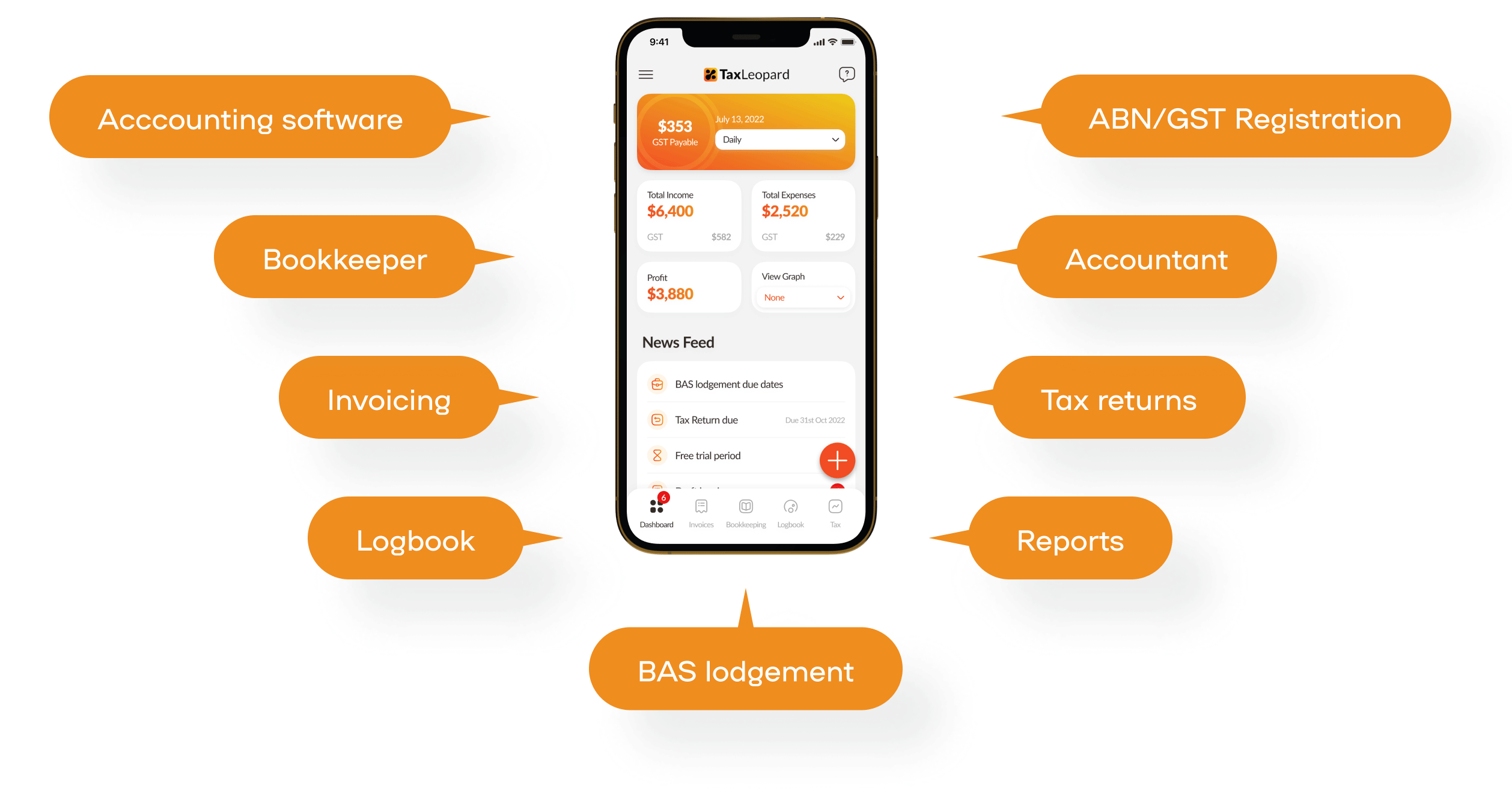

Selecting the perfect accounting software for sole traders is crucial for efficient financial management, particularly for sole traders. Apps like TaxLeopard are designed to meet the unique needs of small businesses, offering tailored features that streamline accounting tasks. Here are some benefits:

- Automates routine tasks, saving valuable time.

- Ensures accuracy in financial records, reducing errors.

- Facilitates better tracking of invoices and receipts.

- Simplifies tax return preparation by organizing income tax and GST data effectively.

2. Fundamentals of Bookkeeping:

Effective bookkeeping is foundational for any successful sole trader. Utilizing a good spreadsheet system or specialized software helps maintain orderly records. Here are key strategies:

- Regularly update financial entries to avoid discrepancies.

- Use software to automate data entry and minimize manual errors.

- Organize receipts and invoices to ensure quick access to tax assessments.

- Track income and expenses meticulously to aid in accurate BAS submissions.

Managing Taxes for Sole Traders

Online accounting software simplifies tax time for sole traders by automating data entry and calculations. Features like PAYG and lodgment schedules help you stay on top of your obligations. With streamlined processes, you can reconcile business income and expenses quickly. These tools ensure accurate and timely personal income tax return submissions. They also offer peace of mind, allowing sole traders to focus more on running their business and less on tax admin.

Understanding BAS and Business Tax:

For Australian sole traders, grasping BAS and business tax requirements is crucial. Online accounting platforms are designed specifically to manage these needs efficiently. They help organize relevant tax information and deductions, reducing the time spent on admin tasks. The software also supports ATO compliance, ensuring you meet all lodgment deadlines. By using cloud-based solutions, you can easily keep track of your cash flow and receive tax advice, helping your business grow responsibly.

Software Solutions for Sole Traders

When choosing software to manage your sole trader business, several features stand out as essential for streamlined operations and financial clarity. Each component plays a crucial role in simplifying your day-to-day tasks, ensuring you can focus more on growing your business and less on administration.

Features to Look For:

- Payroll Integration

- Receipt Management

- Cloud-Based Flexibility

- Comprehensive Tax Handling

- Automated Bookkeeping

Choosing the right accounting software designed specifically for Australian sole traders, like TaxLeopard, can transform how you manage your business. These tools are tailored to meet the unique needs of freelancers and tradies, ensuring that you enjoy the benefits of optimized accounting practices without unnecessary complexity.

Optimizing Financial Tasks

Efficiently managing invoicing and receipts can significantly reduce time spent on admin for freelancers and self-employed individuals. Selecting the right accounting software facilitates this process by automating data entry and ensuring invoices are accurate and dispatched promptly. This not only helps maintain cash flow but also provides peace of mind knowing that financial records are organized and up-to-date.

Furthermore, streamlined payroll management is crucial for running your own business smoothly. The use of cloud-based software designed specifically for Australian sole traders simplifies tasks like PAYG lodgment, managing superannuation payments, and handling personal income tax returns.

These solutions help you stay on top of financial obligations, letting you spend less time on paperwork and more on growing your business.

Why Moving Toward Digital Accounting?

Transitioning to digital accounting offers significant advantages for sole traders and freelancers. By utilizing cloud-based software specifically designed for Australian business needs, individuals can manage their finances more efficiently. Here are some key benefits:

- Automates tasks like business income reporting and PAYG calculations, ensuring timely ATO compliance.

- Offers real-time insights into cash flow, expenses, and earnings, helping you make informed decisions.

- Minimizes time spent on data entry and financial administration, allowing more focus on growing your business.

Choosing the Best for Your Business

Choosing the best accounting software for your sole trader business in Australia requires careful consideration. Look for features that support lodgment, reconciliation, and payroll, ensuring compliance with ATO requirements. By selecting the right tools, you not only save time on administrative tasks but also gain peace of mind, allowing you to focus more on growing your business.

Try TaxLeopard and experience the simplicity of managing your taxes, payroll, and bookkeeping all in one place. Whether you’re a freelancer or running your own business, TaxLeopard makes it easier to stay on top of your finances with cloud-based solutions tailored to Australian sole traders.

Join us today! and start enjoying the benefits of our specialized software. Let TaxLeopard help you grow your business with less time spent on admin and more on what you do best.

Conclusion

Navigating the complexities of sole trader accounting can seem daunting, but with the right tools and knowledge, you can simplify the process and focus on what you love. This guide has covered essential topics to assist you in managing your finances more efficiently. Are you ready to implement these strategies and transform your business accounting? How will you adjust your financial management tactics to better suit your sole trader operations?

FAQs

1. How should sole traders manage their cash flow?

Effective cash flow management involves regular monitoring of accounts receivable and payable, creating accurate cash flow projections, and budgeting for taxes.

2. What are the record-keeping requirements for sole traders?

Sole traders need to maintain detailed records of income, expenses, GST collected and paid, and other financial transactions.

3. How do sole traders pay themselves?

Sole traders don’t receive a salary but can draw money from their business earnings, known as ‘drawings.’

4. How often do sole traders need to lodge BAS?

If registered for GST, sole traders must lodge a Business Activity Statement (BAS) quarterly or monthly, depending on their registration details.

5. What expenses can sole traders write off?

Expenses directly related to earning business income, including advertising, business travel, and office costs, can be deducted.